Much like 2020, the last year was filled with twists and turns and surprises that kept the world, investors, businesses, and families on our toes. From a pure investment standpoint, value stocks mounted a powerful surge that rivaled growth stocks for the first time in years, and corporate earnings continued to break records despite inflation and supply chain pressures. The stock market delivered another solidly positive year.

Looking ahead to the new year, I continue to see an environment where the prevailing sentiment is that the economy is not in great shape, with a particular fixation on the inflation issue. That could be good news for stocks – particularly if the jobs market continues to improve, earnings go up, price pressures ease, and pandemic-related risks eventually fall. With that in mind, and to kick off the new year, I’m laying out three underappreciated positives for 2022.

Normalizing Earnings Trends

In the third quarter of 2021, U.S. corporate earnings notched a new all-time quarterly record, surpassing the record set in the preceding period. It is also true that earnings growth rates have come down and are projected to fall further in the coming periods, but in my view, that just signals a normalization of earnings trends from a relatively bizarre and unexpected two-year period. Earnings surprises – which have largely been to the upside – are moderating towards the longer-term trend.1

Looking ahead, I think corporations still see an environment of elevated demand for goods and services. The aggregate tally of total earnings remains very high, and there is a breadth of strength across all the key sectors. But we also know that the unusually high growth rates of 2021 will not continue into the new year, as they in part reflect easy comparisons to the year-earlier periods that were severely impacted by Covid-related disruptions. Here again, we see a normalization of earnings growth trends.

Inflation is the one dynamic that may give corporations some problems in the new year, but I think many companies have the pricing power and market share to navigate price pressures successfully. In the new year, investors will have an important mandate of evaluating companies by their ability to navigate (or pass along) price increases, in my view.

Inflation Trending in Stocks’ Favor

Inflation is likely to remain the biggest concern as we push into the new year, and I think price pressures will probably persist for a few months at least. But the inflation story does not automatically have to be negative for 2022, for two reasons.2

The first is that stocks are one of the best asset classes available in a world of inflationary pressures, in my view. The data also backs me up – looking back to the 1920s, one would find that stocks tend to do quite well in moderate (5% to 10%) inflationary environments. The relationship breaks down when inflation becomes runaway (greater than 10%), but I do not see that outcome as remotely likely – particularly as the Federal Reserve plans to shift policy objectives in 2022.

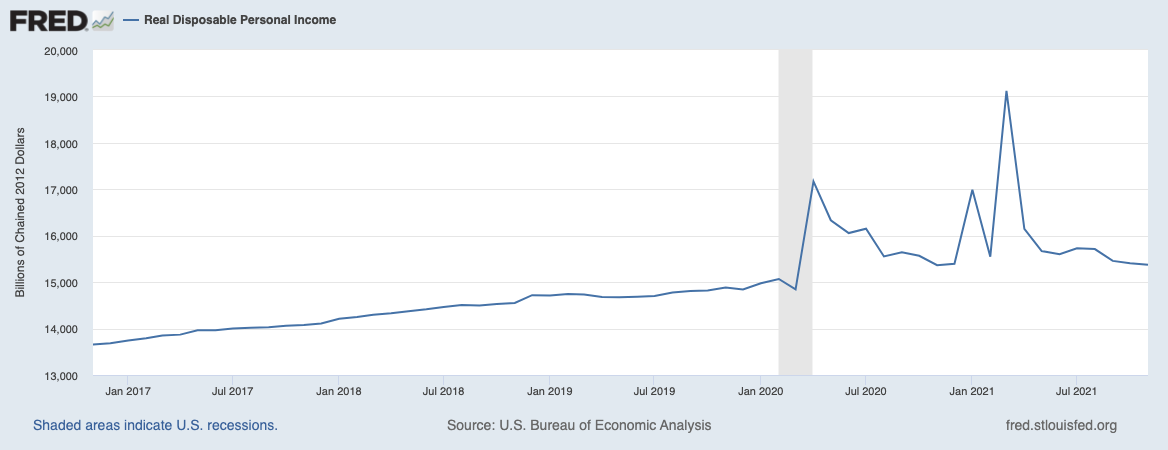

Second, I would not underestimate the ability of consumers and businesses to navigate the inflation issue. The jobs market in the U.S. is extremely tight at the moment, and wage pressures have given many workers higher incomes as the new year begins.

