Alison T. from Topeka, KS asks: Hello Mitch, I’m curious if you’d ever make a long-term prediction about where the U.S. economy is headed? I’m talking 10, 20, 30 years out. These are some pretty crazy times, and I wonder where you see it all going.

Mitch’s Response:

Thanks for your question, Alison. I generally do not make forecasts more than one or two years out – there is too much that can change in terms of interest rates, inflation, and corporate earnings to give a good answer about the U.S. economy’s trajectory over that many years. If you do encounter a forecast for that many years in the future, don’t read into it too much – the forecaster is just guessing.

I do think, however, we can use history to make some high-level, non-numerical projections about the future. And I think I can give you an answer to your question using two charts.

______________________________________________________________________________________________

Are Your Retirement Plans on Track?

While you are working hard to build a nest egg for retirement, the important question to ask is: are your retirement assets working smart for you?

One way to successfully build your retirement portfolio while minimalizing anxiety is to make thorough plans. You should still feel as confident and assured as possible.

To help you do this, we are offering readers our free guide that provides a step-by-step blueprint to potentially help you build a sound retirement portfolio. This guide offers you a checklist of the most important financial, tax, and investment considerations for new retirees, with detailed explanations to help you prepare for this new stage in your life.

If you have $500,000 or more to invest, get our free guide today!

Download Zacks Guide, Thinking of Retiring Soon? Here are 4 Things to Consider First1

______________________________________________________________________________________________

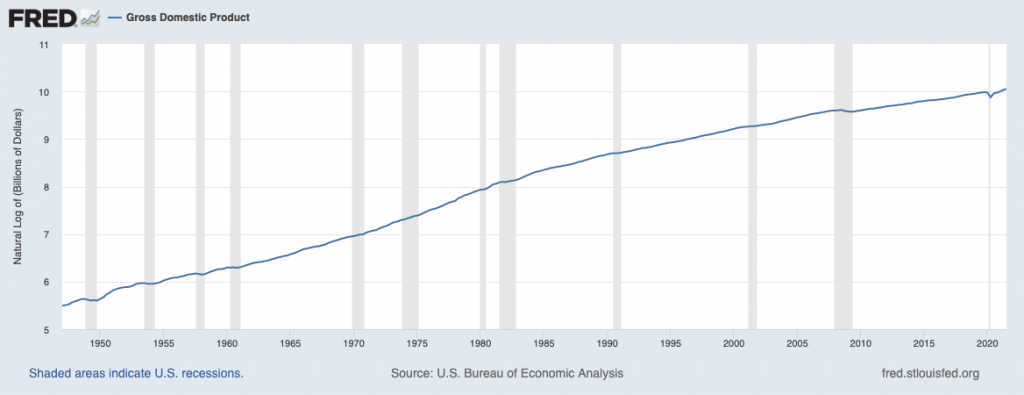

The first one is simply United States GDP – which is a measure of the economy’s total output – looked at in the post-World War II era (the modern economy). I adjusted the chart to be a natural log so you can better see the overall trend of economic growth since the late 1940s. As you can see, the U.S. economy has steadily gotten bigger and bigger over the years, with setbacks along the way but not enough to break the trend.

U.S. Gross Domestic Product, 1947 – Present

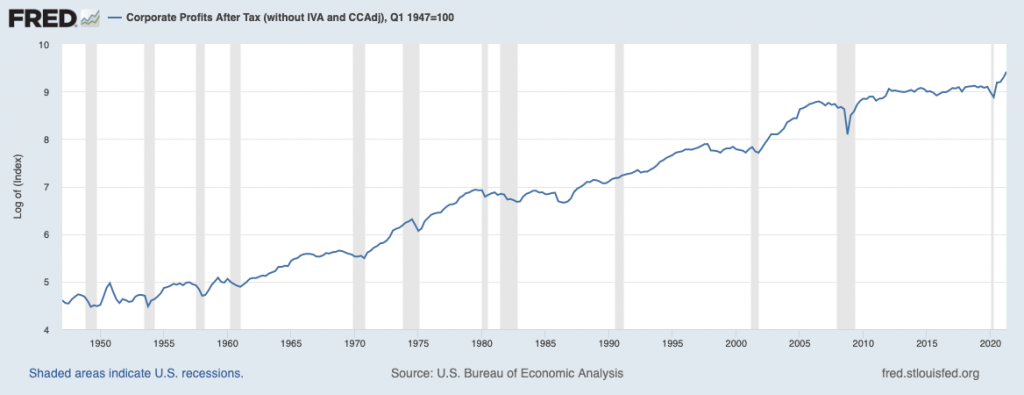

The second chart to show you is U.S. corporate profits after tax. Long-time readers of my columns know my conviction of tying corporate earnings to stock market returns. Changing expectations around interest rates and inflation are important, too, but corporate earnings are the engine for the economy and the markets, in my view. As you can see in the chart below, corporate profits have also tracked steadily higher since the late 1940s. There were plenty of bumps along the way, but the engine of profit has marched higher from decade to decade.

U.S. Corporate Profits After Tax, 1947 – Present

In your question, you referred to these as ‘crazy times,’ which is a fair assessment. But remember that history is full of crises, high tax rates, inflation, disinflation, rising interest rates, bursting bubbles, wars, tight and loose monetary policy, and pretty much everything else you can think of. Through it all, the U.S. economy continued to grow and corporations continued to generate earnings.

In my view, history offers a compelling enough reason not to bet against the U.S. economy long-term. But we are also firm believers in the U.S.’s ability to lead in innovation – in analyzing companies as we do every day here at Zacks Investment Management, we constantly see new ideas, new businesses, new products, and often marvel at the economy’s ability to grow, adapt, invent, and generate new value and wealth. So, while I can’t say for sure where the U.S. economy will be in 10, 20, or even 30 years, I do know that I will not be betting against more growth and progress.

This is important information for almost every investor who is planning their retirement. No one knows what the state of the economy will be years from now, and that’s why we’re here to guide you! We’ve created our guide to help you review your financial situation so you can make any adjustments necessary to keep your plans and lifestyle on track.

If you have $500,000 or more to invest and want to understand your retirement options, get our guide, Thinking of Retiring Soon? Here are 4 Things to Consider First.4 Simply click on the link below to get your copy today!

Disclosure

2 Fred Economic Data. October 28, 2021. https://fred.stlouisfed.org/series/GDP#0

3 Fred Economic Data. September 30, 2021. https://fred.stlouisfed.org/series/CP#0

4 Zacks Investment Management reserves the right to amend the terms or rescind the free How the Looking to Retire in 2021? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.