Zacks Investment Management provides insight into the biggest news stories, and key factors that we believe are currently impacting the market such as:

- Inflation comments from Treasury Secretary Janet Yellen

- Supply chain bottlenecks continue to hunt automakers

- The booming housing market, and sputtering commercial real estate

Treasury Secretary Janet Yellen Spooks Markets with Inflation Comment – Treasury Secretary Janet Yellen sparked some selling pressure in the equity markets Tuesday when she inferred that interest rates may need to move higher to keep the economy from overheating. She was referring to the effect that $4 trillion in additional government spending could have on growth, which in a sense also provided a talking point for those opposed to additional spending plans. For equity markets, there has been a recent history of downside volatility, over short stretches, any time someone at the Fed or Treasury implies any type of monetary tightening. Yellen’s comments sparked a similar outcome. Interestingly enough, Yellen walked back her comments later in the day, stating that “I don’t think there is going to be an inflationary problem, but if there is, the Fed can be counted on to address it.” Early signs are pointing to at least short-term inflationary pressures: consumer prices jumped 2.6% from March 2020 to March 2021.

______________________________________________________________________

How to Navigate Through The Market Despite The Unknowns

This past year has proved to many investors that any market outcome is possible. Oil prices have seen a solid recovery, and Biden has passed the $1.9 trillion American Rescue Act, but what’s next? Questions may arise, such as: Are we on the road to full economic recovery? If so, how long will it take?

To better navigate through the market’s ups and downs, it’s important to be prepared for both the good and bad. In this report, we look at whether the bulls or the bears will dominate in 2021. We also take a look at:

- Oil is rebounding, but long-term outlook is bleak

- Fiscal spending that won’t quit

- 7 reasons to be optimistic in 2021

If you have $500,000 or more to invest and want to learn more, download your guide today!

Download Our Just Released, “May Market Strategy Guide”2

______________________________________________________________________

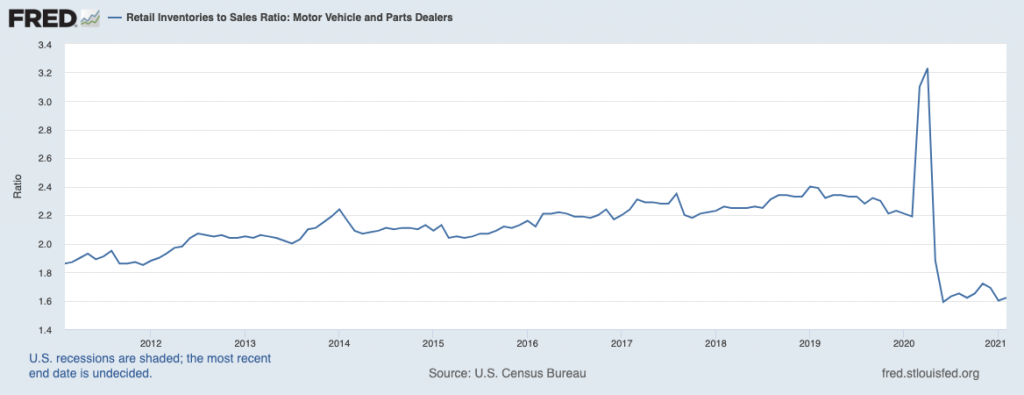

Supply Chain Bottlenecks Continue to Haunt Automakers – Over 70 years ago, in 1950, a Toyota executive named Taiichi Ohno visited a U.S. supermarket and was amazed. He was impressed at how shelves were restocked as soon as they were emptied, even though storage at supermarkets was limited. Ohno’s amazement gave way to “just in time” inventory management for Toyota and other automakers. Instead of keeping warehouses full of steel and other components, supply chains were developed to have inputs needed to assemble cars without having to stock parts. Automakers have been following this model for decades, but the pandemic has turned the process on its head. Toyota has been stockpiling some parts up to four months; Volkswagen is building six factories to make its own batteries; General Motors is building a $2.3 billion factory to produce enough batteries for hundreds of thousands of vehicles a year; and of course, Tesla is disrupting the business model by seeking to lock-up access to raw materials, namely nickel. With the effect of the pandemic coupled with the Suez Canal fiasco and the storm in Texas, automakers have been struggling to obtain parts needed to manufacture cars. As you can see in the chart below, the inventory to sales ratio is the lowest it has been in over a decade.3

While the Housing Market Booms, Commercial Real Estate Sputters – Over the last year, one of the biggest economic takeaways was the “K-shaped” economic recovery. During the summer of 2020 and thereafter, the “K” referred to some parts of the economy thriving in the economy (namely, the digital economy), and others suffering greatly (hospitality, travel, retail). At this stage, the economy is now experiencing a broad-based recovery, but the “K” still exists in real estate. Spending on residential building (housing) rose for the 10th straight month in March, and prices have soared over the last year. Meanwhile, nonresidential spending, which includes offices, hotels, factories, and so on, has dropped to its lowest level in two years. The recovery has not quite taken hold yet, as demand for commercial real estate remains light, and projects are stalled because of backlogs and rising prices for key materials.5

Will the Bulls or Bears Dominate in 2021? – The market has been very volatile for the past few months, and questions may arise, such as: Are we on the road to full economic recovery? If so, how long will it take? As you navigate through the ups and downs in the market, it’s essential to be prepared for what’s next.

In our just-released May Market Strategy Report, we take a look at the key factors that are influencing the economy and markets as the year continues to unfold. We look at whether the bulls or bears will dominate in 2021 and we also focus on:

- Oil is rebounding, but long-term outlook is bleak

- Fiscal spending that won’t quit

- 7 reasons to be optimistic in 2021

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

3 Wall Street Journal. May 3, 2021. https://www.wsj.com/articles/auto-makers-retreat-from-50-years-of-just-in-time-manufacturing-11620051251

4 Fred Economic Data. April 26, 2021. https://fred.stlouisfed.org/series/MRTSIR441USS#0

5 The Construction Association. May 3, 2021. https://www.agc.org/news/2021/05/03/nonresidential-construction-outlays-drop-march-fourth-straight-month-weak-demand

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.