As we look forward to what the new year has to offer, we dive into key factors that we believe could impact the future of the market such as:

• Housing dragging inflation down

• Stock ownership in America reaches new high

• U.S. leads bid to secure Red Sea

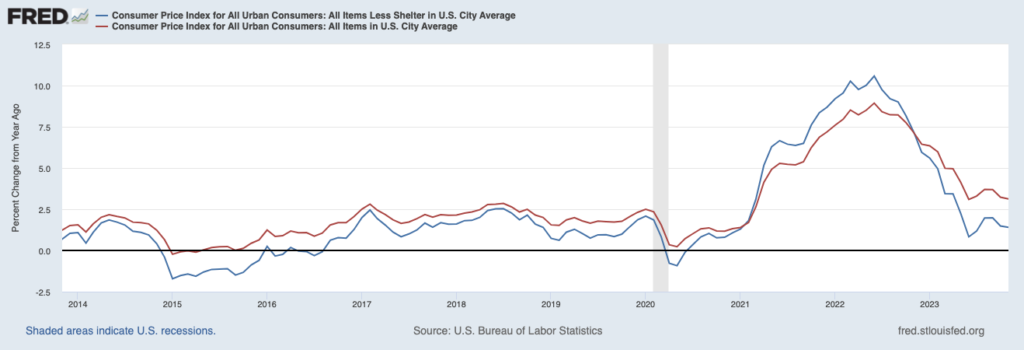

Inflation’s Last Mile: Housing Costs – We’ve written quite a bit about inflation’s downward trend over the past year. In November, consumer prices (CPI) rose by 3.1% year-over-year, well within striking distance of the Fed’s 2% target. Aiding in inflation’s decline was largely falling prices for goods, namely cars, furniture, and electronics. But missing from this list is CPI’s biggest component: housing. Also known as ‘shelter costs,’ housing makes up 35% of the CPI number, and owners and renters alike all know how prices have been moving. Home prices rose 3.4% year-over-year in October, reaching a record for the month. In aggregate, the housing component of CPI rose 6.5% year-over-year in November, which is having an outsized effect on the headline CPI number. The good news for inflation watchers, however, is that if you remove the shelter component and look at CPI minus the housing factor, inflation went up 1.4% year-over-year in November, which is below the Fed’s target (see chart below).1

When removing housing costs from CPI (blue line), inflation is running below 2%

And we think there’s better news ahead. Because shelter costs include tenants’ rent (making up 7.7% of CPI) – and because this data is reported on a lag and includes new and existing leases – we expect more softening ahead. According to Zillow, rent growth has declined to 3.3% through November, which is lower than the average rent increase in the two years preceding the pandemic.

What the Market Showed Us in 2023 to Prepare for the New Year

The economy and markets in 2023 prompted us to consider a few other classic lessons, and in our free December 2023 Zacks Market Strategy Report, we look back at some of these and why they are important for any investor to keep in mind.

Download your free report now for our insights on 2023’s lessons including:

• Don’t overwatch the Fed

• Don’t chase heat (The “Magnificent 7” stocks that pulled markets higher

• Don’t fear volatility

• Plus—Earnings estimates are now flat for Q4—is the feared earnings recession coming back?

If you have $500,000 or more to invest and want to learn more, download your guide today!

