One of the prominent items on President Donald Trump’s to-do list is to revive output and employment in the U.S. Energy sector. Trump wants to loosen regulations for the industry, with an overarching goal of making the U.S. less dependent on foreign (OPEC) sources of oil.

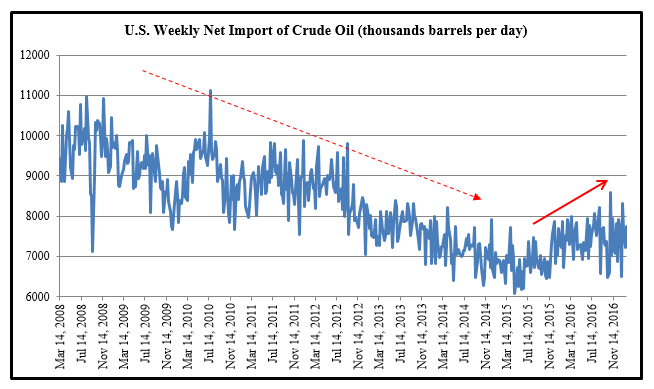

To be sure, the production of natural gas via the “Shale Revolution” already started paving the way for U.S. energy independence. But there’s also been an uptick in oil imports over recent years.

Source: U.S. Energy Information Administration

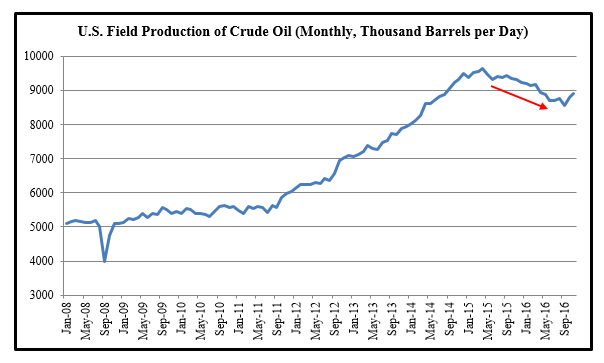

Source: U.S. Energy Information Administration

The reason for reduced domestic output was likely tied to the prolonged and rather dramatic decline in crude oil prices starting in late 2014, which severely bruised the sector’s earnings. Low prices forced many drillers (particularly smaller players) to cut back on output, which may have led U.S. refineries to turn to other nations for crude. In November 2016, the per-day crude oil production in the U.S. was 4.3% lower compared to the same month in the preceding year.

Source: U.S. Energy Information Administration

Trump’s Proposed Policy May Change the Energy Landscape

A possible outcome of Trump’s proposed policies is new taxes on oil/energy imports, which would be designed to nudge domestic refineries to purchase more from U.S. crude oil producers. This would give domestic oil producers a leg-up on price bargaining.

With regards to plans for de-regulation in the industry, Trump has cleared the way for two controversial pipeline projects. His executive order on the Keystone XL pipeline – meant to carry heavy crude from Western Canada to the U.S. Gulf Coast – should potentially ‘compete away’ Middle Eastern imports, which are also variety of heavy crude.

The President has also given the green light on the Dakota pipeline, which has the potential to move 450,000 barrels a day from the Bakken shale basin to the Texas coast refineries. At present, around 200,000 to 300,000 barrels a day from Bakken have to be transported on relatively costly rail cars, possibly contributing to the -19% cut in output from the region over the past two years. The pipeline is being viewed as a lower-cost option for carrying crude, and is therefore expected to boost extraction from the basin.

For both the projects, Trump has emphasized on the use of U.S.-made material and American labor, which could provide a tail boost for domestic companies in the Materials and Industrials sectors, as well.

Bottom Line for Investors

Donald Trump’s plans to boost domestic energy output and curb imports, if materialized, could push prices up for domestic oil; on the other hand, higher exports from the U.S. could create downward pressure on global prices.

While a higher price point for domestic crude oil is a positive for drillers, the possible impact on the rest of the U.S. economy is not as straightforward. A rise in fuel costs squeezes earnings for oil-intensive sectors and increases fuel expenses for consumers, but higher employment/wages in U.S. Energy sector could boost GDP and aggregate demand. The bottom line, however, is that until and unless the proposals gain more traction, the exact net effect is nearly impossible to predict.

Moreover, many U.S. corporations are rapidly transitioning to renewable energy – something that could drag demand for fossil fuels and therefore neutralize the positive contribution to earnings of new policy.

Watching how the Trump Administration’s proposed energy policies take shape will be crucial in the months ahead. In the meantime, there are several other factors affecting the economy that investors need to keep a close eye on, and you can find them all in our just-released Stock Market Outlook report. Click below to download your free copy today:

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.