In a world of growing competition, mergers and acquisitions have become a survival tactic, especially for big multinationals.

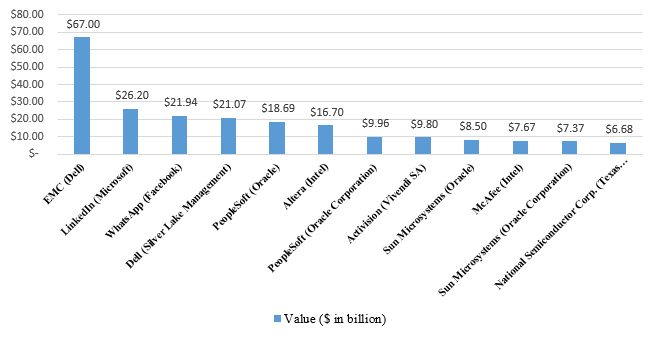

Recently, Microsoft announced the colossal acquisition of LinkedIn for $26.2 billion at $196 per share. The acquisition will bring together one of the world’s leading cloud-based businesses for professionals with the world’s leading professional network.

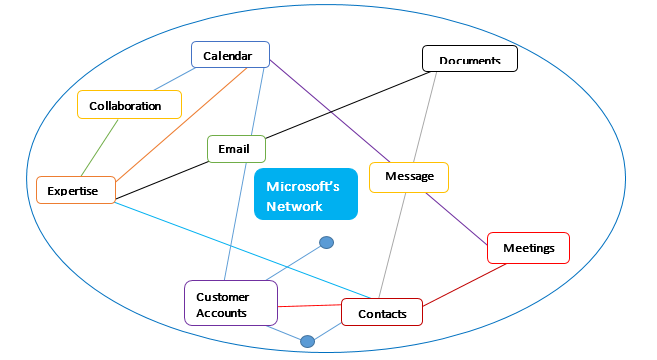

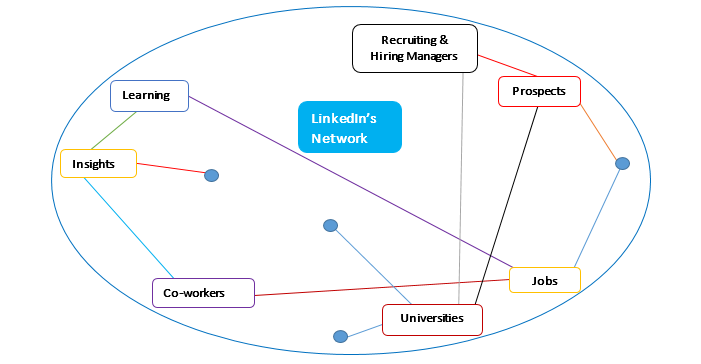

Today’s professional relationship management world is essentially comprised of two components: (1) Customer Relationship Management (CRM) to support engagement of prospects and clients by businesses, and (2) personal professional networks used by individuals, primarily, to maintain business relationships. According to Microsoft, this acquisition will help them bridge these two worlds to better serve customers.

Connecting Two Professional Worlds

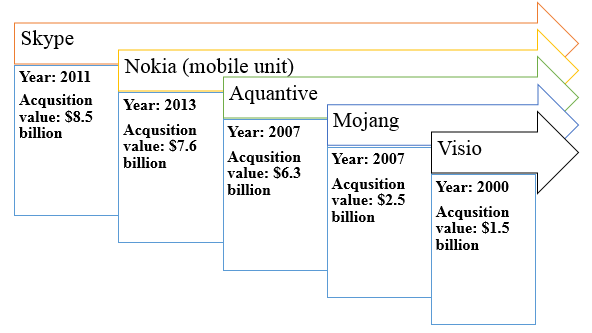

This is the largest acquisition in Microsoft’s history and the 2nd largest in recent tech history. Additionally, it brings together two different kinds of companies—a tech giant of business software tools with the largest business-oriented social networking site (with more than 400 million members globally).

Microsoft’s Top 5 Acquisitions Prior to LinkedIn

Source: Venture Beat

Major Tech Acquisitions in the last 15 years

Source: Dealogic

However, the most interesting part of the deal is the funding. Despite being awash in cash, Microsoft is taking out a big loan to pay for the acquisition. Why?

First, in an effort to lower its tax bill. This move will help Microsoft avoid paying a 35% tax rate to repatriate cash from overseas accounts. Second, the acquisition will help the company lower its weighted average cost of capital along with deduction of interest payments, thus reducing its future U.S. tax bills.

So, in using this debt-financing strategy, Microsoft could legally avoid paying roughly $9 billion in U.S. taxes in the current financial year and save many more millions in the years to come.

Other Benefits for Microsoft Include:

- Help fill gaps where SharePoint has not been sufficient: contact management and content publishing.

- Combining Microsoft’s cloud and LinkedIn’s network will help accelerate the growth of Microsoft Office 365 and Dynamics. Additionally, a host of new services will help Microsoft strengthen its competitive advantages.

- Sales professionals already use LinkedIn for customer relationship management and lead-sourcing tasks. With that, integrating LinkedIn’s social graph with Microsoft’s growing cloud-based enterprise CRM platform could add significant value by providing background information on users.

- LinkedIn provides Microsoft with a number of new revenue sources like paid content, recruitment ads, and premium subscription.

- LinkedIn’s treasure-trove of data could help Microsoft obtain a strong foothold in the B2B marketing and digital advertising market by targeting all-important business-decision makers.

- Microsoft’s answer to Apple’s Siri, Cortana, could provide more professional networking tools to its users with LinkedIn’s vast store of millions of profiles, tens of millions of content nuggets and a host of other data at its disposal.

For LinkedIn, the deal offers hope to renew its decelerating growth as well to offer an exit to shareholders, after the stock tumbled from a peak of $269 in February 2015 to as low as $101.11 last February. Weaker-than-expected growth forecasts in 2016 have held it back since.

Bottom Line for Investors

With the acquisition of LinkedIn, Microsoft will have far greater reach in terms of social networking services and professional content. Additionally, the deal also serves to bolster its cloud business.

Expectations are that there will be some cost savings with the merger and a minimal negative impact of about 1% on adjusted earnings for its fiscal 2017 and 2018. Given this, the deal is expected to add to Microsoft’s non-GAAP earnings per share in fiscal 2019. If Microsoft can leverage its strengths with those of LinkedIn’s, there’s solid potential in the marriage.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.