The CEO of JP Morgan Chase, Jamie Dimon, shared a memorable anecdote a few years back. His daughter came home from school sometime in 2008 and asked, “What is the financial crisis?” Mr. Dimon responded by saying, “It’s something that happens every five to seven years.”

Recent turmoil in the banking sector has many investors wondering if we’re on the cusp of the next financial crisis, or whether it’s already begun. In a span of just two weeks, we’ve seen the collapse of Silicon Valley Bank and Signature Bank, as well as an orchestrated takeover of 166-year-old Credit Suisse, a financial institution with over 50,000 employees. This string of events certainly makes it feel like there’s a financial crisis in the offing.1

But as I’ll explain below, these institutions were largely in a league of their own in terms of their risk exposure, and each company made ill-timed and ill-informed management decisions that ultimately set them up for failure, in my view.2

Let’s start with Silicon Valley Bank (SIVB).

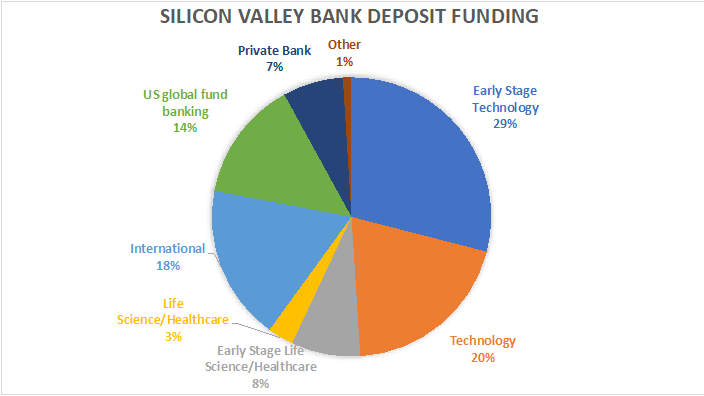

SIVB was a bank that catered mostly to early-stage technology companies, venture capital companies, and private equity firms. In the year following the Covid-19 lockdowns—when liquidity surged in the U.S. from massive fiscal and monetary stimulus—SIVB saw its deposits surge from $62 billion to $124 billion, a roughly 100% increase at a time when most banks were experiencing 20% to 30% increases in deposits. SIVB was gaining large, wealthy clients in very concentrated industries.

Silicon Valley Bank’s Deposits Were Too Concentrated

Undiversified, uninsured deposits can pose major problems for a bank. We learned last week that the Federal Reserve Bank of San Francisco started issuing SIVB citations in 2021 for the way it was handling risks. In short, the Fed flagged SIVB for not having enough cash on hand in the event of a crisis, and by July 2022, the SF Fed had put the bank in full supervisory review. By the fall, staff from the San Francisco Fed met with senior SIVB leaders about its deficient risk controls, and what the bank planned to do about exposure to losses on its fixed-rate securities portfolio when interest rates rose. SIVB was in a league of its own: unrealized losses on its books rendered its Tier 1 capital ratio as essentially 0%. SIVB largely did nothing in response.

Signature Bank offers another example of poor risk management, in my view. In 2018, the bank opened its doors to cryptocurrency companies, and within three years, the share of crypto industry deposits grew from 0% to 20% of total deposits at the bank. By the end of 2022, 93% and 90% of SIVB and SBNY’s deposits were uninsured, respectively.

Times are good when “risk is on,” but when the cryptocurrency industry suffered major setbacks and the startup world saw funding evaporate, many early-stage companies (clients of SIVB) and crypto firms (clients of SBNY) drew down cash reserves to continue funding operations. It could be said that the writing was on the wall.

As for Credit Suisse, problems had been emerging for months if not years. A high level of executive turnover contributed to the Swiss lenders’ mismanagement, and they notoriously made bad bets in its alignment with now-bankrupt Greensill Capital and its $5 billion loss from the collapse of Archegos Capital Management. That’s an entire year’s worth of profits. Last October, rumors of the banks’ problems on social media led to a major outflow of wealthy clients, with deposits falling more than 40% and assets plummeting by 30% in 2022. Again, much of this writing appeared to be on the wall.

It could very well be that more bank failures are on the way, but I sincerely do not think that will be the case—at least here in the U.S. What I think we’ve seen recently is the collapse of mismanaged banks with bad risk profiles, which I confidently believe is more of an exception than a rule in the U.S. banking system.

Bottom Line for Investors

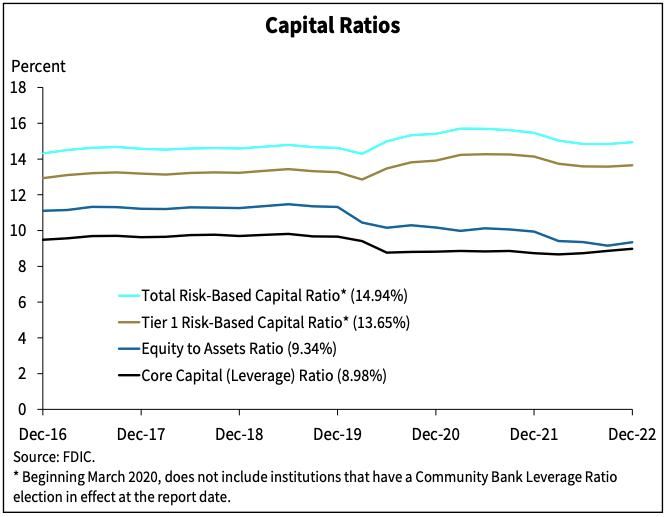

Another reason not to fear a new financial crisis now is that the U.S. banking system is extremely well-capitalized, with Tier 1 capital ratios at very solid levels and loan-to-deposit ratios at almost their lowest levels in 50+ years. By these key measures, the banking system is arguably the strongest it’s been in decades.

Nearly all large banks can meet withdrawal requests without selling illiquid assets or fixed-income assets at losses, and smaller banks have access to the Federal Reserve’s new lending facility to prevent forced sales.

Now, to be fair, I do believe actions today can have consequences in the future. For instance, the decision to make uninsured SIVB and SBNY depositors whole is likely to have serious implications in the future. There is also a good argument that every time regulators step in to provide liquidity and transfer risks onto their balance sheet, they are ultimately setting the stage for the next crisis. We may be talking about these very decisions when the next financial crisis does arrive – I just don’t think that’s now.

Disclosure

2 Wall Street Journal. March 21, 2023. https://www.wsj.com/articles/anxiety-strikes-8-trillion-mortgage-debt-market-after-svb-collapse-15ef0207?mod=djem10point

3 J.P. Morgan. March 10, 2023.

4 FDIC. 2023. https://www.fdic.gov/analysis/quarterly-banking-profile/graph-book/2022dec/qbpgr.pdf#page=15

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI ACWI ex U.S. Index captures large and mid-cap representation across 22 of 23 Developed Markets (DM) countries (excluding the United States) and 24 Emerging Markets (EM) countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.