Cecilia and Jorge R. from Richmond West, FL ask: Hi Mitch, my husband and I saw on the news last night that most investors are expecting very weak profits and earnings this year. It feels counterintuitive to want to own stocks when profits are falling. What are we missing?

Mitch’s Response:

Thanks for your question. Let’s first dig into the news story you saw, which highlighted falling expectations for U.S. corporate earnings in 2023. Wall Street consensus is calling for an approximately -4% decline in aggregate Q4 2022 profits (year-over-year) for S&P 500 companies. This profit decline would be the first since the economic shutdown in early 2020 when the pandemic struck. Consensus goes on to forecast profits declining in the first half of 2023, only to rebound in the second half for a full-year +4% gain.1

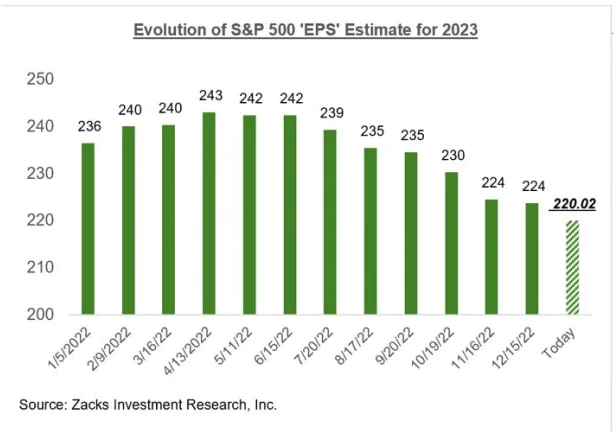

Zacks Investment Research has a slightly different outlook for corporate earnings in 2023, as seen in the chart below. We see a bigger decline in Q4 2022 but agree on an earnings rebound in the second half. Regardless, the bottom line remains the same – corporate earnings are expected to be weak in the first half of 2023 with a rebound expected later in the year.

Rebalance Your Investment Portfolio to Meet Your Ultimate Retirement Goals

For investors nearing retirement, it’s common for market ups and downs to cause you to worry and uncertainty about your financial future.

The key is to define your investment objectives, determine your asset allocation, and manage your investments over time. To help you better prepare and plan for retirement while navigating through the market downturns, we’re offering our guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio, which covers:

- How to accurately establish your retirement income needs

- Developing an investment discipline that allows you to get good results over time

- Investing rules to help you avoid self-sabotage

- Plus, our views on key steps to create and maintain the ultimate retirement portfolio

If you have $500,000 or more to invest, get this guide to learn our ideas on building and maintaining a retirement portfolio to potentially achieve your long-term goals.

Get our FREE guide: 7 Secrets to Building the Ultimate DIY Retirement Portfolio2

In your question, you make the point that it feels counterintuitive to own stocks when profits are falling, which based on the above forecasts would mean not owning stocks in the first half of 2023. I understand where you’re coming from – a key objective in owning shares of stocks is to own a portion of future profits and earnings. If those profits are falling, then wouldn’t that be a time to ditch stocks, at least until earnings recover?

While this line of thinking may make logical sense, there’s a problem – the stock market is a discounting mechanism, meaning that the decision whether or not to own stocks does not depend on what earnings will do in the coming quarter or two, but rather where earnings are headed a year-plus from now. If you expect earnings to recover later this year and on into next, then it would make now the time to own stocks, in my view.

By the same logic, investors should consider that last year’s weakness in the stock market was likely driven by a pricing-in of current corporate earnings weakness, several months and even a year before it took place. After all, we know with the benefit of hindsight that expectations for S&P 500 earnings estimates peaked last April (see chart below).

The question now for investors is whether earnings will surprise to the upside in 2023, and whether or not you want ownership in the possibility of a profit rebound later in the year and early 2024. If the answer is yes to both, then it would make now the time to be in stocks, in my view.

If you’re nearing retirement in this volatile market, I recommend taking a look at rebalancing your portfolio. This takes a lot of work and dedication, and I want to share some additional steps to help you! Download our exclusive guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio5, to get insight on how to protect your investments and create a portfolio that meets your financial goals.

If you have $500,000 or more to invest, get this guide to learn our ideas on the step-by-step process of building and maintaining a retirement portfolio that will potentially help you reach your goals and enjoy a secure retirement.

Disclosure

2 ZIM may amend or rescind the guide “How to Build Your Ultimate Retirement Portfolio” for any reason and at ZIM’s discretion.

3 Zacks Investment Research. January 20, 2023. https://www.zacks.com/commentary/2042184/making-sense-of-the-early-q4-results-is-an-earnings-cliff-coming

4 Zacks Investment Research. January 20, 2023. https://www.zacks.com/commentary/2042184/making-sense-of-the-early-q4-results-is-an-earnings-cliff-coming

5 ZIM may amend or rescind the guide “How to Build Your Ultimate Retirement Portfolio” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.