It may feel strange reading this, but it’s been nearly a decade since the United States has endured a recession.1 Economic growth rates have notably been modest throughout this expansion, and corporate earnings endured a whole year (2015) of negative growth.2 But overall, millions of jobs were added, personal wealth has risen, the economy has grown, and stocks have delivered solidly positive cumulative returns. It’s been an unloved economic expansion and bull market, but perhaps that’s not a fair assessment. After all, growth is growth, and its been happening now for nearly ten years.

If the U.S. economy keeps growing for just 14 more months – which we expect that it will – it will become the longest expansion in United States history. Now that’s something.3

Naturally, thoughts of the longest economic expansion have many thinking about how long it can all really last, and what the catalyst will ultimately be for the next recession. There are many possible causes of recessions, and the next cause may be one that no one anticipates. But in this piece, we want to explore one factor that has historically accompanied – and perhaps triggered – recessions in the post-WWII era: rising interest rates.

_______________________________________________________________________

Want to Learn More? Download Our Stock Market Outlook report.

This report will provide you with forecasts and factors to consider:

- What produces U.S. optimism?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- Which sectors are hot and which are not?

- What industries within those sectors most merit your attention?

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Download the Just-Released Stock Market Outlook4 >>

_________________________________________________________________________

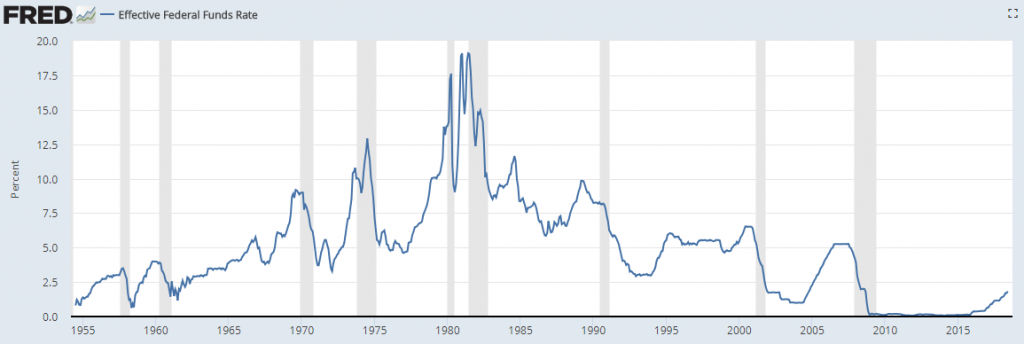

The chart below does much of the explaining for us. The blue line represents the effective federal funds rate, which is the interest rate set by the Federal Reserve in their management of monetary policy. The gray vertical bars in the chart represent recessions. Look closely at the chart and you’ll notice a common trend: the blue line is generally rising in the lead-up to the gray bars. In other words, rising interest rates have preceded recessions in just about every instance since 1950.

Rising Interest Rates Have Preceded Recessions in the Post-WWII Era

Source: Federal Reserve Bank of St. Louis

Again, there are many causes of recessions, from sentiment-driven swings to financial crises to oil price spikes. But much research in the post-WWII era shows that perhaps the most frequent contributor to modern recessions has been monetary policy tightening, oftentimes in response to inflation that is caused by those other factors, like oil price surges.5 While the Federal Reserve’s intentions are almost always noble ones, the end result is increasing borrowing costs which hits the consumer and chokes off business investment and bank lending. Monetary policy is often a catch-22.

Perhaps the most memorable example of the relationship between interest rates and recessions comes from the experience in the 1980s. Many readers will remember that time, when buying a CD at a bank or taking out a mortgage meant double-digit interest rates. Inflation was a major concern at the time, and the Federal Reserve was actively raising interest rates in an effort to keep it in check. The argument follows that it was the Federal Reserve that triggered the July 1990 – March 1991 recession.6 Raising interest rates too quickly choked off growth, in my view.

Why This Matters Now

As mentioned previously, we have an economic expansion now approaching ten years, with a Federal Reserve that has raised interest rates twice in 2018 and seven times since the end of the Great Recession. They have also issued guidance for two more rate increases before the end of the year, to the dismay of President Trump.

Perhaps the most notable difference to the 1980’s is the inflation factor. Today, inflation has been steadily hovering around the target 2% and the labor market remains firm. The Federal Reserve appears to simply be using the opportunity of strong economic growth to normalize interest rates, since the nine hikes from the Great Recession have only served to pull interest rates off the zero bound.7 The question is, how far will the Fed go, and will they go there too quickly?

Bottom Line for Investors

The Federal Reserve is likely to move even further into the public eye with President Trump weighing in on monetary policy, but in my view, it seems unlikely to shift their overall position – gradually raising interest rates assuming economic data remains firm and the U.S. economy remains at or close to capacity. With the Federal Reserve now issuing very clear and straightforward guidance, the element of surprise interest rate moves also seems more remote, which should help the market adjust expectations accordingly.

You may not know when the next recession could occur, but many of you may be wondering – How can I prepare for it?

In our view, it is smarter to just stay the course and keep focus on the long-term, instead of making emotional, knee-jerk reactions.

We believe that one way to do this is to focus more on the fundamentals than day-to-day price movements. To help you do this, I invite you to download our Just-Released Stock Market Outlook Report. Click on the link below to get your copy.

Disclosure

2 FactSet, July 20, 2018, https://insight.factset.com/hubfs/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_072018.pdf

3 Blomberg, February 6, 2018, https://www.bloomberg.com/view/articles/2018-02-06/don-t-forget-what-causes-a-recession

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

5 ZeroHedge, June 24, 2017, https://www.zerohedge.com/news/2017-06-24/goldman-finds-most-modern-recessions-were-caused-fed

6 The National Bureau of Economic Research, July 24, 2018, http://www.nber.org/cycles.html

7 The New York Times, June 13, 2018, https://www.nytimes.com/2018/06/13/us/politics/federal-reserve-raises-interest-rates.html

8 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.