For this week’s Steady Investor, we take a look at three investment categories that investors might consider in a world of high inflation and rising interest rates.

Category 1: Value and Dividend-Paying Stocks

In the previous decade’s era of low inflation and a dovish Fed, dividend stocks and value stocks were largely seen as second fiddle to high-flying growth stocks. The bond market was also locked in a secular bull market until early 2020, which gave fixed-income investors good reasons to hang tight in bond portfolios.1

The tides have now turned. The Federal Reserve has decisively shifted into hawkish mode in light of soaring inflation, and the bond market has been suffering losses in lockstep with stocks as yields rise. That has made dividend stocks look like attractive options for yield-seeking investors who are interested in long-term growth with steady and elevated cash flows.

On the value stock side, value has a history of outperforming growth during periods of rising inflation and interest rates. Since value stocks are generally known for strong current cash flows, investors know what they’re paying for in a rising rate environment. With growth stocks, higher cash flows are expected in the future, which gets discounted by higher rates and makes investors rethink the premiums they want to pay. The proof is in the pudding: from 1978 to 2020, value stocks delivered an annualized return of 10.9% in rising rate environments, versus 3.4% in falling rate environments.2

_________________________________________________________________________

As Challenging as Volatility Is…Here’s How You Should Handle It

Sudden market changes (like the ones we’ve been witnessing the last few months) often result in emotional decision-making – like when investors believe that selling out of stocks is the best route to avoid further losses.

The real challenge is not finding a way to eliminate volatility—it is developing a mental approach to dealing with it. Our guide, “Helping You Manage Market Volatility,” will provide you with insights and tips to do just that. Get answers to questions like:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Download Zacks Volatility Guide, “Helping You Manage Market Volatility.”3

_________________________________________________________________________

Category 2: A Focus on “Quality”

This category is related to the first one, in that investors may increasingly favor companies with strong balance sheets, free cash flows, and sizable gross profit margins. If rising rates and a hawkish Fed will arguably lead to slowing economic growth in the months and quarters ahead, these are the types of companies that are likely best suited to weather any economic challenges and market volatility.4

Category 3: International Stocks

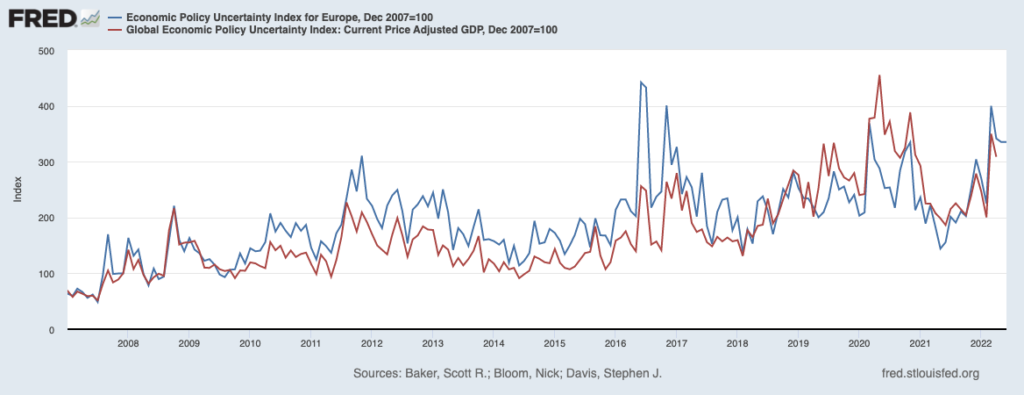

Looking ahead, an unfortunate reality is that the war in Ukraine is showing few signs of ending anytime soon. Russia has also been applying leverage over Europe in the gas markets, by cutting the flow of natural gas down to 20% of normal capacity. Taken together, these factors have driven European economic uncertainty (blue line) and global economic policy uncertainty (red line) to levels not seen since June 2016 – when the United Kingdom voted to leave the European Union (Brexit).

But that does not mean Europe’s economy is doomed, and there is a distinct possibility that Europe may not fare as poorly as many expect. Stocks appear to be discounting very challenging conditions: the current P/E ratio for the MSCI EAFE index is at long-term lows not seen since the recessions of the past few decades, which again we think opens up the possibility for earnings resilience leading to a positive upside surprise.

In the Emerging Markets space, it is worth noting that China’s central bank, the People’s Bank of China, confirmed its commitment to provide accommodative fiscal and monetary policies as the country continues to push ahead with its zero-Covid strategy. If the Chinese government also reduces ambiguity around its regulations on technology companies, which appears possible, investors could regain the confidence to invest in the region. In our view, the potential upside in the Chinese economy is unique within a global economy otherwise struggling to generate growth.

One final upshot: historically, high and rising inflation expectations have led foreign stocks to outperform domestic US stocks. With foreign stocks having lagged US stocks for some time now, some mean reversion feels likely sometime in the not-too-distant future.

In a world of high inflation and volatility, the challenge for many investors is understanding how to react to it. It is important to remember that volatility is a normal part of the market flow.

We believe the key is not to look for ways to eliminate it, but to develop a mental approach to dealing with it. In our guide, “Helping You Manage Market Volatility,”6 investors are provided with insight and tips to do just that. You can get answers to questions like:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Disclosure

2 Black Rock. July 21, 2022. https://www.blackrock.com/us/individual/insights/equity-investing-ideas-amid-higher-rates-inflation

3 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

4 Black Rock. July 21, 2022. https://www.blackrock.com/us/individual/insights/equity-investing-ideas-amid-higher-rates-inflation

5 Fred Economic Data. July 31, 2022. https://fred.stlouisfed.org/series/EUEPUINDXM#

6 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.