Since 1982, it has taken an average of almost four years for the U.S. economy to fully recover job losses and to establish new records of output. After the 2007–2009 Global Financial Crisis, it took even longer – six years. How long will this economic recovery take?

A brief look at history is warranted here. With the 2000 tech bubble and the 2008 financial crisis, we saw deep, cyclical recessions based on systemic failures in the financial markets. Too much risk-taking was a prominent feature of both downturns.

In 2020, the recession was based on an extraneous shock – the sudden and unexpected pandemic – which occurred when the underlying economy was largely on strong footing. Interest rates were rising but still low, banks had strong capital positions across the board, and credit markets were working smoothly. Inflation was in check. With these economic fundamentals in place before the pandemic, one could reasonably expect this economic recovery to occur more quickly.1

_________________________________________________________________________

Has the Economic Rebound Run Its Course?

The economic recovery seems to be slowing with the reintroduction of Covid-19 restrictive measures, questions surrounding more stimulus and uncertainties as to when a vaccine will be released. Even in the face of so many uncertainties, 2021 still could be a big year for the economy with pent-up demand in the wake of a potential vaccine. Therefore, it’s important not to give into the negative narrative and for investors to position themselves for the long-term.

To help you focus more on the hard data and economic indicators that could positively impact your investments, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Potential impacts of a Biden Presidency

- How Covid-19 continues to impact travel, unemployment, consumer demand and more

- Is it time to buy U.S. stocks in early November?

- Zacks Rank S&P 500 Sector Picks

- The global response to the U.S. Election

- What produces 2021 optimism?

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released December 2020 Stock Market Outlook2

_________________________________________________________________________

But there’s a problem, in my view. The ‘low hanging fruits’ of this economic rebound may have already run their course. Employers cut some 22 million jobs in the early months of the pandemic, and like a light switch were able to bring back 12 million jobs once the economy reopened. Recovering the next 10 million jobs, however, poses a far greater challenge – one that could take years.

We also must consider that businesses are likely to look much different on the other side of the pandemic. Industries like airlines, movie theatres, restaurants, and retailers have spent much of the year completely rethinking their business models, and one common takeaway seems clear: they don’t need as many workers. Adjustments made at the business level may cause dislocations in the labor market, and in many cases, result in a greater number of permanent job losses. Had the pandemic only lasted three or five months, this may not have been an issue. But it’s gone much longer.

The Wall Street Journal recently surveyed a handful of private sector economists and CEOs, and found that more than half of respondents did not expect the job market to fully recover until 2023 or later. As the pandemic continues to spread and some states consider re-introducing restrictive measures, the economic recovery could be entering a tenuous phase. More fiscal stimulus is almost certainly needed.

The Economic Silver Lining

The U.S. economy is facing a challenging couple of quarters, but there are a few upshots to keep in mind. The first is the vaccine.

Both Pfizer and Moderna have made recent announcements that their vaccines are proving highly effective, both sporting over 90% efficiency. Most estimates place full-scale distribution by sometime next spring, which means another four or five months of pandemic-related drags to growth.

A second upshot is that in this four or five-month period, there is a chance of more fiscal stimulus being injected into the economy. To be sure, the odds of major fiscal stimulus seem to be falling quickly – a Republican-controlled Senate is not likely to hand the Biden administration an easy win early in the new term. But in my view, the need for fiscal stimulus is largely a bi-partisan issue, as states across the union are hurting. The deal may just be much smaller than previously anticipated.

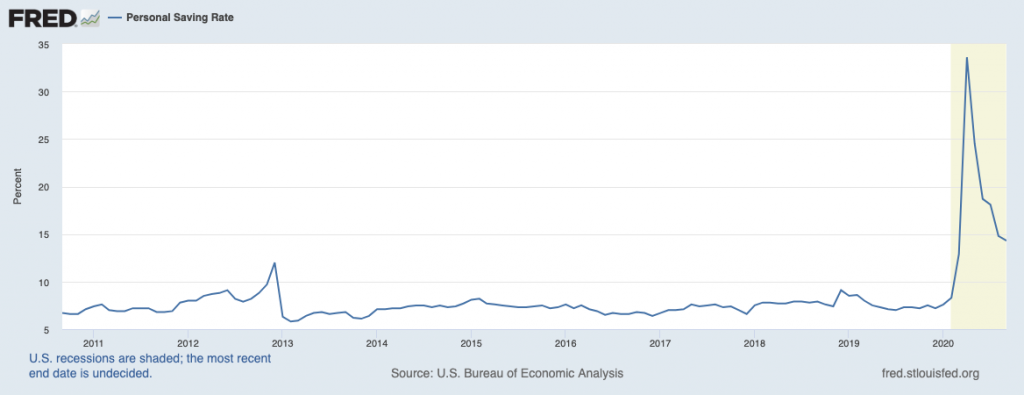

Finally, there is the matter of pent-up demand across the U.S. economy. U.S. households have been saving during the pandemic, to the tune of about 20% of after-tax income since April. Studies have also shown that a big chunk of households socked away the government stimulus checks and some of the extra $600 a week in unemployment benefits. The personal savings rate shot-up in 2020, as shown in this chart:

Source: Federal Reserve Bank of St. Louis3

When the risk of the pandemic fully fades, consumers are likely to be eager to get out and spend again. More fiscal stimulus in the meantime would only add to this pent-up demand, in my view.

Bottom Line for Investors

The economic recovery to date has been swift, but I think it’s fair to say it’s been losing steam – particularly as the pandemic worsens. We are likely entering a challenging phase of the rebound, where growth is likely to slow and job gains may be much more difficult to come by. The next two quarters may show an economic recovery that’s faltering, not strengthening.

The upshot, in my view, is that there is plenty of pent-up demand and capital market liquidity to spur a surge in economic activity once the risk of the pandemic fades, which could come as early as this spring. If the government manages to pass some fiscal stimulus in the meantime, and the vaccine proves effective and efficiently distributed, 2021 could be a big year for the economy. Equity investors should be positioning for such an outcome today, in my view.

To help you position yourself for such an outcome, I recommend focusing on hard data and economic indicators that could positively impact your investments in the long-term. Get insight into this data and more in our Just-Released December 2020 Stock Market Outlook Report.

This report looks at several factors that are producing optimism right now and contains some of our key forecasts to consider such as:

- Potential impacts of a Biden Presidency

- How Covid-19 continues to impact travel, unemployment, consumer demand and more

- Is it time to buy U.S. stocks in early November?

- Zacks Rank S&P 500 Sector Picks

- The global response to the U.S. Election

- What produces 2021 optimism?

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3Fred Economic Data. October 30, 2020. https://fred.stlouisfed.org/series/PSAVERT

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.