Laurie and Simon B. from Las Cruces, NM ask: Hi Mitch, we have been hearing and reading that the U.S. economy may not be in recession because the jobs market is so strong. But what we are seeing locally are many businesses struggling with worker shortages, and our friends in other cities say the same. Do you see a problem here?

Mitch’s Response:

Thanks for writing. The U.S. labor market has been one of the most perplexing aspects of the U.S. economy in the last couple of years, and your question cuts into an ongoing debate about economic output in the face of plentiful jobs, but also an abundance of worker shortages (particularly in the services sector). Anyone who has gone out to a restaurant or taken a flight in the past few weeks has probably experienced this shortage first-hand.1

We can use labor market data to analyze and shine light on this issue. First, we know that the overall labor force in the U.S. is smaller than it was before the pandemic. According to Labor Department data, there are about 600,000 fewer workers than in early 2020, and if you adjust these figures for population growth, it is a million-plus fewer workers. These numbers have been in recovery over the past year or so, but in March they started falling again.

Are Your Investments Protected from Inflation?

While some investors are staying optimistic in regards to inflation, others, especially those investing in their retirement, may feel worried about what’s next for the market and how it will affect their investments.

The turbulence of inflation can be very costly for the economy, but what can investors, especially those nearing retirement, do to keep their investments afloat?

Instead of panicking, I recommend that you take a look at steps that could help reduce the sting of inflation. To help, we’re offering our exclusive guide, 4 Ways to Protect Your Retirement from Rising Inflation2. You will get insight on:

- How to build or modify your asset allocation to outperform inflation

- The importance of analyzing your spending by category

- Strategies to maximize Social Security retirement benefits

- Plus, more practical ideas to fight back against inflation

If you have $500,000 or more to invest, get our free guide today! Download 4 Ways to Protect Your Retirement from Rising Inflation2.

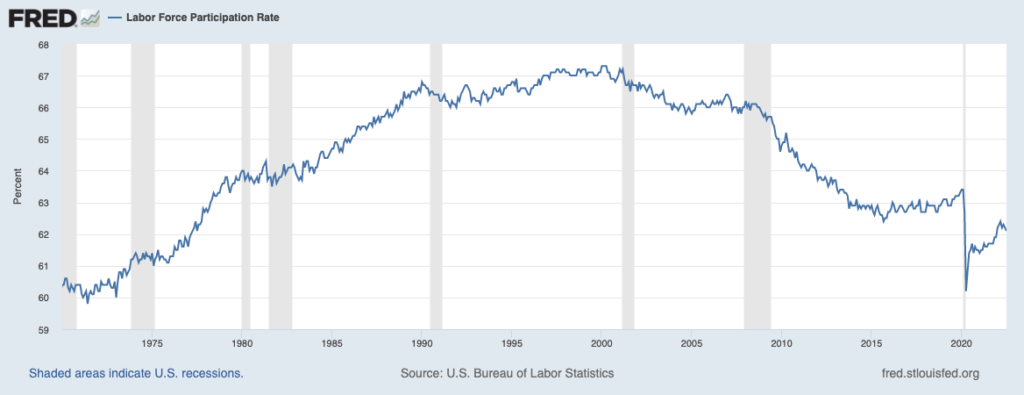

Second, and related, the labor force participation rate has been in decline for decades, but saw a sharp drop off during the pandemic. As you can see in the chart below, labor force participation started to climb sharply in the 1970s, when women entered the workforce en masse. But for reasons that are difficult to pinpoint, the participation rate has been in steady decline since 2000. The rise of the internet is likely somewhere in the explanation, but the exact reasons for the decline are unclear. The pandemic, of course, saw a big portion of the labor force drop out, and also notably led to a wave of early retirements among baby boomers.

Finally, I think it is important to remember the role of the ‘digital economy,’ and how the pandemic catalyzed the movement of work to remote and online settings. The rise of remote work has created an accessible alternative to in-person service jobs, and it has led many workers to choose not to return to their old jobs. What’s more, shortages in the service sector often mean working more hours or working harder to make up for short staff, which can make those positions even less desirable.

In terms of your question of ‘seeing a problem,’ in the near term, I think the issue centers around how labor shortages affect inflation. Earlier this year and last, we know that supply chain issues and energy shortages pushed prices higher across the global economy. As those pressures ease, rising wages are starting to supplant them, as businesses struggle to attract new workers and retain existing ones. Wages in the private sector grew 5.7% in Q2 from a year ago, the fastest pace of wage increases since 2001. If wages keep going up and add more inflation pressure, the Fed will have a hard time slowing the pace of their monetary tightening – a headwind for markets.

Inflation can be very costly for the economy, but there are steps you can take to prevent it from affecting your long-term investments. Even during difficult times when emotions are running high, I recommend taking steps that could help reduce the sting of inflation. To help, I am offering our exclusive guide, 4 Ways to Protect Your Retirement from Rising Inflation4. You will get insight on:

- How to build or modify your asset allocation to outperform inflation

- The importance of analyzing your spending by category

- Strategies to maximize Social Security retirement benefits

- Plus, more practical ideas to fight back against inflation

If you have $500,000 or more to invest, get our free guide today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Ways to Protect Your Retirement from Rising Inflation offer at any time and for any reason at its discretion.

3 Fred Economic Data. August 5, 2022. https://fred.stlouisfed.org/series/CIVPART#

4 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Ways to Protect Your Retirement from Rising Inflation offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.