We’ve come a long way in our relationship with Great Britain over the years. And by ‘years,’ we mean hundreds of years. Let’s start from the beginning.

In 1776, the United States declared independence from Great Britain, with the American Revolutionary War lasting until 1783. Two years later, the two countries established diplomatic relations, and apart from the War of 1812 (where we were at war for three years), we’ve had a relationship that has strengthened with time.

Today, the United States has no closer ally than the United Kingdom, and British foreign policy emphasizes close coordination with the United States. Bilateral cooperation has been nurtured over time with a common language, but also as each country has worked closely to establish ideals and democratic practices. The strongest of bonds, however, was established during both World Wars, and then afterward when the British army fought alongside U.S. troops in the Korean conflict, the Persian Gulf War, Operation Iraqi Freedom, and in Afghanistan. Our foreign policy and security objectives are nearly in sync.

But what about our economic policies?

The United Kingdom is one of the largest markets for U.S. exports and one of the largest suppliers of U.S. imports. The U.K. is currently our 7th largest trading partner, and in 2016 (through August) we have exported $32 billion in goods and imported $31 billion. Our trade with them is 3.1% of our total trade, which is actually a decently sized number considering how many places our goods travel around the world. Last year, we exported $56 billion and imported close to $58 billion.

Apart from trade, foreign capital flows are a vital part of our economic activity. The United States and Britain share the world’s largest bilateral foreign direct investment partnerships, as New York and London stay closely linked as the two financial centers of the world.

But that was all before Brexit.

Will “Brexit” Move Britain to the Back of the Queue?

The Brexit vote threatens to change this favorable status with the U.S. that Britain has enjoyed for decades, and it may mean having to re-establish many of its trading arrangements.

That’s precisely why Britain’s new Prime Minister, Theresa May, recently visited the U.S. and held meetings with executives from Goldman Sachs, Morgan Stanley, Blackrock, Amazon, and about 60 other U.S. companies. She is no doubt trying to maintain strong ties with her most strategic trading partner and ally, particularly given the fallout with the European Union that’s likely due ahead as Brexit takes hold.

The problem is that our trade arrangements with Britain were largely tied to trade deals with the European Union, and now Britain has to revisit the table in hopes of achieving a bilateral deal. Chances are Prime Minister May will have to work out the deal with the new U.S. president, which only adds to the uncertainty of what lies ahead for Britain.

Reduce Global Uncertainty with Diversification

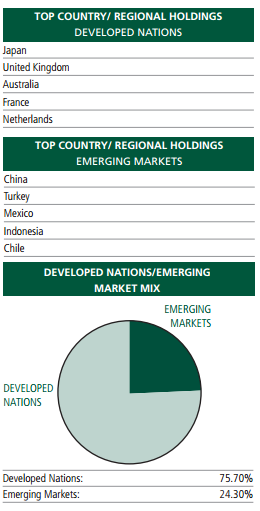

Having some foreign exposure in your portfolio can add to your overall diversification and also potentially boost performance over time. But if you want to invest globally, you also need to consider the risks of investing in economies that are inherently less developed and less liquid than the United States. The Zacks International Equity strategy seeks diversification and growth through investments in both emerging market and developed nations, and we rely on a quantitative methodology – with a strong fundamental overlay – to control risk. Our diversified approach targets those countries we believe have solid growth potential and favorable domestic conditions, such as a stable political setting, sound interest rate policy, and controlled inflation. You can see below that we look all over the world for opportunities:

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.