Eric B. from Edison, NJ asks: Hello Mitch, I understand that the stock market is doing well this year so far. But it seems like it’s just a continuation of last year when really big technology companies are doing much of the heavy lifting. Do you see that as an issue?

Mitch’s Response:

Thanks for sending me an email, Eric. Late last year, the “Magnificent Seven” stocks were a significant driver of the market rally, and so far, this year, technology stocks are up double-digit percentages. Your question concerns the seeming lack of breadth in this market rally’s trend.1

But a closer look now shows that the market’s gains have spread beyond just mega-cap technology companies. For instance, the S&P 500 equal-weighted index has now also risen to a record high, and I’d note that about 20% of stocks in the S&P 500 are now trading at 52-week highs. That’s the most we’ve seen since May 2021.2

Small-cap stocks have also been participating in the recent rally, with the Russell 2000 index up nearly 30% from its October lows. Small-caps stand to benefit from lower rates in the future, as refinancing costs can have a meaningful impact on small-cap companies’ balance sheets. Small-caps also tend to be economically sensitive, so investors may be pricing in the expectation of a soft landing.

Tips to Help You Manage Market Fluctuations!

Volatility is a normal part of investing. But you still may find yourself pondering questions like – what should I do when market downturns occur?

To help you steer through financial changes, I’m offering our free guide, “Helping You Manage Market Volatility,” which provides expert insights and answers questions like:

• Market downturns can and will occur, but what should you do?

• How can diversification help you manage volatility without compromising your returns?

• When volatility is too much for you to handle, how can a money manager help?

• Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Download Zacks Volatility Guide, “Helping You Manage Market Volatility.”3

The bottom line, however, is that tech does continue to lead, and you’re asking if I see that as an issue. I would be concerned if, much like in the late 1990s, technology companies were being bid-up to exorbitant premiums with no earnings and free cash flow to justify sky-high prices. But that’s not what we’re seeing now.

The Tech sector is the biggest earnings contributor to the S&P 500 index, and it is expected to bring in 28.6% of the index’s total earnings in 2024. The second and third biggest contributors are Finance and Medical, at 17.8% and 12.5%, respectively.

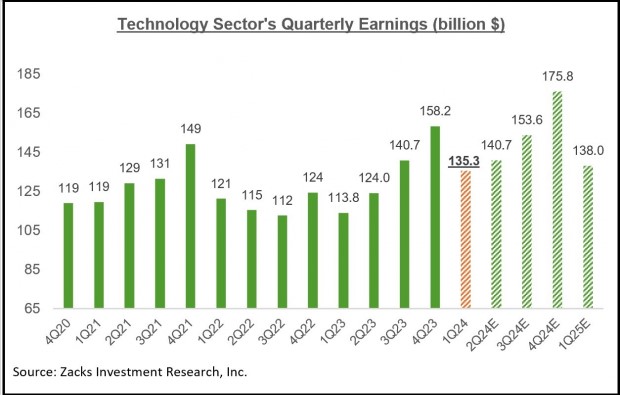

In Q1 2024, Tech sector earnings are expected to increase +18.9% from the same period last year on +7.9% higher revenues. This would follow the sector’s +27.4% year-over-year earnings growth in Q4 2023, on +8.5% higher revenues. In short, U.S. technology companies are delivering blistering earnings, and their stock prices are pushing higher. The two are connected. As seen in the chart below, technology’s $158.2 billion earnings tally in Q4 2023 was a new all-time quarterly record.

With outstanding earnings like what we’re seeing in tech, we’d expect the sector to lead. 2024 should usher in earnings recoveries for other sectors as well, however, as U.S. economic growth is expected to continue throughout the year. I think we’ll see more breadth to the market rally in the process.

During this unpredictable period, I recommend revisiting your investment portfolio to ensure its resilience in the face of market changes!

Our free guide, “Helping You Manage Market Volatility”, is a great tool to use for expert insights during market turbulence and answers questions like:

• Market downturns can and will occur, but what should you do?

• How can diversification help you manage volatility without compromising your returns?

• When volatility is too much for you to handle, how can a money manager help?

• Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Disclosure

2 Zacks. 2024. https://www.zacks.com/commentary/2238312/previewing-the-2024-q1-earnings-season

3 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

4 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.