In previous columns, I’ve touched on the growing idea that globalization is in rapid decline. Recent events on the geopolitical stage appear to be hardening this narrative.1

In quick succession, the U.S. shot down a Chinese spy balloon, President Biden made a surprise visit to Ukraine, Russian President Vladimir Putin announced Russia would pause its participation in the nuclear-arms treaty with the U.S., and the Wall Street Journal reported that President Xi Jinping was planning a trip to Moscow in the spring. You don’t need to be an expert in geopolitics to conclude that tensions are escalating between the East and West.

Many prognosticators cite these events – and the lingering effects of the pandemic, which saw supply chains break down and shipping rates soar – as further evidence that globalization trends are set to reverse in the coming years and decades. Some ‘experts’ have all but written obituaries for globalization.

Many CEOs and investors are also worried. According to a survey published by the Harvard Law School, executives cited uncertain macroeconomic conditions and de-globalization as two of the top issues heading into 2023. A full 86% of investors and CEOs said that de-globalization is an imminent risk, which suggests that global supply chains and global trade are poised to unwind.2

Put simply, the fears of de-globalization appear to be moving to new heights, which usually prompts me to ask the question if the fear of an economic outcome may outweigh the reality of it occurring. Any time that happens, the possibility of a positive surprise increases, which is essentially the formula for how markets climb a wall of worry.

I think we’re seeing this with the globalization story. While the narratives for de-globalization have increased dramatically over the last year or so, the data in global trade suggests that the opposite is happening.

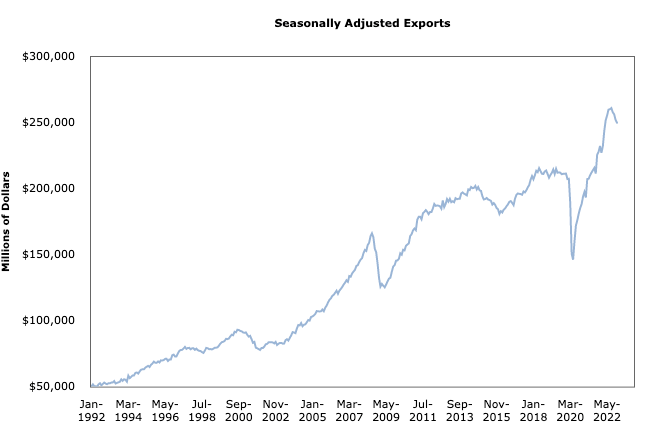

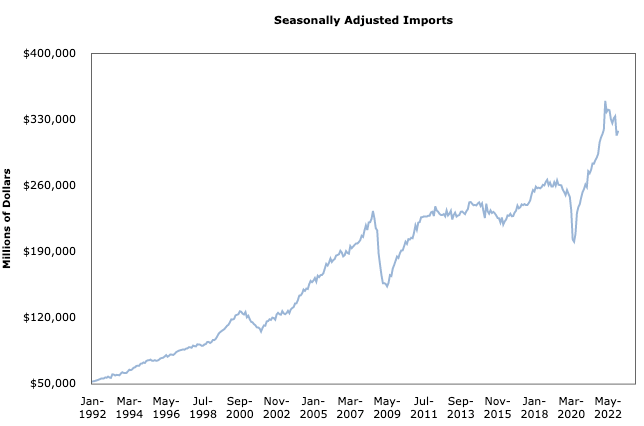

In 2021, global trade growth accelerated so quickly that it shot back up to its pre-2008 trendline. In 2022, global trade volumes reached a new record, posting figures nearly 10% higher than they were pre-pandemic. For the U.S., exports increased by 17.7% in 2022, while imports increased by 16.3%. As the charts below show, the U.S. is not exactly shutting itself off from the world economically.

