Diana T. from El Paso, TX asks: Hello Mitch, I wondered if you had any thoughts about a big rebound in energy this year. My husband and I work in the oil and gas industry and feel like it could be a good year.

Mitch’s Response:

Thanks for writing, Diana. Generally speaking, I share your outlook about the energy sector, and in particular oil and gas. Three factors drive my views: supply, demand, and mean reversion. I’ll explain each one below.

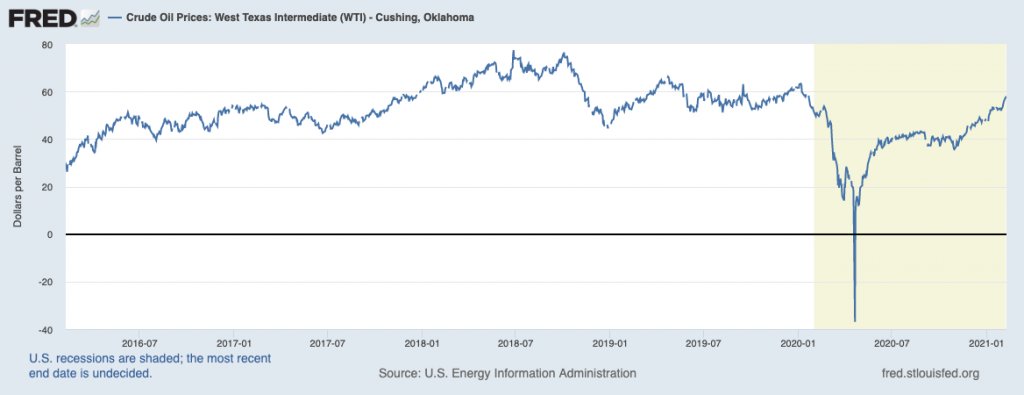

Let’s start with supply. In the years leading up to the pandemic, there was a notable supply glut in crude oil. The shale boom drove stockpiles higher, and when the pandemic hit, inventories ballooned – putting intense downward pressure on prices. Since you work in the oil and gas industry, you probably remember the moment when oil futures turned negative, on the heels of extreme uncertainty. You can see the plunge in the chart below.

Source: Federal Reserve Bank of St. Louis1

_________________________________________________________________________

Use Market Volatility to Your Advantage in Times of Uncertainty

As you experience the ups and downs in the market, remember not to panic! Being a successful investor means dealing with the turbulence of the market, especially at a time like this when uncertainty levels are high. Feeling worried is completely normal right now, but did you also know there are several positive aspects of volatility?

If you have $500,000 or more to invest, get our free guide, “Using Market Volatility to Your Advantage,” and learn our insights, based on decades of experience, about how a volatile market may be able to actually help investors refine their strategies and potentially generate solid returns over time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

Download Our Guide, “Using Market Volatility to Your Advantage”2

_________________________________________________________________________

The supply situation looks better today. Stockpiles are shrinking, and the Organization for Petroleum Exporting Countries (OPEC) continues holding back millions of barrels a day from the market. These dynamics support upward pressure on crude oil prices.

Next is demand, which was obviously sapped during the global economic lockdown and all the restrictions that followed (and continue today). An economic recovery bodes well for the energy markets, and there’s a good argument we’re still in the early phases of said recovery. As vaccine uptake improves and the world moves past the pandemic, I expect demand to firm up even more.

In the current environment, the winter storms engulfing much of the United States also raises demand for oil and gas. According to the National Weather Service, over 150 million Americans are under a winter advisory of some type. Natural gas prices are very sensitive to extreme weather events, and we’ve seen prices move higher as a result.3

The final factor driving my positive outlook for energy is mean reversion. Energy has been battered down in recent years as other areas of the market have rallied, and I think high valuations in many parts of the market will nudge investors to rotate from high valuation to low valuation. Energy is the most obvious sector for some of this capital to rotate.

Volatility in the market will always occur, but also understand that there are also positive aspects about it that you don’t want to overlook. You have the opportunity to make the most out of these challenging times!

To give you insight into some of these positives, I am offering all readers our guide “Using Market Volatility to Your Advantage”4. This guide can help you learn about our insights, based on decades of experience, about how a volatile market may be able to actually help investors refine their strategies and potentially generate solid returns over time.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

2 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion

3 Wall Street Journal. February 15, 2021. https://www.wsj.com/articles/oil-prices-reach-fresh-highs-as-cold-blast-hits-texas-11613394038?mod=hp_lead_pos4

4 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.