The presidential primary season has hit full stride – cue the rhetoric on everything ‘wrong with the economy!’ In just about every presidential election year, the economy becomes a central issue underscoring its perceived weaknesses. We need more jobs! Raise the minimum wage! We need more tariffs to protect domestic industries! And so on. At Zacks Investment Management, what matters most are the proposed policies (tax codes, property rights, trade) that might affect overall demand and how the economy may respond to potential changes in the law.

Separating Rhetoric from Reality

To be clear, the negative rhetoric on the economy is not totally unfounded. I won’t sit here and write that the U.S. economy is ‘peaches and cream’ and that growth is robust. It’s not – we’re late in this business cycle and growth rates are likely to ‘muddle through’ at 1.5% – 2.5% for the foreseeable future.

But, for our presidential candidates to harp endlessly on the supposed dour state of our economy is extreme in my view. Many stump speeches portend disaster. Still, no candidate or political party is going to alter the course of the business cycle that dramatically. Business cycles largely have a mind of their own and the private sector knows how to adapt and adjust to policies that get implemented. Additionally, any policy too extreme is likely to get shut down in Congress.

So, while economic conditions may not be ‘goldilocks,’ they’re also very far from the ‘dreadful’ that is sold on the campaign trail. In Warren Buffet’s annual letter to shareholders, he noted that ‘babies being born in the U.S. today are the luckiest crop in history.’ His is certainly not the most popular view, but in terms of looking at the macro, secular outlook, it is likely the most accurate one.

Two Examples of Misguided Rhetoric

Again, I don’t want to make it seem as if everything is hunky dory with the U.S. economy. But, it’s not as bad as advertised – here’s why.

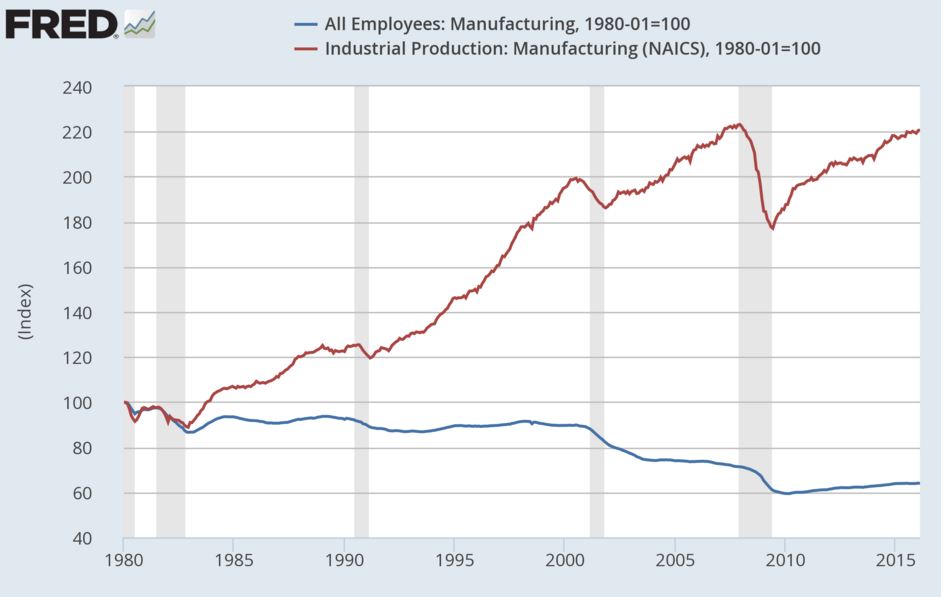

Two of the biggest targets in election years are trade and manufacturing. Let’s start with manufacturing. Imagine a politician saying, “manufacturing output is at an all-time high for the United States and we’re producing more efficiently than at any time in history!” They’d be shown the door in a heartbeat – for telling the truth!

