With all the recent headlines surrounding the current state of the market, rising inflation and now a bear market, we are taking a deeper dive into key factors that we believe investors should keep an eye on, such as:

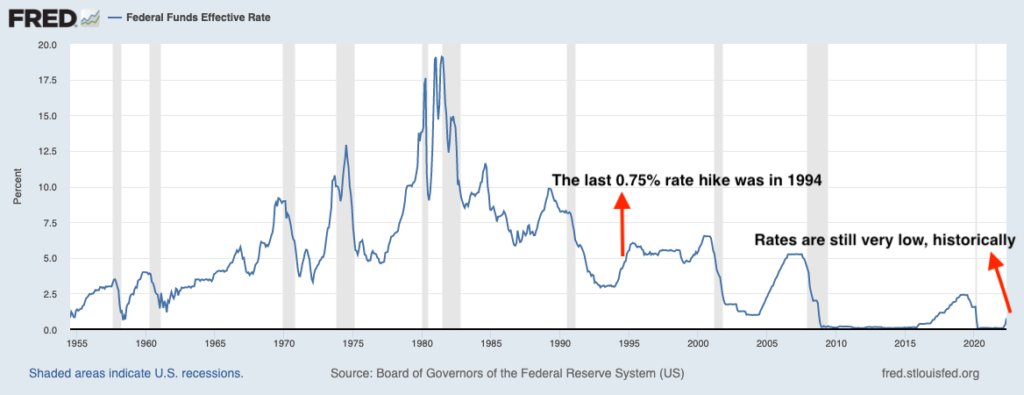

The Federal Reserve Raises Rates by 0.75% – The much-awaited Federal Reserve rate hike decision came last Wednesday, and it proved to be on the high end of the market’s expectations. The Federal Open Market Committee voted 10-1 to hike the benchmark fed funds rate by 0.75%, an increase not seen since 1994. The sizable rate hike seems dramatic, particularly since the Fed appears to be racing to stave off further inflation. But context is also important: even with the 0.75% rate increase, the fed funds benchmark rate now sits at a range of 1.5% to 1.75%, which is still very low by historical standards (see chart below). For readers who may not be familiar with the fed funds rate, it represents an overnight rate on lending between banks. This overnight rate influences the interest rates that banks issue on loans, credit cards, savings accounts, etc. The Federal Reserve issued more guidance on the potential path of rate increases for the remainder of the year, both those projections shift often and have not been very reliable. More important is what the Fed may do at its next meeting, to which Federal Reserve Chairman Jerome Powell remarked that he does not “expect moves of this size [0.75%] to be common, adding that the late July decision “could well be about a decision between 50 and 75” basis points.1

_________________________________________________________________________

Recession Fears Rise as Inflation Increases

With inflation on the rise and the market entering bear market territory, investors are now fearing a recession around the corner.

If you’re at or near retirement, a recession may require pivoting your retirement investing strategy. The market turbulence and uncertainty are scary—but now is the time to take action and prepare yourself for the coming months. It’s important to understand the following –

- Recession signals and indicators

- How recessions work

- How long recessions last

- How to potentially protect yourself and your family from long-term damage

If you have $500,000 or more to invest, get our free guide. You’ll learn the scope and impact of recessions, and get our viewpoint on the most important moves you can make to weather a potential one. Don’t wait—get this guide today!

Download Your Copy Today: A Recession is Coming: 6 Insights to Know You’re Prepared2

____________________________________________________________________________

The Fed Funds Rate is Still Very Low

U.S. Stocks Dip into Bear Market Territory – Stocks rallied on the day of the Federal Reserve’s announcement, but last week saw the S&P 500 dip into bear market territory (a decline of -20% or more). Technology shares have led the declines while Energy stocks have moved in the complete opposite direction, having posted sizable gains year-to-date. Even with technology’s outsize declines, however, the S&P 500 technology sector remains over +20% higher than it traded pre-pandemic, a reminder that the drawdown follows two years (2020 and 2021) of major gains. Looking ahead, it’s important to remember that trying to time the bottom of a bear market is hazardous and ripe for making a serious misstep. History tells us that pronounced volatility – in both directions – is likely to persist now that a bear market has been confirmed. In the last 20 years, about 50% of the S&P 500 Index’s strongest days were posted during a bear market, and 34% of the market’s best days took place in the first two months of a bull market – which can only be confirmed with the benefit of hindsight.4

Retail Sales Fell 0.3% in May, But the Headline Number Doesn’t Tell the Whole Story – Market-watchers were spooked this week when retail sales – which measure spending at stores, restaurants, and online – dropped by 0.3% month-over-month in May. The decline marked the first-time retail sales dipped in 2022, which garnered headlines that the U.S. consumer was tapping out. But a closer read of the figures shows that a sizable drop in vehicle sales disproportionately affected the number. Excluding autos and gasoline, retail sales were positive for the month. It is also worth noting that year-over-year, retail sales have risen 8.1% from last May, which trails the 8.6% inflation rate but still signals that consumers are out spending. According to Federal Reserve Chairman Jerome Powell, “overall spending is very strong,” and “we see the economy slowing a bit but still at healthy growth levels.’5

U.S. Home Equity Reaches Record High – In a week seemingly filled with bad news and negative headlines, there was one bright spot for homeowners in the U.S. Total home equity jumped by nearly 20% in Q1 2022, reaching a record-high $27.8 trillion. The amount of equity that homeowners can access grew by a record $1.2 trillion in Q1 to $11 trillion, and a majority of that equity is in the hands of homeowners with mortgage rates lower than 4%. From a net worth perspective, an optimistic view would be that a 20% increase in home equity over the past year neutralizes a -20% loss in the stock market, keeping household net worth near record highs.6

Is the Market Entering a Potential Recession? For the past few weeks, there have been many headlines discussing where the market is headed and if a recession is around the corner. If you’re at or near retirement, a recession may require pivoting your retirement investing strategy. In order to do this, it’s important to understand how recessions work, how long they last, and how to potentially protect yourself and your family from long-term damage to your assets and security. We can help you with our free guide, A Recession is Coming: 6 Insights to Know Now So You’re Prepared.7

If you have $500,000 or more to invest, get our free guide today. You’ll learn the scope and impact of recessions, and get our viewpoint on the most important moves you can make to weather this one. Don’t wait—get this guide today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free: A Recession is Coming: 6 Insights to Know Now So You’re Prepared offer at any time and for any reason at its discretion.

3 Fred Economic Data. June 1, 2022. https://fred.stlouisfed.org/series/FEDFUNDS

4 Wall Street Journal. June 14, 2022. https://www.wsj.com/articles/bull-markets-winners-dragged-the-s-p-500-into-a-bear-market-11655184522?mod=hp_lead_pos7

5 Wall Street Journal. June 15, 2022. https://www.wsj.com/articles/us-economy-retail-sales-may-2022-11655238895?mod=hp_lead_pos1

6 Wall Street Journal. June 15, 2022. https://www.wsj.com/articles/u-s-home-equity-hits-highest-level-on-record-27-8-trillion-11655250769

7 Zacks Investment Management reserves the right to amend the terms or rescind the free: A Recession is Coming: 6 Insights to Know Now So You’re Prepared offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.