Technology seems to reign supreme in our society with nearly every aspect of life connecting to the internet and mobile phones in some way. So, it seems only a matter of time before E-commerce payment systems obliterate the need for cash or credit cards. Indeed, online payment portals (like Square, PayPal, Venmo) and e-wallets have gained traction in the past few years, but at the same time, these platforms still have big hurdles to jump before they can be fully implemented across the globe. For one, the E-commerce payments space is witnessing the rapid entry of several players so competition is fierce, in a bid to cash-in on the modern consumer’s increasing reliance on mobile and online networking.

The Evolution of Online Payment

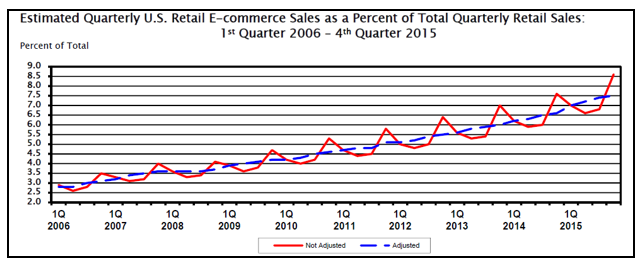

Soon after the internet gained traction in the early ‘90s, so did the notion of processing transactions online. The first online banking platform appeared shortly after, and Pizza Hut was notably among the first to enable online ordering on its website in 1994. Since that time, the share of E-commerce in U.S. retail sales has grown substantially over the last decade.

Source: US Census Bureau

Source: US Census Bureau

E-Wallet War Intensifies

To capitalize on the growing market for online transactions, we’re witnessing an increasing number of players entering the online payment/e-wallet systems space, especially over the last few years.

Apple Pay, launched in October 2014 and has already garnered 12 million monthly users globally, as estimated by mobile-payment researcher Crone Consulting, LLC. What’s more, Apple claimed in January that the usage growth rate in the second half of 2015 was 10 times greater than in the first half.

But where there’s an Apple there’s a Samsung, and as expected they’re eager to partake in the mobile payment/digital wallet space. Having debuted in September 2015, Samsung Pay (developed after Samsung acquired the mobile-payment technology startup LoopPay) already boasts of 5 million users and more than $500 million in transactions processing , as estimated by Crone Consulting. The estimates also mention Google’s Android Pay, which was also launched in September 2015, and has 5 million monthly users to date.

Also fueling competition is Wal-Mart Store Inc., which launched its in-house mobile payment service, WalMart Pay, in December. This launch could imply that Current C, a merchant-owned mobile paying system which was developed jointly by Wal-mart, Target Corp and Best Buy Co Inc., is losing some of its exclusivity with the retail chain.

The competition only seems to intensify with more and more players vying for a slice in the mobile payment space, which could exceed $142 billion by 2019 as predicted by Forrester Research.

A Market Still Developing with Untapped Revenues

To be sure, the mobile payment market is still in its nascent stages, leaving a lot to be desired in terms of mass penetration. Several digital payment tools are limited to only a handful of devices. For instance, Samsung Pay is available only on some selected models of its latest Galaxy handsets (mostly the higher-end ones). .

Furthermore, a large part of the international market is still untapped by e-wallets, and there are limitations to where e-payments are accepted. In some countries, a particular e-wallet application covers only a limited number of banks. Only this year, Apple Pay launched its services in China and Singapore with its services limited to American Express card holders for the latter.

These shortcomings could very well change in the coming months, and we could see more traction as additional banks adopt mobile payment services. Apple Pay, for instance, will reportedly extend its services in Singapore to include more banks such as DBS Bank, UOB and Standard Chartered in the near future.

Bottom Line for Investors

Given the all-encompassing footprint of mobile phones in our lives, it shouldn’t take too long for people to grow accustomed to their presence in day-to-day monetary transactions, provided there are incentives to switch. What this means for E-commerce payment platforms is the need to strengthen its secure payments solutions, enhance discounts/loyalty rewards and expand the range of devices and regions that can access their services. The players who can address these issues will be the ones whose stocks are worth owning.

This story paints a clear picture of just how quickly the business environment can change with new technologies changing consumer preferences. Investors who stay attuned to these changes may be more likely to navigate their investments to success. And for many, investments are the nest egg for retirement, so success is imperative. Here at Zacks Investment Management, we have helped thousands of people manage their retirement assets with confidence by crafting custom portfolios fit for each individual’s needs, concerns and risk tolerance. To learn more about how you can manage your retirement assets, download our free guide “4 Steps to Managing Your Retirement Assets” by clicking on the link below:

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.