Skyler O. from Grand Forks, ND asks: Hi Mitch, Happy New Year! I was curious if you had a breakdown of where investors moved money in 2023. I enjoy assessments of ‘inflows’ and ‘outflows’ for the year, and think there’s a lot of good info to gather from them. Thank you.

Mitch’s Response:

Thank you for writing, Skyler, and Happy New Year to you as well.

That’s a great question, and I agree with your general take about gaining good insights from analyzing money flows over the course of a year.

Let’s start with the stock market. The S&P 500 finished the year up +24%, with a very solid showing in Q4. Investors got a lot more enthusiastic about the market late in the year, with the SPDR S&P 500 ETF Trust showing $40+ billion of inflows in December alone. That was the biggest month of inflows in 30 years.1

The problem many investors faced in 2023, however, was being too cautious early in the year. There were near-unanimous calls for recession, and the regional banking crisis had many worried about the possibility of a sustained rally. The first six months saw outflows from equity mutual funds and ETFs, the opposite of what investors should have been doing.

How Should You Spend Money in Retirement in 2024?

If you want to ensure your money will last, it’s essential to understand some strategies and best practices. Our free guide, 4 Strategies for Spending Money in Retirement2 offers some guidelines to help ensure your retirement nest egg lasts as long as possible. You’ll also get insight on:

• Spending 101: Understanding Tax Buckets

• The 4% Rule

• Dynamic Spending with the 5% Rule

• And more…

If you have $500,000 or more to invest, download our guide 4 Strategies for Spending Money in Retirement.2 Simply click on the link below to get your copy today!

Download Zacks Guide, 4 Strategies for Spending Money in Retirement2

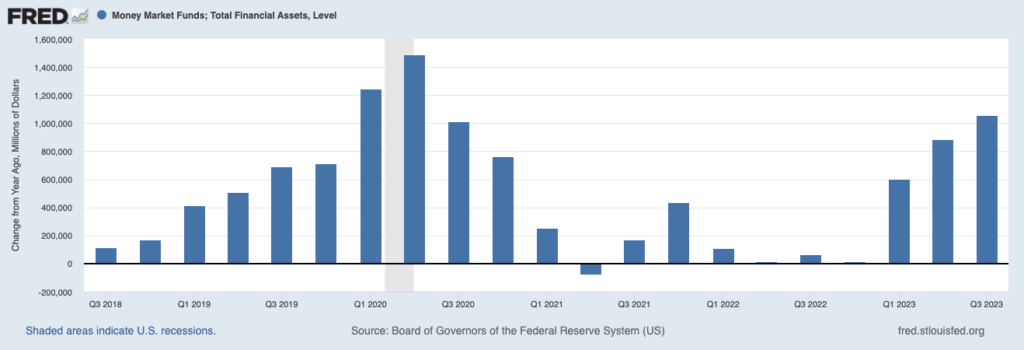

Money market funds are also worth mentioning here. With annual rates of return hovering in the 5% range, many investors engaged in the ‘dash for cash.’ By year-end, assets in money market funds surged to over $6 trillion, a new record. As seen from the chart below, 2023 was a big year for inflows, and Americans did well – investors in money market funds collected $300 billion in interest income, which is more than the previous ten years combined.

Money Market Funds, Year-over-Year Change (in Millions of Dollars)

One important note to consider here is that with $6+ trillion in money market funds, there’s a good argument that Americans have plenty of cash not only to spend, but also to invest. If sentiment continues to shift positive as inflation falls and an economic ‘soft landing’ feels more likely, some of this cash could very well move to equity markets or be spent in the economy – both positives.

A final point to make for inflows is for Treasuries and certificates of deposit, i.e., risk-free securities. In 2023, the purchases of both were at their highest levels since 2015, and taxable bond funds also attracted about $147 billion in inflows. In short, investors put their money in many different places last year, with positive returns relatively easy to come by.

Today, I am offering our exclusive guide, 4 Strategies for Spending Money in Retirement3, to all Mitch’s Mailbox readers. In this guide, we explore some effective strategies and best practices that investors should consider when developing a retirement spending plan. You’ll get insight on:

• Spending 101: Understanding Tax Buckets

• The 4% Rule

• Dynamic Spending with the 5% Rule

• And more…

If you have $500,000 or more to invest and are ready to learn more, click on the link below to get your copy today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Strategies for Spending Money in Retirement offer at any time and for any reason at its discretion.

3 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Strategies for Spending Money in Retirement offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The ICE U.S. Dollar Index measures the value of the U.S. Dollar against a basket of currencies of the top six trading partners of the United States, as measured in 1973: the Euro zone, Japan, the United Kingdom, Canada, Sweden, and Switzerland. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees or other expenses. An investor cannot invest directly in this Index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.