In a bid to boost employment in the U.S., Donald Trump wants to offer a tax holiday: a one-time tax of 10% on American corporations’ earnings repatriated from abroad.

At present, the U.S. corporations have to pay up to 35% on repatriated foreign incomes, and then get credited for taxes already paid abroad. The U.S. ranks among countries with the highest corporate tax rates, causing manyAmerican companies to stash earnings in lower-tax nations.

Source: Bloomberg

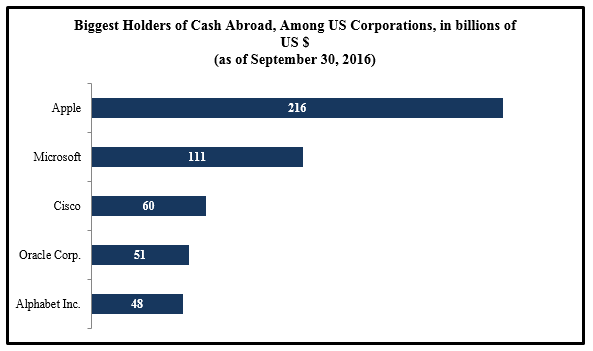

As of September 2016, U.S. companies held around $2.5 trillion overseas, upnearly +20% over the past two years (according to Capital Economics).Trump is hoping that the one-time tax “discount” will incentivize corporations into bringing more of the cashback home and use it to hire people in the U.S.

But,cana tax holiday really guarantee higher employment in the U.S.?Even if companies bring back cash, what’s to saythey won’tuseit for other purposes such as mergers/acquisitions, paying off debts or increasing shareholder payouts.In the past, top cash holders such as Apple and Microsofthave heavily borrowed – helped by low-interest rates –mainly to buy back shares or raise dividendsversus increasing employment in the U.S.

Back in 2004, asimilar repatriation holidaywas implemented in the U.S., which offered a one-time tax rate of 5.25% on overseas earnings’ repatriation and imposed restrictions on share buybacks from the repatriated cash. The resulting cash repatriation didnot entirely go towardsjob creation or infrastructure spending.A 2014 paper suggests that for every$1 brought back home by the top 20 repatriating corporations, 49 cents were used in cash acquisitions, 10 cents on debt reduction and 9 cents on research and development. A 2011 study even indicated that every $1 repatriated led to an increase in shareholder payouts by 60 to 92 cents.

Bottom Line for Investors

Trump’s tax holiday, if implemented, could lead to an influx of corporate cash into the U.S. But how much of that is actually going to boost jobs is anybody’s guess at this point.One can’t rule out the possibility that companies with dragging earnings growth such as Applewould be more inclined to use the extra cash inappeasing shareholders through better payouts or debt reductions than incurring employment costs.

Irrespective of whether the tax holiday meets Trump’s objectives, its implementation could potentially augur well for investors. If the repatriated cash is used to raise shareholder payouts/stock repurchases, higher shareholder incomes could boost stock prices. Debt reduction should help in improving balance sheets. Alternatively, if the cash is indeed utilized towards employment and/or infrastructure spending, we can expect higher productivity and income in the economy – something that couldpossibly lift market sentiments.

However, the tax holiday is still in the proposal phase, and the legislative status on it is not likely to come out beforethe end of the year. Until then, don’t let speculations drive your portfolio decisions! Ultimately, it is fundamentals that should determine a stock’s long-term potential.To help give you an inside look into the current state of the market, we would like to offer you a sneak peek into our latest Stock Market Outlook report.This 22-page briefing gives you an edge over other investors, disclosing facts and predictions about the market and the economy to help guide your investing strategy. To download your free copy, click on the link below:

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.