U.S. stocks entered a technical bear market this week, with the S&P 500 index declining more than -20% from its January peak. The downdraft has been led by technology shares, which disproportionately impact the broad index’s returns since technology is the largest sector by market capitalization. As of this writing, tech shares are down over -30% from their peak.1

It’s also true, however, that technology shares remain over +20% higher than they were pre-pandemic, which signals the market is simply repricing some of the exorbitant gains posted in the second half of 2020 and throughout 2021. Remember, too, that U.S. stocks soared more than +100% from the Covid-19 bear market lows, which means this current retracement of -20%—while unpleasant and unwelcomed—does not make equity investors any worse off than they were two years ago. In fact, U.S. household net worth is still hovering around all-time highs, thanks in large part to +20% gains in home equity over the past year.2

______________________________________________________________________________

How to Survive this Bear Market?

During a bear market, I think the key for investors is to focus on the fundamentals and remember that bear markets do not last forever, in fact, they are generally much shorter than bull markets.

To help you focus on important data and fundamentals during this volatile time, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- U.S. Macro Outlook

- What fundamentals are U.S. stock markets pricing in with ‘22 and ‘23?

- What of U.S. GDP Growth?

- Zacks forecasts for the remainder of the year

- Zacks rank S&P 500 sector picks

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released July 2022 Stock Market Outlook3

My advice to investors now is not to get drawn into the fear narratives that always accompany sharp stock market declines. Over the roughly thirty years I have been managing money, every bear that the U.S. economy now faces an existential problem that will persist for many years. This time around the problem is inflation, which many believe can only get worse. There is also a seemingly widely-held belief that the U.S. economy is already in freefall, which has driven pessimism to extremes.

Case in point: last week’s University of Michigan Consumer Sentiment Survey found that Americans are more dissatisfied with the economy today than they were in the depths of the 2008 Global Financial Crisis. The unemployment rate climbed to 10% during that time and almost 10 million Americans lost their homes. Today, there are more available jobs than there are unemployed people, and discretionary spending remains relatively strong. Spending on everything from airline tickets, to hotel stays, to restaurants has been going up, which is the type of activity you’d expect to see in good times – not dreadful ones.

We’re seeing this same disconnect in the small business space, a key engine of growth for the U.S. economy. Normally, small business sentiment about the economy is tightly correlated with hiring plans – optimistic small business owners make plans to hire more workers, and vice versa. But today the opposite is true. Small businesses are reporting low levels of optimism about the economy, but at the same time, they’re trying to bring on more workers.

This leads me to believe we are experiencing a recession-less, sentiment-driven bear market that is not likely to resemble the big, fundamentally-driven bear markets of 2000 and 2008. We’ve seen this outcome many times throughout history. There have been 26 bear markets since 1929, but only 15 of them were tied to a recession. Zacks is still estimating over 2% GDP growth for the U.S. this year.

As I have written many times before, I am not proclaiming the U.S. economy to be in perfect shape with all concerns and fears being unwarranted. I am simply highlighting that current sentiment reflects an economy that is mired in recession, when in fact jobs are plentiful, profit margins are high, and fundamental indicators like services PMI and consumer spending are signaling growth. The wider the gap between how investors and consumers feel relative to how the economy is performing, the closer I think we get to see a market low.

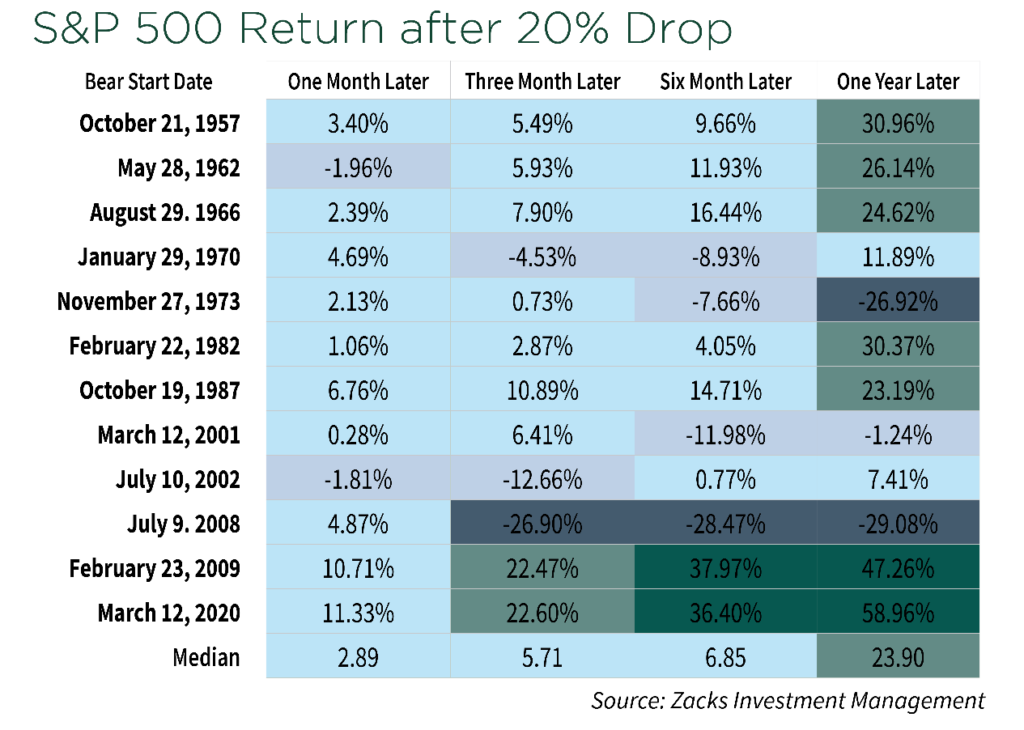

The table below shows how the S&P 500 has historically responded in the months and years after closing in a bear market. While we cannot know whether or for how long the bear market will continue, we do know that periods of weak returns have almost always been followed by periods of strong returns.

Bottom Line for Investors

As for what investors should do now, my answer is not to panic and to stick to your plan. Trying to time the bottom of a bear market is hazardous and ripe for making a serious misstep, so I strongly caution against attempting to do so. About a third of the stock market’s best days have happened within the first two months of a bull market, which we will only be able to confirm with the benefit of hindsight. The biggest risk now, in my view, is being on the sidelines when that happens.

In the meantime, I advise that you focus on the fundamentals and key data points. To help, I am offering all readers our Just-Released July 2022 Stock Market Outlook Report.

This special report was created to help you better prepare your investments for any market changes. It contains some of our key forecasts to consider such as:

- U.S. Macro Outlook

- What fundamentals are U.S. stock markets pricing in with ‘22 and ‘23?

- What of U.S. GDP Growth?

- Zacks forecasts for the remainder of the year

- Zacks rank S&P 500 sector picks

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Hartford Funds. 2022. https://www.hartfordfunds.com/practice-management/client-conversations/bear-markets.html#:~:text=Watch%20for%2020%25%3A%20Market,of%2010%25%2D19.9%25

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.