The equity market continues its volatile streak, which as I wrote last week, I expected to be the case. Volatility and market corrections tend to come in spurts (often scary and sudden ones), and a few days and weeks can start to feel like a lifetime, in my opinion.

I know navigating the ups and downs in the short term can be difficult and present some emotional challenges, so I’d encourage readers to try and stay patient and focused on your longer-term objectives. I believe the U.S. and global economy will continue to expand in 2019 despite the headwinds, and I see the market fully recovering in time as well.

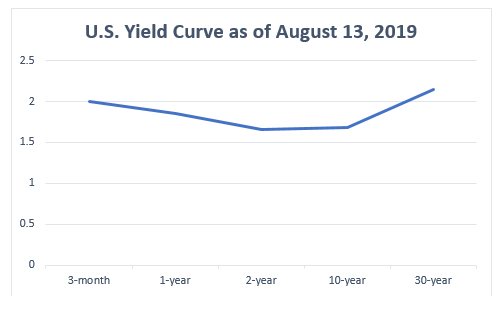

This week, global equity markets sold off sharply again when the yield on the 2-year U.S. Treasury ticked higher than the yield on the 10-year U.S. Treasury, creating a yield curve inversion that many see as a recession signal. The yield on the 30-year U.S. Treasury also fell to a record low, though it remains higher than yields on the shorter end of curve (meaning, ultimately, that the yield curve is actually more ‘u-shaped’ than inverted).

_____________________________________________________________________________

How to Prepare Your Portfolio for a Potential Recession?

Instead of getting caught up in the fearful narrative that surrounds current volatility and the possibility of a recession, why not look at how to posture your portfolios for a late cycle, mature bull market? In my opinion, that means staying focused on hard data and key economic indicators.

Our just-released Stock Market Outlook report can help you do just that. This 22-page report contains some of our key forecasts to consider such as:

- Our Global Outlook – China’s Economy, the Trade-war and More…

- Can a U.S. stock market bounce back this fall?

- Stock market returns expectations

- What of U.S. GDP Growth?

- Returns for Small, Mid, and Large Cap stocks

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released August 2019 Stock Market Outlook1

______________________________________________________________________________

Source: U.S. Department of the Treasury2

Recession concerns are not without merit. The U.K. and Germany recently reported slight GDP contractions in Q2, and the ongoing U.S. – China trade dispute continues to weigh on sentiment and new business investment. Even though the market got some good news earlier in the week with the Trump administration delaying implementation of new China tariffs until December,3 the market does not seem convinced that there’s a visible end to this trade war.

In my opinion, we’re seeing the classic signs of a market correction – not a bear market. The two most notable sell-off days recently have come from renewed fears over old, recycled stories. Last week it was China, the trade war, and the yuan, and this week it’s the yield curve. But in my view, the market has been pricing in the trade war since last summer, and close market watchers know that the yield curve has technically been inverted since May – when the 3-month yield ticked higher than the 10-year yield. Even still, the headlines are treating these developments as if they’re new and wildly shocking. They’re neither.

I think there are three good reasons to keep calm now and not to get too wrapped up in the negative headlines about the yield curve.

1. Markets Tend to Keep Moving Higher Even After a Yield Curve Inversion

Since 1978, the S&P 500 has gone up an average of +13% from the time a yield curve first inverts to the beginning of a recession. The historical occurrence of this final push higher makes perfect sense in my view, since a yield curve inversion itself does not signal the beginning of a recession. The inversion has historically been a reliable leading indicator for recessions, which can occur up to two years later.4

2. Successful Long-Term Investors Don’t Get Baited by Volatility Events

In my view, investors cannot secure the historically attractive long-term returns offered by stocks (~10% annualized return of the S&P 500 with dividends reinvested from 1970 through 2019) by getting in and out of the markets each time there’s a volatility scare. The nature of stock market returns is that market movements are independent over almost all time periods. Thus, big down days, big down weeks, big down months, even big down years have no statistical ability to predict future returns.

Effectively, the market discounts almost all available macroeconomic information, so that over any future twelve-month period the market has roughly a 70% of moving up and a 30% chance of moving down – regardless of what has happened historically.

So, the correct course of action, in my view and historically speaking, is not to try to predict or time the market but to continue to bet on the base scenario that the market moves up over time. If you pursue this strategy you will be right 70% of the time over any given 12-month period. You will be hit by every single bear market, every single correction, and every single pullback, but ultimately, I strongly believe you will generate a higher rate of return over time than you could achieve by trying to time the market.

3. August is a Notoriously Low Volume Month, Which Can Result in Higher Volatility

Market swings tend to get a bit haywire when trading is slow and volumes are down, which is precisely what August tends to bring. In August 2011, the equity market fell sharply following Standard & Poor’s downgrading of U.S. Treasury debt, and in August 2015 stocks sold off when China unexpectedly devalued its currency (sound familiar?). This particular August, stock and bond trading volumes have fallen off more than usual, which I would argue is contributing to the wild swings.5

Bottom Line for Investors

I would set the expectation that the current wave of bumpiness could last for a few more weeks and perhaps into the fall. At the end of the day, however, no one can know with certainty when conditions will stabilize.

We do have history as a reliable guide for navigating these kinds of market conditions, though, and two key insights should remain front-of-mind as we move forward:

- Recoveries often happen just as quickly as the pullbacks.

- Market corrections can almost always be viewed in hindsight as mere speedbumps in the long-term pursuit of your goals.

Remember, too, that equities remain attractive on a valuation basis relative to bonds, due to extremely low yields.

In the meantime to help you get a deeper look into these and other factors that could impact the market, I am offering all readers our Just-Released August 2019 Stock Market Outlook Report.

This Special Report is packed with newly revised predictions to consider for 2019 that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- Our Global Outlook – China’s Economy, the Trade-war and More…

- Can a U.S. stock market bounce back this fall?

- Stock market returns expectations

- What of U.S. GDP Growth?

- Returns for Small, Mid, and Large Cap stocks

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!6

Disclosure

2 U.S. Department of the Treasury, August 13. 2019. https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

3 The Wall Street Journal, August 14, 2019. https://www.wsj.com/articles/asian-stocks-gain-on-tariff-delay-11565769562?mod=article_inline&mod=hp_lead_pos1

4 The Wall Street Journal, August 14, 2019. https://www.wsj.com/articles/asian-stocks-gain-on-tariff-delay-11565769562?mod=article_inline&mod=hp_lead_pos1

5 The Wall Street Journal, August 14, 2019. https://www.wsj.com/articles/asian-stocks-gain-on-tariff-delay-11565769562?mod=article_inline&mod=hp_lead_pos1

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.