Already a leader in mobile, fixed telephone and satellite television services, AT&T is apparently looking to boost content – by acquiring TV Network Time Warner. And, it’s willing to shell out $85.4 billion for it.

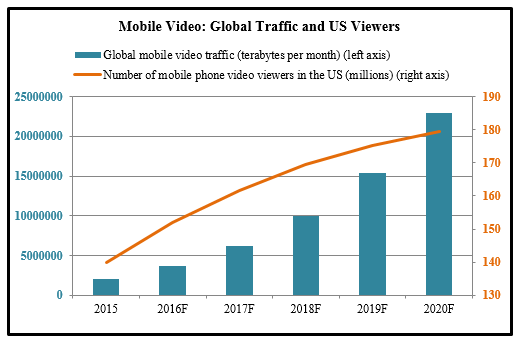

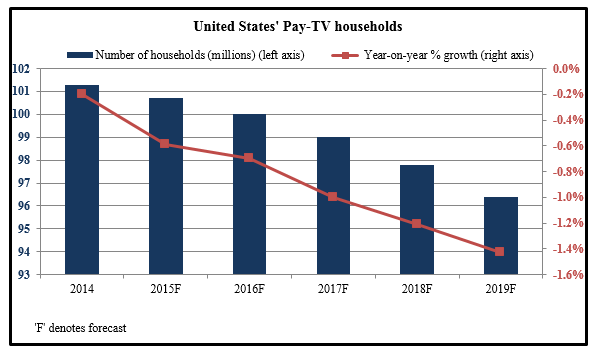

AT&T is already a provider of broadcast television services through DirecTV. But, as online video streaming rapidly takes over traditional pay-TV viewership, AT&T’s proposed merger could be its ticket to stay ahead of the curve. To cater to a population increasingly hooked to their mobile gadgets, AT&T is apparently looking to beef up content for multi-device viewing. And joining hands with content maker Time Warner – owner of HBO and CNN – could just be the perfect catalyst for that purpose. The deal could reap rewards for AT&T, given a projected +25.5% growth in the number of mobile video viewers in the U.S. over 2015-2019 against the expected deceleration in the number of American pay-TV households across the same period.

Source: Statista

Source: Statista

Recent GfK reports reveal that already about 25% of U.S. households don’t subscribe to pay-TV. The trend is expected to only intensify in the next couple of years, with evolving technology such as the 5G spectrum to proliferate mobile video viewership.

Already, AT&T is set to launch its online streaming platform, DirecTV NOW. The merger should only make it easier and probably economical for AT&T to get access to the extensive repertoire of movies/TV series as well as new content from the Warner factory. The coupling could even spell an influx of advertisers hoping to leverage AT&T’s data/user base. All this could potentially get translated into lower prices for subscribers of AT&T.

Does the Merger Pose Threat to Competition?

But the million-dollar question is: would the deal get the regulatory nod? Last year, the Comcast-Time Warner Cable proposed deal was deemed by the Department of Justice to violate competition laws. The deal involving AT&T and T-Mobile USA was blocked on similar grounds in 2011. However, unlike the cases mentioned above, the merger between AT&T (America’s fifth-largest firm by profits and second-biggest wireless carrier) and Time Warner (the world’s third largest TV network) would not be a horizontal merger since it involves the integration of a distributor with a content maker. So, chances are the proposed merger will not necessarily be seen as violating antitrust regulations.

Nevertheless, speculations are rife on the possibility of AT&T thwarting its rival broadcaster/streamers from licensing Time Warner content at fair prices, should the union happen. Some are also pointing towards the likelihood of AT&T charging their subscribers disproportionately more for watching content produced outside of Time Warner – akin to the “zero rating” concept in web browsing and thereby frustrating viewers’ choices.

But, a potential antithesis is that AT&T’s focus on bolstering content production/distribution for online streaming could actually galvanize other players in the broadcasting/media industry to up their game. That, in turn, should lead to more innovation – fueling competition along the way – to whet the burgeoning consumer demand for mobile videos/online streaming.

Also, it is likely that regulators would approve the deal conditional upon AT&T agreeing to charge fair and non-discriminatory prices to other broadcasters/online distributors for licensing Time Warner content. Regulators offered similar protection to video distributors in case of the Comcast-NBCU merger.

Bottom Line for Investors

It is still too early to tell whether or not the AT&T-Time Warner deal will get regulatory approval. But, the proposal is yet another instance of companies seeking every opportunity to milk the growing consumer appetite for fast-evolving technology. And, that could eventually lead to more choices in content, viewing devices and broadcasters for consumers.

Regardless of the status of AT&T’s plans to acquire Time Warner, it’s evident that broadcasters are looking for ways to diversify into more platforms/devices and boost content to compete with rapidly growing online video streaming firms.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.