Download Our Exclusive “December Market Strategy Guide”3

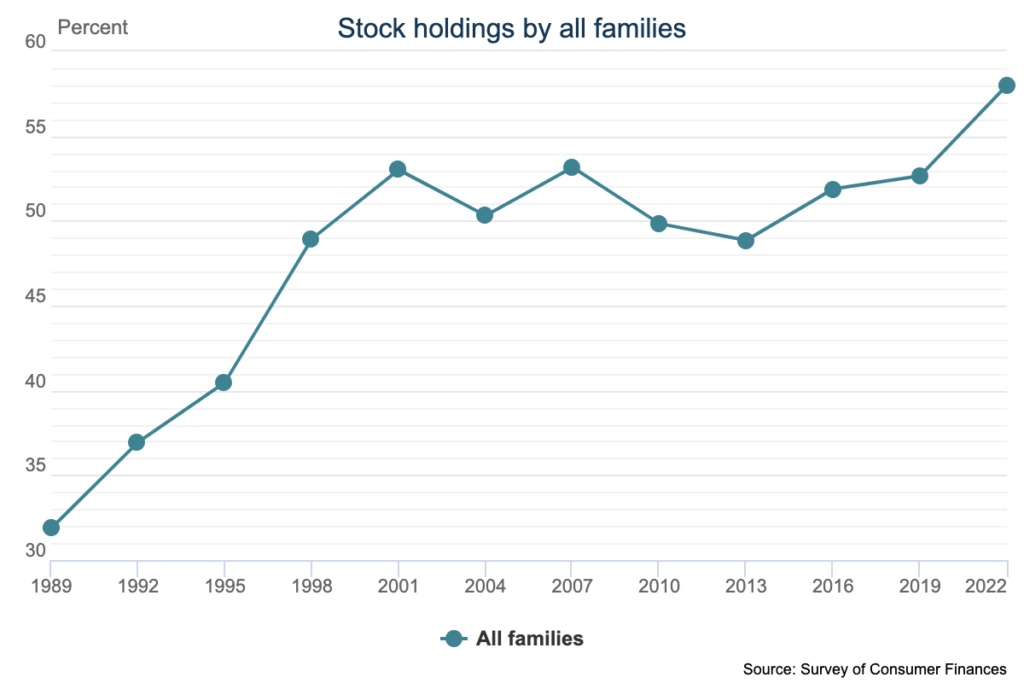

Stock Ownership in America Reaches All-Time High – The pandemic reshaped the global economy and altered the way we live and work in many ways. But it also made a significant impact on how many Americans invest. According to a triennial Federal Reserve survey, a record 58% of American households own stocks in some form, mainly in retirement accounts. But there has also been a strong uptick in the number of small individual brokerage accounts that households have opened, thanks in large part to the confluence of stimulus dollars and the elimination of commission fees on stock trading across U.S. brokerages. According to the survey, direct stock ownership rose from 15% of families in 2019 to 21% of families in 2022, which marked the biggest jump since the survey began in 1989. To be fair, not all investors are long-term oriented, and in many cases, individuals are trading as a hobby or to try to ‘get rich quick.’ But the high-level takeaway here is a positive, in our view. If more Americans are buying stocks, that’s a good thing.4

Could Red Sea Attacks Snarl Supply Chains All Over Again? – The Red Sea occupies a critical sliver of water, separating the Mediterranean Sea and the Indian Ocean, where 12% of the world’s seaborne oil, 8% of its liquified natural gas, and 20% of all container trade pass through. It is not an exaggeration to call it one of the world’s most valuable trade routes. But recently, shipping companies have been rerouting vessels and getting worried about commercial traffic there, as recent attacks on merchant vessels by Houthi forces in Yemen have sparked fears that cargo and personnel could be in danger. The shipping giant A.P. Moller-Maersk announced it would reroute vessels around the Cape of Good Hope in Southern Africa, which adds time and cost to the movement of goods. It follows that higher prices for goods and energy could add to inflation concerns globally. This is a risk worth watching. So far, the U.S. has stepped in with a multinational naval force to protect vessels, which market watchers are hoping will deter future attacks.6

Preparing to Invest in 2024 – 2023 has been an eventful year for the economy and markets. To sum up some of the most important developments, we dusted off some classic investing lessons to prepare investors for what’s to come.

Our free December 2023 Zacks Market Strategy Report covers some of these lessons and why they are important for any investor to consider in their strategies. You’ll get insight on ways to:

• Don’t overwatch the Fed

• Don’t chase heat (The “Magnificent 7” stocks that pulled markets higher

• Don’t fear volatility

Plus—Earnings estimates are now flat for Q4—is the feared earnings recession coming back?

If you have $500,000 or more, fill out the form to get your free report today!

Download Our Exclusive December Market Strategy Report7

Disclosure

2 Fred Economic Data. December 12, 2023. https://fred.stlouisfed.org/series/CUSR0000SA0L2#

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

4 Wall Street Journal. December 18, 2023. https://www.wsj.com/finance/stocks/stocks-americans-own-most-ever-9f6fd963?mod=djemRTE_h

5 The Federal Reserve. 2022. https://www.federalreserve.gov/econres/scf/dataviz/scf/chart/#series:Stock_Holdings;demographic:all;population:1;units:have

6 Wall Street Journal. December 19, 2023. https://www.wsj.com/world/middle-east/red-sea-attacks-worry-shipping-companies-even-as-u-s-sends-warships-382cdafa?mod=djemRTE_h

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.