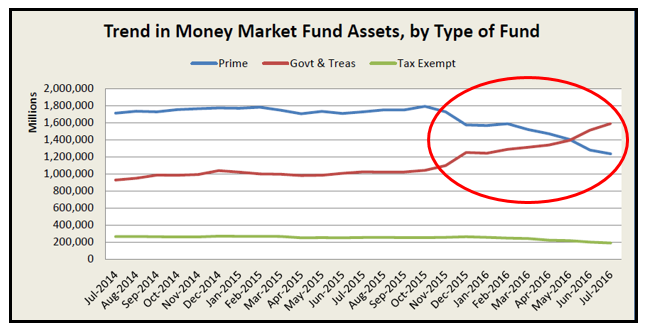

Ahead of soon-to-be-implemented money market reforms, investors have been dumping shares of prime money market funds. The funds – invested mainly in short-term debts of corporations and financial institutions – have lost more than $556 billion (-31%) in assets from the end of October 2015 through July 2016, mostly due to withdrawals by institutional investors.

The new SEC rules became effective this month, and are set to require prime and municipal money market fund shares for institutional investors to have a floating net asset value (NAV) per share, to reflect daily price movements of the underlying assets. This regulation marks a switch from the long-standing fixed $1-per-share status quo. Institutional investors are possibly viewing this as tantamount to losing ‘principal certainty,’ as the forthcoming rules will cease to guarantee the $1-per-share NAV for some fund types. In a less optimistic view, money market funds’ reputation of being as safe as savings deposit accounts is crumbling.

Investors are instead shifting cash to government debt money market funds, since these are exempt from the new NAV rule. More than $547 billion (a +52.5% growth) of assets were added to government/treasury funds from the end of October 2015 through July 2016, diverging vastly from the trends in prime and tax exempt/municipal fund assets mentioned above (According to the SEC).

Source: SEC

Source: SEC

Fund managers are responding to these mass redemptions by moving away from prime categories and increasing holdings of government securities. Fidelity Investments, for instance, changed its biggest prime fund – worth $115 billion of assets – into a government fund late last year.

While retail investors are exempted from the NAV change, they are (along with institutional investors) subject to another redemption-restricting part of the reform, and it’s a big one: every money market fund board will be allowed the discretion of temporarily freezing liquidations and/or imposing withdrawal penalty of up to 2% if the fund’s weekly liquid assets fall short of 30% of its total assets, provided the board believes it’s in the best interests of the fund (According to the SEC).

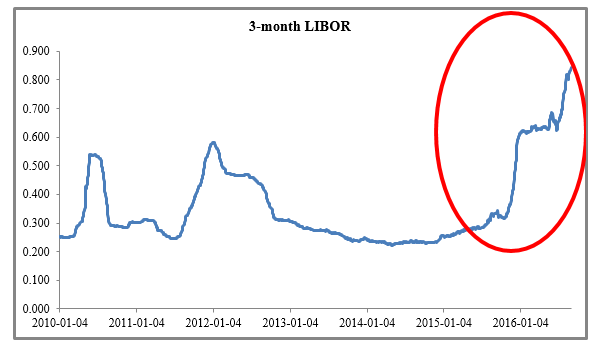

Redemptions to Make Borrowing More Expensive?

Liquidations of prime money market fund shares, and hence the underlying debt securities, make corporations and financial institutions vulnerable to rising costs of short-term borrowing. On August 22, the three-month LIBOR increased 0.2 percent points above June level, to reach seven year high of more than 0.82% (According to the Economist).

Adding to banks’ short-term debt concerns, money market funds’ lightened their holdings of U.S. financial institution securities by -37% in July 2016 from a year ago, which is steeper than the decline (-29%) of the overall holdings of prime funds, as suggested by Office of Financial Research data.

Can SEC Reforms Prevent a Future Crisis?

These reforms are designed to dis-incentivize investors’ itch to redeem fund shares, which almost certainly arose from 2008’s sell-off frenzy. In 2008, Reserve Primary Fund, the oldest U.S. money market fund, had to “break the buck” – i.e., it was compelled to lower its fund share price below $1, due to its exposure to Lehman Brothers securities. This propelled a mass exodus, particularly of institutional investors, from across money market funds, leading the federal government to insure the investments and thereby prevent a systemic crisis.

When flooded with redemption requests, the underlying assets could undergo a downward spiral, stressing out funds as they still struggle to maintain the $1 per share NAV. The new rules seek to reduce some of this stress, by aligning fund share prices to the component debt securities and tightening redemption facilities.

Bottom Line for Investors

Fearing that the only asset category (money market funds) that have long guaranteed the safety and flexibility equivalent to that of bank deposits is about to lose those desired qualities, institutional investors are fleeing prime money market funds. The flight of capital could depress prices of the underlying short-term debt securities and therefore possibly lead to a rather “low” debut of the floating per-share NAV. Whether that would set-off a self-reinforcing downward slide of NAVs, or attract a new round of investments through bargain prices is something to watch out for. But in the end, it’s another classic example of regulation leading to unintended consequences as the market responds adversely to reforms.

To be sure, certain aspects of the reform appear beneficial and will likely help over time. Part of the new rules encourage more diversification, disclosure and stress testing requirements for money market funds – something that could be deemed to make funds more transparent and investor-friendly. In addition, the reforms might be a powerful cushion in financially vulnerable times, and reduce government intervention and potentially save taxpayers’ money.

The money market fund industry is likely to feel some disturbances in the short-term as the market adjusts to new regulations, but that is to be expected. Over time, the market tends to adjust and adapt to new regulations. For investors, the impact should be minimal in the short and long-term, as any new risk can be diversified away through other types of cash equivalents, risk free assets, and long-term exposure to growth assets like stocks. In short, “nothing to see here.”

Still, staying steady for the long-term is a challenge many investors face. But, the right investment manager can make an enormous difference over the long-term and help you stay steady through market changes. When you’re managing your own investments, there’s generally a gap between how well you can do with what you have and how well you could be doing if you had the right resources. Our aim at Zacks Investment Management is to close the gap. But, don’t take our word for it. If you’re thinking about working with a manager, read “What to Look for in a Money Manager” – it includes 10 tough questions you can ask any prospective investment manager…download it now

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.