Abigail F. from Biloxi, MS asks: Seasons Greetings Mitch, I’m curious to hear how the shopping season has gone this year, and whether it’s good or bad news for the market. Are Americans still out spending a bunch or are some cracks starting to show? I figure that these numbers are the most important ones to watch in the final days of the year. Thank you.

Mitch’s Response:

Thanks for writing, Abigail. I hope you’re having a wonderful holiday season.

The data suggest the U.S. consumer has been doing just fine over the past several weeks. In November, consumer spending surprised to the upside, with retail sales rising 0.3% from October. The consensus was that sales would decrease by -0.1%. These figures are not adjusted for inflation, but we know that CPI rose by 0.1% month-over-month in November, which tells us that we’re seeing real spending growth here.1

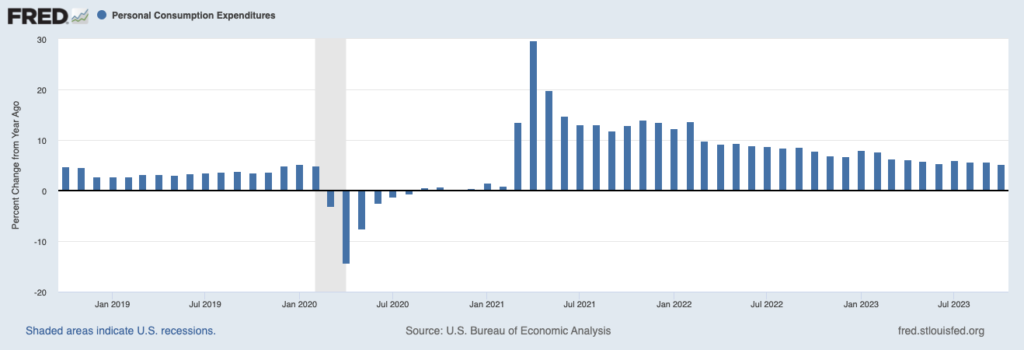

And, zooming out over the past few years, the consumer has managed to keep up spending even after all the stimulus money from the pandemic faded. As seen in the chart below, the year-over-year change in spending remains solidly positive and running at levels slightly higher than pre-pandemic. Through November, retail sales have gone up 4.1% year-over-year, while CPI rose by 3.1%. Again, real spending growth.

Learn the 7 Secrets of Building an Effective Retirement Portfolio

This new year, learn how to create a retirement investment plan that can withstand any market—and potentially help you achieve your goals.

With our guide, you’ll learn the secrets of successful retirement portfolios, including the right way to set your goals and retirement needs, as well as the key basics of disciplined investing, based on our decades of experience.

If you have $500,000+ to invest, get our free 7 Secrets to Building the Ultimate DIY Retirement Portfolio2 guide today.

Personal Consumption Expenditures, year-over-year % change

One interesting point to make as well, when ‘peering under the hood’ of the spending data, is that spending on gas went down pretty significantly in November, due largely to lower gas prices. If you remove auto sales and gas sales from the headline spending number, retail sales rose by 0.6% last month. That’s pretty strong.

All told, Americans are expected to shell out close to $1 trillion this holiday season, which would mark the 15th consecutive year of growth. In fact, there’s only been one year in the past two decades when spending fell year-over-year, and that was during the 2007-2008 Global Financial Crisis.

There is one feature of the data I’d like to call out, however, that is arguably bolstering the numbers this year versus what we may have seen in years past. And that’s the new “Buy Now, Pay Later” option that has arguably expanded credit in the U.S. and is an option being used increasingly by younger households.

According to a Bank of America survey, more than 40% of Gen Z and millennial households will go into debt to get through the holidays, with many opting for the buy now, pay later option. In many cases, these options provide an interest-free option for making a purchase, and a strong labor market supports a household’s ability to make the payments. So, net-net, it’s a positive. We just don’t want to see too much reliance on credit generally speaking, which in a sense could undermine the strength we’re seeing in the data.

As we approach the new year, I recommend taking additional steps to help create a portfolio that meets your financial goals.

In our free guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio4, you’ll have access to details on key investment planning for your retirement, including:

• How to accurately establish your retirement income needs

• The two phases of determining your asset allocation

• Developing an investment discipline that allows you to get good results over time

• Investing rules to help you avoid self-sabotage

• Plus, our views on key steps to create and maintain the ultimate retirement portfolio

If you have $500,000 or more to invest, get this guide to learn our ideas on the step-by-step process of building and maintaining a retirement portfolio that will potentially help you reach your goals and enjoy a secure retirement.

Disclosure

2 ZIM may amend or rescind the guide “How to Build Your Ultimate Retirement Portfolio” for any reason and at ZIM’s discretion.

3 Fred Economic Data. November 30, 2023. https://fred.stlouisfed.org/series/PCE#

4 ZIM may amend or rescind the guide “How to Build Your Ultimate Retirement Portfolio” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.