Chase K. from Reno, NV asks: Hello Mitch, I’m sure many of your readers are worried that the banking crisis could unravel into a full-on financial crisis, akin to what we saw in 2008. Most of the commentary I’ve read says that the likelihood of a recession has now gone way up, which makes the whole situation feel like a ticking time bomb. Would love to hear your thoughts, thank you.

Mitch’s Response:

Thanks for writing. There are two questions here, the first regarding the possibility of a financial crisis and the second regarding the economic recession. I’ll break my response up into two parts.

The first part is regarding a full-on financial crisis, which I see as a very unlikely possibility. The Silicon Valley Bank (SIVB) and Signature Bank New York (SBNY) failures have been billed as the second and third-largest bank failures ever, but that’s a misleading characterization, in my view. When you scale the size of the bank failures relative to the U.S. GDP and adjust for inflation, you find that other bank failures in history were much bigger.1

See Why You Should Avoid Market Timing During a Financial Crisis

Far too often, investors fall into the trap of trying to buy “at just the right time,” or selling stocks in the midst of a financial crisis when emotions are running high.

There is one big problem with market timing — study after study shows that the average investor is a poor market timer. In many cases, investors allow emotions and media noise to get the best of them, selling in and out of the market at the wrong times.

Our guide, “How Market Timing Can Affect Your Retirement Plan1” seeks to explain these behavioral traps and offers potential solutions. If you have $500,000 or more to invest and want to learn how you may be able to avoid these mistakes today, click on the link below to get your free copy:

Download Zacks Guide, “How Market Timing Can Affect Your Retirement Plan.”2

The other important characteristic of these two bank failures is that both banks were in unique risk positions, with SIVB catering to VC/tech clients and Signature Bank having 20% of its depositors in the cryptocurrency industry – both of which suffered greatly in 2022. By the end of last year, both banks had 90+% of deposits uninsured, and neither had taken any steps to manage interest rate risk on their fixed-rate investment securities on balance sheets. Both banks were largely in a league of their own.

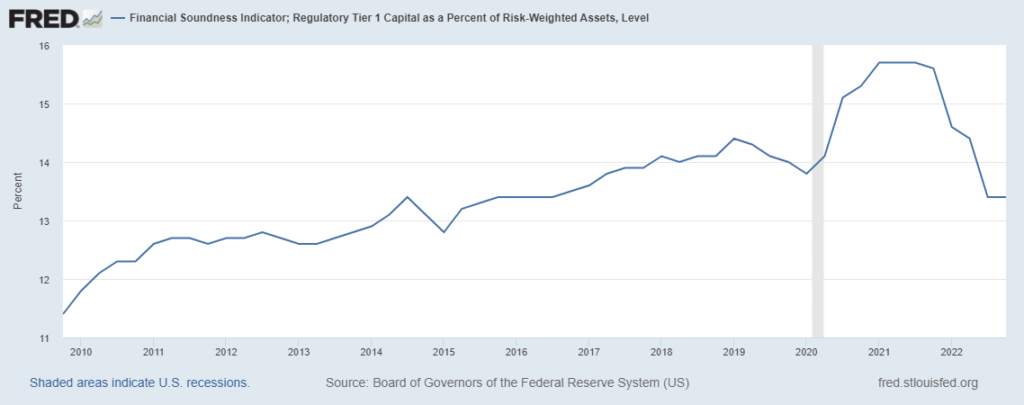

Looking outside of these failures in the broad U.S. banking system, I do not think it is an exaggeration to state that the system is extremely well-capitalized. Tier 1 capital ratios are well above average (see chart below), and loan-to-deposit ratios are at their lowest levels in 50+ years. By our assessment, almost every major bank can meet withdrawal requests without having to make sales in their fixed-rate securities portfolios, which has become even more apparent as deposits have flowed from regional banks to larger ones. In short, while confidence in regional banks remains tenuous, and could result in more volatility in that space and perhaps even more failures, I think the risk of a broader financial contagion is very, very low.

Tier 1 Bank Capital as a % of Risk Assets

The recession question is an interesting one. In the wake of the regional bank crisis, there have been more calls for regulation, which I think could drive some uncertainty in the markets and also arguably put more banks into ‘risk averse’ mode. Smaller banks may also respond to this environment by deciding that a dollar in reserves is better than a dollar leant, which could reverberate into a slowdown in loan activity. The 25 biggest banks account for approximately 60% of all outstanding loans, which of course means smaller banks make up the remaining 40%. Smaller banks also account for 67% of commercial real estate lending, according to the Federal Reserve, which could mean capital for new projects could be restrained.4

On the other hand, the jobs market remains strong today, and the impact of higher rates on banks’ investment securities portfolios is putting future rate hikes into question. My guess is that the Fed will be thinking hard about a ‘pause’ perhaps sooner than expected, which would lower the possibility of overtightening and triggering a recession in the process. My general view here is that the fresh wave of pessimism that has come from the SIVB and SBNY failures has pretty dramatically set up the U.S. economy to surprise to the upside since just about everyone is recalibrating their expectations for recession.

During this time of uncertainty, I would suggest that investors avoid the urge to give in to market timing. Instead, focus on the long-term view and stick to your course!

Our guide, How Market Timing Can Affect Your Retirement Plan5, seeks to explain emotional and behavioral traps that investors can fall prey to and offers potential solutions to common mistakes that many self-managed investors make.

If you have $500,000 or more to invest, and want to learn how you may be able to avoid these mistakes today, get your free copy by clicking on the link below:

Disclosure

2 ZIM may amend or rescind the “How Market Timing Can Affect Your Retirement Plan” guide for any reason and at ZIM’s discretion.

3 Fred Economic Data. March 9, 2023. https://fred.stlouisfed.org/series/BOGZ1FL010000016Q#

4 Wall Street Journal. March 19, 2023. https://www.wsj.com/articles/smaller-banks-critical-role-in-economy-means-distress-raises-recession-risks-ba31e6a8?mod=djemMoneyBeat_us

5 ZIM may amend or rescind the “How Market Timing Can Affect Your Retirement Plan” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual.