The Federal Reserve is clearly on a mission to tamp down inflation. When Chairman Jerome Powell recently announced a 75-basis point rate increase, it was a bigger hike than what he projected in May and also marked the biggest rate increase since 1994.

In Chairman Powell’s words, “we are strongly committed to bringing inflation back down, and we are moving expeditiously to do so. We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses.”

Part of the Fed’s approach is to “front-end load” bigger rate hikes, in hopes that moving big and fast will solve the inflation problem sooner rather than later.1

But I’m not convinced the plan is going to work.

The reason is simple: inflation today is primarily a supply issue, and the Fed has no control over supply. Many would argue that years of easy monetary policy and massive fiscal stimulus programs created too much money and drove demand off the charts, a fair point. But these factors were more relevant in 2020 and 2021, in my view, and in normal times I believe the global economy could have absorbed this surge in demand.

But 2020 and 2021 were anything but normal. Excess demand was met by snarled supply chains, labor shortages due to the pandemic, rolling factory shutdowns across the world, clogged ports, and rising shipping costs, to name a few. The phenomenon in those years is what I like to call ‘inflation classic’: too much money chasing too few goods. Even if we removed U.S. fiscal stimulus from the equation, there still wouldn’t have been enough goods.

In 2022, the demand side of the equation is still strong, but the fiscal stimulus has largely run its course and monetary tightening is underway. What we’re facing now is uniquely a supply problem (again, too few goods) that the Fed can’t fully fix by ending QE, trimming its balance sheet, and/or raising the fed funds rate.

In a New York Times op-ed written by former Fed Chairman Ben Bernanke, he acknowledged this shortcoming when he wrote that “factors beyond the Fed’s control can contribute to inflation. Supply-side forces are, indeed, important today — not only the increases in global energy and food prices already mentioned but also pandemic-related constraints, like the disruption of global supply chains. Unfortunately, the Fed can do little about these supply-side problems.”2 Bernanke’s last line there is key.

To make matters more complicated, just as the global economy was ramping back up, supply chain issues were starting to resolve, and spending was shifting from goods to services, Russia invaded Ukraine. The war clearly created major dislocations in the oil and gas markets, reducing global supply as many nations banned Russian energy imports. But the war also disrupted food supplies, fertilizer production, and further obstructed global shipping routes. Consumers around the world are feeling these inflationary effects, not just Americans.

Then the situation got worse. China implemented strict Covid-19 lockdowns across the country this spring, but most notably in the most populous and wealthiest city of Shanghai, where residents were confined to their homes for two months. Manufacturing output and spending fell, and restrictions elsewhere in the country only added to the global supply problem.

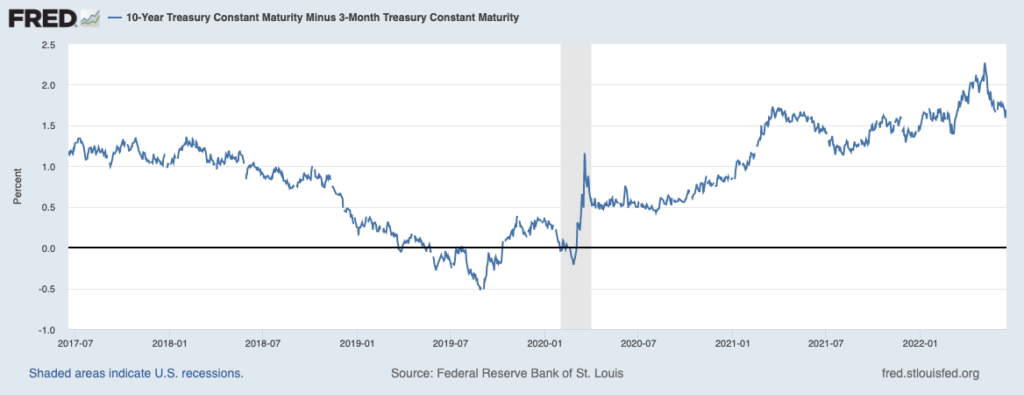

The Fed cannot do anything to change these issues. Monetary policy can soften demand indirectly, by adjusting credit markets and making access to business loans and mortgages more costly, for instance. Eventually, the Fed could raise the benchmark fed funds rate high enough that it exceeds the yield on the 10-year U.S. Treasury bond, which could essentially shut off banks’ incentive to lend. That’s another way of saying that too many rate hikes could invert the yield curve. But we’re not there yet – the yield curve has actually steepened this year, which tells me the Fed has a ways to go before choking off demand.

So, what does this all mean for investors? I think for one it means we can stop fixating on the Fed’s role and apparent power over inflation, which to me is much smaller and less significant than many think. The real focus should shift to the supply issue, and whether it gets better or worse from here. The outcome is key for markets.

Bottom Line for Investors

There are a few scenarios that could help global supply chains moving forward. Pressure on commodity markets could ease if oil production outside of Russia increases (which we are already seeing), shutdowns and restrictions related to Covid-19 could go away, shipping routes and backlogs could clear over time. There could also be negative surprises that hinder supply chains even further, as we have seen already in 2022 with Russia’s war and China’s lockdowns.

Markets tend to move on surprises when outcomes are better or worse than expected. At this point, it feels to me as though everyone is expecting the worst, or at least expecting inflation to get much worse. And that lays the groundwork for a positive surprise.

Disclosure

2 NY Times. June 14, 2022. https://www.nytimes.com/2022/06/14/opinion/inflation-stagflation-economy.html

3 Fred Economic Data. June 17, 2022. https://fred.stlouisfed.org/series/T10Y3M

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.