From a pure supply and demand standpoint, Initial Public Offerings (IPOs) have mixed reviews. When new shares of stock get issued, investor demand often reflects over-enthusiasm for a company’s earnings potential, both of which can skew prices out of the gate. Additionally, more often than not, IPOs are just too expensive.

But newly-issued stocks (and investor enthusiasm for them) is also a good barometer for risk appetite, assuming it doesn’t get taken to extremes as it did leading into the 2000 tech bubble. But when done in moderation, investor enthusiasm for IPOs often equates to enthusiasm for the market and the economy, which is a good thing.

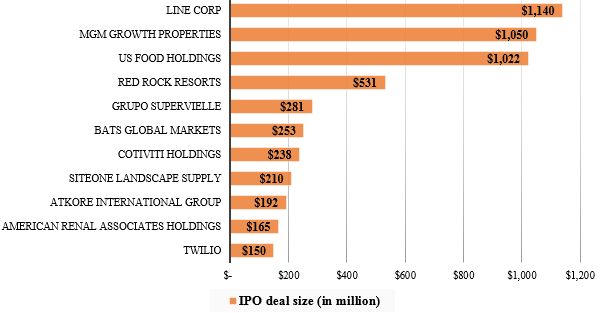

That’s why weak IPO activity has some observers concerned. After 2015’s middling year for new IPO issuance, 2016 has been even weaker. It has marked the slowest year for IPOs since 2009, with just nine IPOs issued in the 1st quarter of 2016. The 2nd quarter saw a little uptick in activity as 30 companies were listed, but the year-to-date total is still only around 60. This makes 2016 IPO activity about 50% lower than 2015 in terms of both issuance and cash raising.

2016’s 11 biggest IPO in U.S.

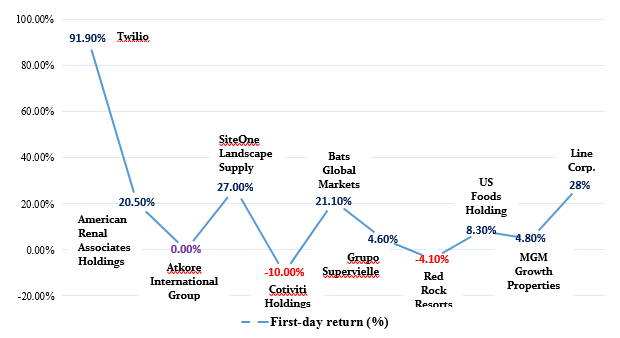

First-day return (in %)

Source: Renaissance Capital, Dealogic

According to industry experts, the principal reason behind the decline in IPOs is the heightened volatility in the stock market and the increased reporting and regulatory requirements, which has dis-incentivised companies from jumping into the public markets.

But there are reasons to remain optimistic. Two sectors, in particular, are poised to see some action (according to CNBC):

Technology

- The Trade Desk: This California-based ad tech company operates in a tough space, but saw impressive 155.5% y-o-y revenue growth in 2015 and has a healthy cash balance on its books.

- Nutanix: This Silicon Valley software company that provides an enterprise cloud platform converging traditional silos of servers, virtualization, and storage into one integrated platform is the most attention-grabbing IPO amongst all Tech IPO’s. With a revenue growth of nearly 90% in last quarter, the company is expected to raise around $240 million.

- Apptio: The tech company, which makes software to help companies better manage their IT, saw its subscription grow by 30% a year and recorded sales of $140 million.

Consumer

- E.l.f. Beauty: This low-cost branded cosmetics company experienced a strong IPO, soaring some 50% at open and raising $141 million. Strong numbers like sales of $213 million, operating cash flow margin of 23% and revenue growth of 32%, helped build enthusiasm.

- Valvoline Inc.: This zero-debt automotive lubricants and quick lube manufacturer with 930 quick-oil-change centers is expected to be one of the biggest IPOs within its segment and expected to raise roughly $750 million. Strong financial numbers such as sales $of 1.9 billion and strong operating cash flow margin of 23% , coupled with rising car sales, is expected to drive growth for the company in the years ahead.

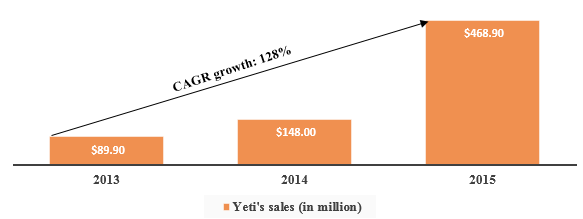

- Yeti Holdings Inc.: This high-ended cooler and drinkware manufacturer has recorded profitable growth every year since inception. It grew its sales by a CAGR of 128% from 2013 to 2015 while operating profit grew at a CAGR of 190% during the same time. The company, which saw its Q1 2016 cooler and drinkware net sales grow by 89% and 704 % respectively, is expected to raise up to $500 million.

Source: Forbes

Despite these two sectors dominating the IPO market, the largest potential deal in the IPO market is expected to come from a private-equity backed life insurance and annuity company, named Athene Holding. It is expected raise up to $1 billion.

Bottom Line for Investors

It’s easy for investors to get very excited about IPOs, but difficult for them to buy these companies at reasonable multiples. Once an IPO makes its way to the open marketplace, it has often already been bid up by institutional players taking big stakes, meaning that a retail investor can only buy an IPO at a premium to what the stock IPO’d for. At the end of the day, IPOs are usually too expensive, and the underlying company still has too much to prove, and many of them end up failing. Dabbling in IPOs is perfectly fine and can be quite rewarding, but investors should avoid buying into hype especially if the company is very new. Just remember to do your due diligence.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.