With the recent headlines surrounding the current state of the market, we are taking a deeper dive into key factors that we believe investors should keep an eye on, such as:

Is It Cheaper to Eat at a Restaurant Versus Cooking at Home? Many restaurants think so and have been designing ads trying to convince consumers of the same. Based purely on inflation figures, restaurants do have a point – over the past year, prices at grocery stores have risen by 13.1% while prices at restaurants are up about half that, at 7.6%. According to the Labor Department, this gap in inflation between grocery stores and restaurants is the biggest it’s been since the 1970s, which is leading restaurants to ramp up marketing of this relative value to consumers. Of all the ads run by restaurant chains, 58% highlighted deals or rewards from May to August, versus 46% from January to April. The difference in costs for grocery stores versus restaurants tends to center on prices of raw materials and labor, respectively. It is still ultimately cheaper to source meals from grocery stores, but only if the time spent preparing meals is not accounted for as a cost.1

Where Should You Invest Your Retirement?

In this market climate, are you ready to see how a dividend strategy could fit into your retirement plan? While diversification is key for a stable and predictable source of income in retirement, we recommend a portfolio also invested in stocks with a strong track record of dividends and dividend growth.

To learn more about how to use dividend-paying stocks in your strategy to potentially generate cash flow for retirement, check out our guide: Retirement’s Uphill Battle: Generating Income in a Low Interest Rate Environment.

If you have $500,000+ to invest, get our free guide, Retirement’s Uphill Battle: Generating Income in a Low-Interest Rate Environment2 today.

US Consumer Holds Strong Despite Inflation Pressures – Though gas prices have been falling in small increments over the last several weeks, they remain elevated and inflation elsewhere in the economy has made life a bit more expensive for consumers. According to a Commerce Department report released this week, however, consumers appear to be holding strong despite higher prices. Overall retail sales, which captures spending online, at brick-and-mortar stores, and in restaurants, rose 0.7% from June to July when the data strips out gas and auto sales. Figures from the previous month were also revised higher, showing a 0.8% increase from May to June. The evidence here suggests that even though consumers are getting fewer goods and services due to higher prices, they are still willing to get out and spend.3

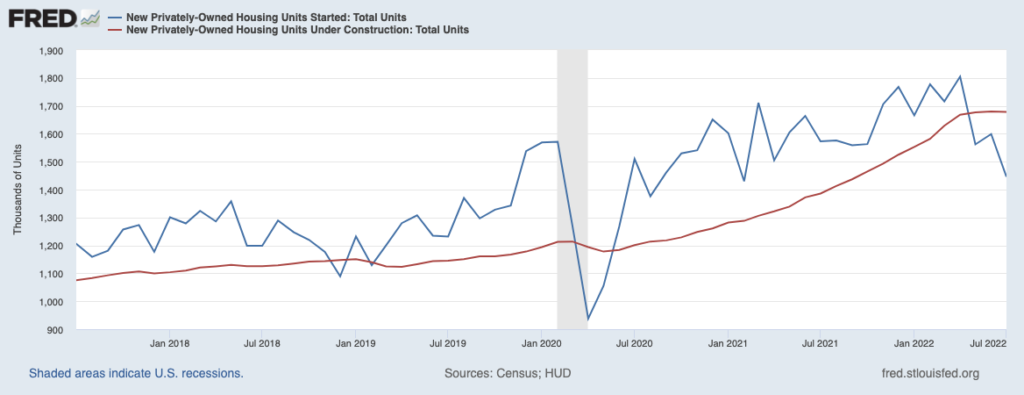

Growing Calls that a “Housing Recession” is Nigh– Homebuilders in the US are starting to send warning signals that activity is dropping off, and that the housing sector may experience some contraction in the months and quarters ahead. As seen in the chart below, housing starts in the US have been in decline since May (blue line), and the number of houses currently under construction has leveled off (red line). Housing starts in July dropped by nearly 10% from June to July, while building permits also fell by 1.3% over the same period.4

This data comes as the National Association of Home Builders housing market index, which we think should be best viewed as a coincident indicator (not a leading indicator), fell for the eighth straight month. The index reading for August was at 49, down from 55 in July and as low as it’s been since the months following the global economic lockdown. Taken together, the data here suggests that tight supplies, rising prices, and higher mortgage rates are starting to take their toll on the housing market.

China’s Fiscal and Monetary Stimulus Falls Short of Expectations – In past years, any inkling of weak economic activity in China generally prompted bold action from the government and the People’s Bank of China, in the form of significant government spending and/or attractive loan incentives for households and businesses. With China’s economy showing distinct signs of weakness in the wake of ongoing Covid-19 lockdowns and restrictions and a battered property sector, market watchers have been anticipating big steps from the government to boost the economy. It hasn’t happened. The People’s Bank of China cut two key interest rates last week, but interest rate cuts in China are not of the same meaning and magnitude of cuts by the Fed in the US. The response from the Communist Party in Beijing has also been muted. In response to the 2008 Global Financial Crisis, Beijing spent approximately three times what the US spent to charge up the economy. This time around, government officials have balked at announcing any new fiscal stimulus and instead have backed away from their goal of 5.5% GDP growth for the full year of 2022.6

Best of Both Worlds When Investing for Retirement – Are you at or nearing retirement? If you are, shifting the focus to total return could mean getting the best of both worlds – having parts of your portfolio actively generating income, while other allocations in your portfolio are designed to drive long-term capital appreciation. This strategy could mean having some of the portfolio allocated to a dividend strategy like the one we manage here at Zacks Investment Management, a percentage allocated to fixed income, preferred stocks, and other categories like small- and mid-cap stocks. The point is to have many parts of the portfolio working towards your long-term goals, with a diversified approach also allowing you to potentially reduce risk (versus a dividend-only approach).

To learn more about how to use dividend-paying stocks in your strategy, I recommend checking out our guide Retirement’s Uphill Battle: Generating Income in a Low-Interest Rate Environment.7

Disclosure

2 ZIM may amend or rescind the guide Retirement’s Uphill Battle: Generating Income in a Low Interest Rate Environment for any reason and at ZIM’s discretion.

3 Wall Street Journal. August 17, 2022. https://www.wsj.com/articles/us-economy-retail-sales-july-2022-11660683658?mod=djemRTE_h

4 Wall Street Journal. August 18, 2022. https://www.wsj.com/articles/existing-home-sales-prices-housing-market-july-2022-11660774574

5 Fred Economic Data. August 17, 2022. https://fred.stlouisfed.org/series/HOUST#

6 Wall Street Journal. August 16, 2022. https://www.wsj.com/articles/chinas-measures-to-boost-economy-dont-match-past-efforts-11660660175?mod=djemRTE_h

7 ZIM may amend or rescind the guide Retirement’s Uphill Battle: Generating Income in a Low Interest Rate Environment for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.