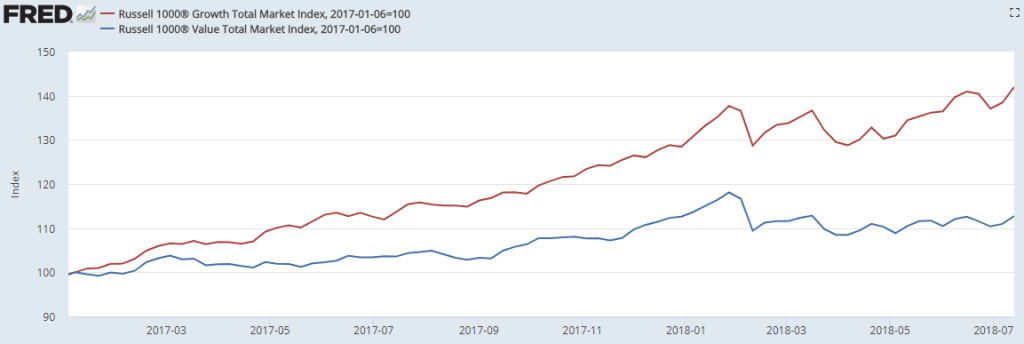

Watchful investors may have noticed a trend that has taken shape over the last year and a half or so, as it relates to growth vs. value stocks. Namely, that growth stocks have been stoutly outperforming value stocks since the beginning of last year:

Growth Stocks (Red Line) Have Recently Outperformed Value Stocks (Blue Line)

Source: Federal Reserve Bank of St. Louis

Using data from the Federal Reserve Bank of St. Louis on the Russell 1000 Growth Total Market Index (which I’ll refer to simply as “growth stocks” in this piece) and the Russell 1000 Value Total Market Index (which I’ll call “value stocks”), we get a clearer picture. My napkin math shows me that on a pricebasis, growth stocks are up around 44% from the beginning of last year through the end of last week, while value stocks are up a much lesser 13%.1

Investors who may have just become aware of this performance discrepancy – either through the above chart or elsewhere – may be experiencing a range of emotions, ranging from regret to resolve. Regret if you weren’t biased towards growth over the last year, and resolve if you decide that you’re going to increase your exposure to growth stocks going forward. I wouldn’t suggest either response.

There may be a few reasons that growth has been outperforming so widely, and also a few reasons why it may not be reasonable to expect the outperformance to last. Growth stocks, in my view, tend to outperform in “risk-on” environments, when investors’ appetite for risk assets increases whether due to better growth conditions, monetary stimulus, fiscal stimulus, deregulation, or some other positive force. Using just my short list, one could argue that the tax cut, deregulation efforts from the Trump administration, robust corporate earnings, and global synchronized growth have contributed to this “risk-on” environment.

By the same reasoning, however, an investor could argue that these factors contributing to a risk-on environment are by now either priced-in or going away entirely. The benefits of the tax cut, in my view, are largely priced, and the Federal Reserve is actively – though gradually – tightening monetary policy. As midterms approach, deregulatory efforts may take pause as campaigning takes over.

In short, I’m not so sure it makes sense for investors to feel regret or have resolve to shift towards growth stocks. I think the pendulum will swing back in due time, and perhaps sooner than many think.

What Does History Tell Us?

I’ll come right out with the answer: over time, value tends to outperform growth. Again, using data from the Federal Reserve Bank of St. Louis, we see that from December 31, 1978 (as far back as the data goes) to July 13, 2018, value stocks (blue line) have edged out growth stocks (red line) by a fairly significant margin:

Since 1978: Value Stocks +8,924% versus Growth Stocks +7,446%

Source: Federal Reserve Bank of St. Louis2

There are no definitive reasons for why value tends to outperform growth, but I have a few thoughts. For one, in my view, growth stocks tend to trade at higher multiples (they’re more expensive) while also having higher debt loads since they’re trying to grow into new markets. Higher leverage means higher risk, which tends to mean the potential for higher return, but can also mean falling further in a recession – or outright disappearing as we saw during the tech bubble in 2000.

Value stocks tend to trade at lower multiples, and value companies tend to have earnings that are more consistent/predictable with balance sheets that are more cushioned with cash. These are companies that also tend to pay dividends to shareholders.

As you can see from the chart above, value stocks have tended to chart a more gradual course higher, while growth stocks have experienced a more volatile run. What particularly stands out is the run-up to the 2000 tech bubble, where you see growth stocks surge higher only to fall faster. I’m not suggesting that’s what we’re seeing today, but it does leave open the argument that value stocks could weather the downturn better when the cycle finally does mature.

Bottom Line for Investors

Many long-term investors may see the bottom line here as: it’s better to just own value stocks over time. Not so, in my view. For equity investors seeking long-term growth, we think it’s important to have exposure to both growth and value over time. Diversification and risk control is a big reason for that, but it’s also to help ensure that you capture the relative outperformance of each category as leadership changes hands.

Trying to time when growth will do better or when value will do better is possible, but unlikely. That’s why, we like exposure to both, with emphasis on finding the right companies to represent each category.

To help you do this, I recommend reading our just-released Stock Market Outlook Report absolutely free.3

Disclosure

2 Reserve Bank of St. Louis, as of July 18, 2018, https://fred.stlouisfed.org/

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The Russell 1000 Growth Index contains those Russell 1000 companies that have lower book-to-price ratios, and thus a higher-than-average growth orientation, than the remaining companies in the Russell 1000 Index that encompass the Russell 1000 Value Index.

The Russell 1000 Value Index contains those Russell 1000 companies that have higher book-to-price ratios, and thus a less-than-average growth orientation, than the remaining companies in the Russell 1000 Index that encompass the Russell 1000 Growth Index.

An investor cannot invest directly in an index.