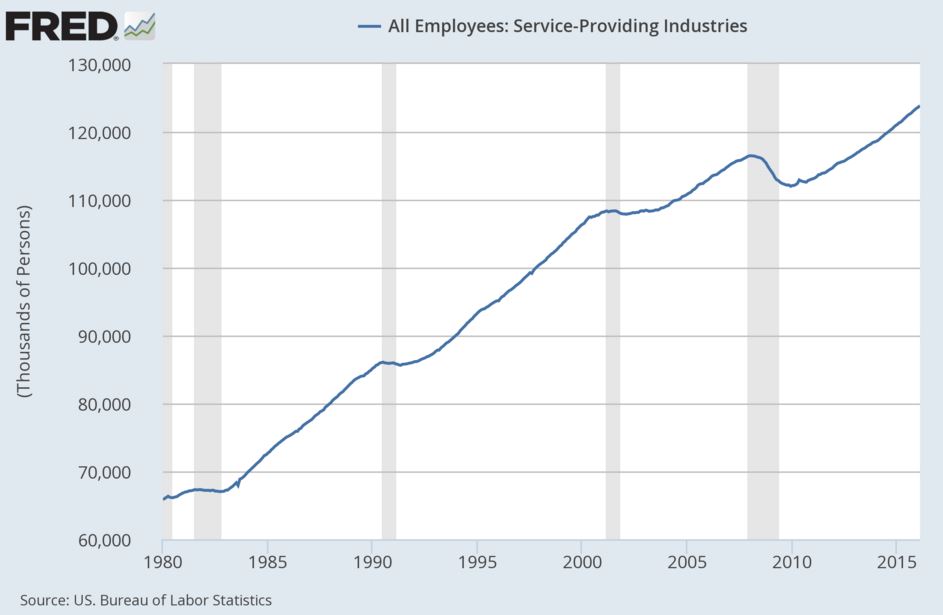

The reality, and I say this from a historical perspective and not as a pessimist, is that we’ve been steadily shedding manufacturing jobs for 30 years and those jobs are almost certainly not coming back. Many of those jobs were lost to automation, but some of them became jobs in the service sector (in logistics, retail and management). There was a time when the United States was an agricultural economy. Then, later, our economy evolved to become industrial. Now, our economy has transitioned to become service oriented. At one point, a majority of U.S. jobs were in agriculture. Imagine the difficulty for many as the economy turned industrial. It wasn’t easy, but look where we are now. Agriculture is a tiny segment of total jobs and we are much better off today than we were in 1900.

And, here’s another fact you won’t hear on the campaign trail – manufacturing output in the United States is at an all-time high. One of the main reasons, of course, is higher productivity. But, another is that the sectoral mix has shifted toward industries with higher value such as computers and electronics.

Manufacturing Jobs Decline as Output Climbs

The Biggest Job Gains Have Been in the Service Industry

The other popular political argument on manufacturing is: we’re shipping all of our manufacturing jobs to China! That is true, to a degree, but China has also been shedding millions of manufacturing jobs over the last two decades as its industrial era starts to transition. Productivity gains globally reduce the amount of jobs needed to support the same output, but it is very unpopular politically to talk about productivity gains being a positive force for economic development long-term.

Trade

This sets up a nice transition to talk about trade. The notion that we’re ‘shipping all of our manufacturing jobs to China’ ignores the reality of how the global supply chain works. Take an iPhone for example. Of the dozens of parts it takes to build an iPhone, some of them come from Japan, others from Italy and Taiwan, still others from South Korea and China. But, a large portion of those parts come from the United States. Apple sources the parts from the best places possible and then sends everything to China (Foxconn) for manufacturing. In this sense, the supply chain is critically global.

Tough talk on trade only stands to disrupt the free flow of goods between these supply chains which will make the end products more expensive and, likely, of lower quality for the consumer. Is that what we really want? Additionally, if we were to raise tariffs on trading partners like Japan and Mexico and China in order to protect domestic industries, it will also hurt U.S. companies that are part of the supply chain for creating foreign products. Other countries will almost certainly respond with tariffs of their own and, now, input costs are higher for everyone. Whatever new jobs may be created locally in the process, demand for the end product is likely to fall due to higher prices. If you’re not selling more goods, you’ll lose the jobs needed to create them. Protectionism policies often hurt more than they help, in my view.

In this way, the costs of free trade (loss of jobs, shutting factories) tend to be very microeconomic, localized and visible – giving them power on the campaign trail. But, the benefits of free trade are distributed across the entire economy through lower costs and efficient supply chains which supports long-term demand. But, these benefits are not as visible and are difficult to measure so they tend to be easily overlooked. What the government and private sector needs to do is a better job of helping those people who experience job loss from free trade to get the training they need to transition to another sector of the economy. The answer is not to try to protect the job in the first place by restricting trade. That approach is likely to backfire.

Bottom Line for Investors

Simple – fundamentals matter more than political rhetoric. And, while the campaign trail is certain to bring negative and exaggerated portrayals of the U.S. economy’s current state, don’t get too caught up in all of rhetoric – especially as you consider your investments.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.