Economic data to start the new year has been stronger than expected, and that has many investors worried.

Some readers may read that sentence and wonder – why would investors be worried about a healthy economy? I’ll explain why below. First, let’s dig into some of the data defying expectations that the U.S. is headed for a pronounced economic slowdown.1

I’ll start with U.S. manufacturing and services surveys, which give strong insight into factory activity and overall levels of demand. In February, S&P Global’s index of services businesses rose to 50.5, pushing it back into expansion territory and marking the strongest reading in eight months (any reading above 50 marks expansion). U.S. companies that participated in the surveys reported their first growth in output since last summer and indicated optimism about activity in the months ahead.

In manufacturing, February’s index reading rose to 48.4 from 46.9 in January. While still contractionary, the improvement suggests that activity is contracting at a slower pace, and manufacturers indicated that softer demand has allowed them to work through the backlogs that remain a legacy of the pandemic. Both manufacturers and service providers pointed to the easing of supply problems and also lower overall inflation for raw materials. Survey respondents also broadly signaled a positive outlook from here, which is not what investors were expecting at this juncture.

The other key area of economic strength is one I’ve pointed to many times in previous columns – the U.S. labor market. Hiring accelerated briskly in January with payrolls surging by 517,000, which was about 300,000 more jobs than Wall Street consensus estimates for the month. January delivered the largest payroll gain since July 2022, which pushed average job growth over the last three months to 356,000 – well above the 163,000 per month added before the pandemic.

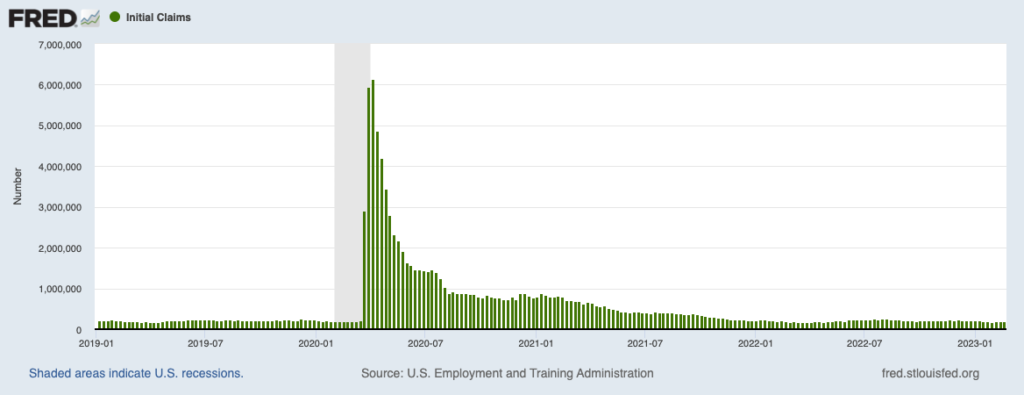

Importantly, initial jobless claims – which is a proxy for layoffs – ticked lower in the last week of February, which suggests that employers continue to desperately cling to workers. First-time applications for unemployment benefits fell to 183,000, which is the lowest reported level since April 2022. The unemployment rate fell to 3.4% on these reports, which is a 53-year low.

Layoffs Continue to Hover at Very Low Levels

Firm wage growth has accompanied the strong jobs market. In January, average hourly earnings grew by 4.4% year-over-year, which followed a 4.8% year-over-year gain in December. Since inflation has been drifting lower as wages move higher, the effect on “real income” has been positive, which has continued to support consumer spending. In January, retail sales unexpectedly jumped 3% from December, which reversed the previous two months of declines.

Overall, what we’re seeing so far in 2023 is an economy cruising at 30,000 feet, not one that’s starting its descent. This gets back to my earlier comment about investors being worried. An economy that’s pushing ahead, expanding employment, raising wages, and seeing strong levels of spending is the opposite of what the Federal Reserve wants to see. For some, that’s problematic.

We already know the Fed is poised to raise rates by 25 basis points at the March and likely the May meetings. A ‘stubbornly’ strong economy raises the possibility of the Fed pushing rates even higher than currently expected, which some argue would come as a negative surprise to markets. It’s gotten to the point where many investors are fixated on Fed policy as the make-or-break factor for the economy and stocks in 2023.

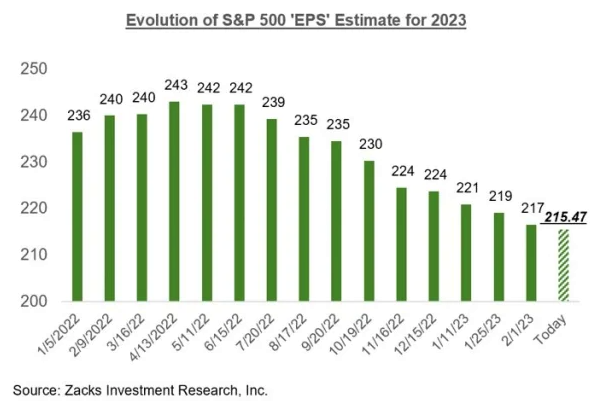

But a key point I think is being overlooked is the effect that a stronger-than-expected economy could have on corporate earnings. Over the past year, analysts and CEOs have been bracing for an economic downturn, which has seen earnings estimates for 2023 march lower (see chart). At present, S&P 500 earnings are expected to decline by -0.2% for the year.

But what happens if economic resilience translates to corporate earnings resilience, and earnings throughout 2023 surprise strongly to the upside? Would fear of higher rates outweigh the benefits of stronger-than-expected earnings? Ultimately, I think the answer is no.

Bottom Line for Investors

In my view, it is counterproductive to want unemployment to rise and for the economy to falter just to increase the possibility of the Federal Reserve ‘pivoting’ to lower rates. This mindset places too much emphasis on the Fed’s role in determining economic and earnings growth, which means placing too much emphasis on how much the Fed influences equity market performance over the long term.

Disclosure

2 Fred Economic Data. February 23, 2023. https://fred.stlouisfed.org/series/ICSA#

3 Zacks.com. February 24, 2023. https://www.zacks.com/commentary/2058948/breaking-down-retail-earnings-and-consumer-spending-trends

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI ACWI ex U.S. Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.