U.S. Exports, Seasonally Adjusted (1992 – Present)

U.S. Imports, Seasonally Adjusted (1992 – Present)

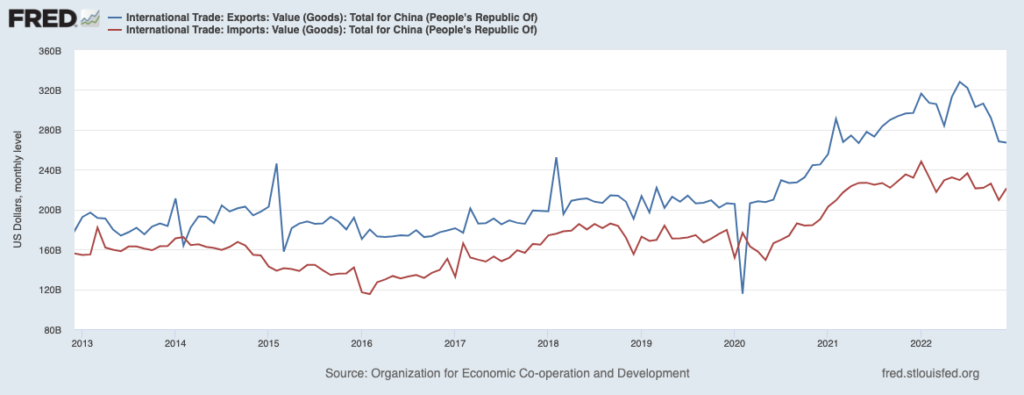

A big feature of the de-globalization argument is that the U.S. and China are at the cusp of a major decoupling, where economic cooperation and trade between the two will be a thing of the past. Yet as the two countries harden their stance toward the other, trade continues to rise: U.S. imports from China increased by 6.3% year-over-year in 2022, while exports rose by 1.6% year-over-year. Despite tariffs and aired grievances, total trade between the two countries reached a record $690.6 billion in 2022.5 Put simply, this is not evidence of de-globalization.

U.S. Imports (Red Line) and Exports (Blue Line) with China

In my view, what many in the media are labeling de-globalization is more of a ‘regionalization’ of supply chains and production, which some have referred to as ‘nearshoring.’ The basic tenet here is that supply chains can be strengthened by moving production closer to the end market, which also hedges against fluctuating shipping costs. That’s why we’ve seen Japanese, South Korean, and now Chinese companies establish factories and production in Mexico, so those goods can be labeled “Made in Mexico” and benefit from the free trade agreement. In this sense, moving production out of China is not de-globalization or some fundamental reworking of global commerce. It’s just global trade being restructured.

Bottom Line for Investors

Global trade as a percent of global GDP reached a peak of roughly 30% in 2013. As of the end of 2022, the figure stands at roughly 26%. This isn’t exactly global trade falling off a cliff.

While headlines often focus on tariffs, trade wars, and geopolitical tensions, behind the scenes there has been a proliferation of new trade deals and economic cooperation across developed countries and emerging markets. That’s a big reason why total global trade has gone up over the past several years, not down.

Iterating on a point I’ve made previously, globalization is not an on-off switch – it’s a complex and layered set of relationships between countries regarding trade, investment, financial systems, immigration, technological networks, supply chains, and so on. At any given time, a country may be seeing more cooperation in some of these areas, and less cooperation in others. But the suggestion that this cooperation is somehow going away seems far off base to me, and I think it’s another example of a global economic fear too far outweighing the reality of it.

Disclosure

2 Harvard Law. February 1, 2023. https://corpgov.law.harvard.edu/2023/02/01/where-is-the-world-going-in-2023-and-beyond/

3 Census. 2023. https://www.census.gov/econ/currentdata/?programCode=FTD&startYear=1992&endYear=2023&categories[]=BOPGS&dataType=IMP&geoLevel=US&adjusted=1¬Adjusted=0&errorData=0

4 Census. 2023. https://www.census.gov/econ/currentdata/?programCode=FTD&startYear=1992&endYear=2023&categories[]=BOPGS&dataType=IMP&geoLevel=US&adjusted=1¬Adjusted=0&errorData=0

5 Wall Street Journal. February 9, 2023. https://www.wsj.com/articles/u-s-china-tensions-are-high-so-is-commerce-between-the-nations-11675920444

6 Fred Economic Data. February 14, 2023. https://fred.stlouisfed.org/series/XTIMVA01CNM667S

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI ACWI ex U.S. Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the US. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.