Source: Federal Reserve Bank of St. Louis3

Savings also remain elevated, and demand for goods and services has not flinched much even with elevated inflation. Businesses have also been able to pass along rising costs where needed, contributing to record-setting earnings that I believe will continue in the new year.

Cash on Hand

In the previous section, I alluded to elevated savings for households, but an economic fundamental less cited is that businesses also set aside enormous amounts of cash as the pandemic played out. As confidence improved in 2021 – even as the pandemic entered new phases – businesses started to spend some of their excess cash reserves on dividends and share buybacks. About 50% of Russell 1000 index companies raised or initiated a dividend in 2021, a strong showing.4

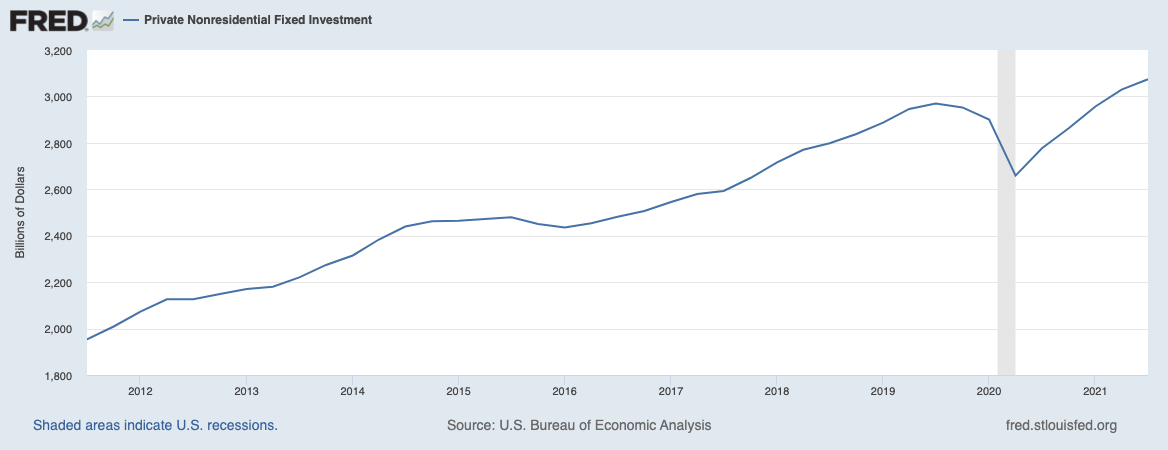

The other factor in having healthy amounts of cash on the balance sheet is a private fixed investment, which is a technical way of saying business investment in equipment, infrastructure, labor, etc. U.S. corporations have been investing again at pre-pandemic levels (chart below), and I see this activity – along with more dividends and share buybacks – increasing more in 2022.

Source: Federal Reserve Bank of St. Louis5

On the investment side, excess cash has been making its way into the capital markets, and in particular the stock market. In 2021 alone, nearly $1 trillion has flowed into equity ETFs and mutual funds, which is more than the previous 19 years combined.

Bottom Line for Investors

Perhaps the factor that keeps me most optimistic about 2022 is the feeling that few investors are optimistic with me. I see an environment where sentiment about the economy and markets is more negative than positive, which to me signals a palpable wall of worry that stocks generally tend to climb. If the economy can deliver outcomes even barely better than most expect, stocks are likely to respond positively to the surprise. I think 2022, much like 2021, is set up nicely for this dynamic.

Disclosure

2 Black Rock. December 15, 2021. https://www.blackrock.com/us/individual/insights/taking-stock-quarterly-outlook

3 Fred Economic Data. December 23, 2021. https://fred.stlouisfed.org/series/DSPIC96

4 Black Rock. December 15, 2021. https://www.blackrock.com/us/individual/insights/taking-stock-quarterly-outlook

5 Fred Economic Data. December 22, 2021. https://fred.stlouisfed.org/series/PNFI

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

“The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.”