Federal Reserve Chairman Jerome Powell made some significant announcements at the Federal Reserve last week, but the news didn’t gain much traction in the financial media. For one, most people do not find “Fed-speak” that invigorating, or even interesting. But secondly, Powell’s pronouncements did not have any immediate impact or implications, as he was setting a course for Fed policy going forward. Market watchers mostly shrugged.

If you’re a short-term trader (which I generally do not advocate doing), this news probably does not have much meaningful impact. But for longer-term investors, I see a few key takeaways – and they’re all good for stocks.

First, a quick overview as to what the announcement means for Fed policy and possibly the economy. Chairman Powell indicated the Fed would be implementing a “flexible form of average inflation targeting,” which is a convoluted way of saying that the Fed will pursue an average 2% (or more) inflation target over time. Because the 2% target has been elusive so far, the underlying implication is that the Fed is now increasingly willing to allow inflation to drift above 2% for “some time,” given that inflation has been running under that target for such a sustained period.1

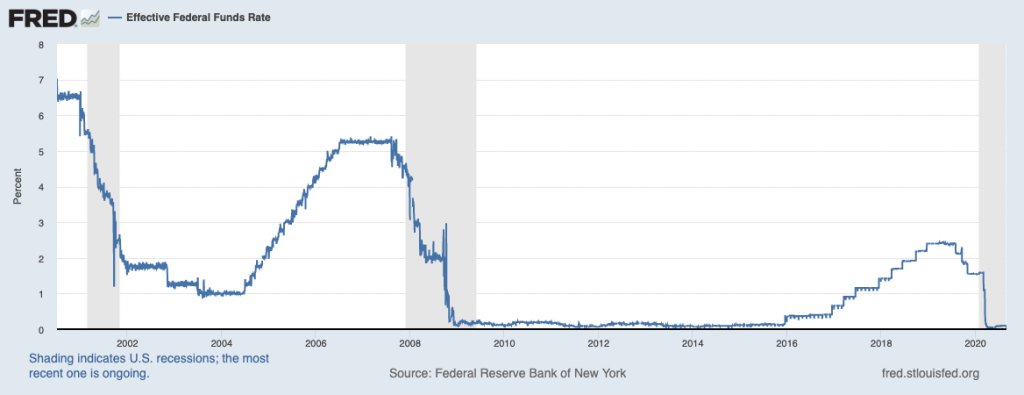

A big takeaway I see: even if inflation ticks above 2% and the unemployment rate drops back down to pre-pandemic levels, the Fed is still going to continue on with its accommodative monetary policy – which now includes asset purchases and interest rates at or near the zero bound. For investors, this means that “lower for longer” interest rates have basically been codified into Federal Reserve policy.

_________________________________________________________________________

In Times Like These, Focus on the Hard Data!

2020 has been a chaotic year of events to say the least. Still, there is money to be made. So instead of focusing on the “what if’s”, I recommend staying calm and focusing on the fundamentals. To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- What’s ‘Fair Value’ on the S&P500?

- Setting U.S. returns expectations for the remainder of 2020

- What should you think about COVID19 era jobs data?

- An update on U.S. fiscal stimulus

- Zacks Rank S&P 500 sector picks

- Status of global energy markets

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released September 2020 Stock Market Outlook2

_________________________________________________________________________

In my view, this pronouncement is not-so-good news for savers and fixed income investors, but it could be great news for equity investors and borrowers.

When it comes to the flow of capital, low interest rates tend to nudge investors into stocks, which is especially true in the current environment. Since the yield on the S&P 500 is materially higher than the risk-free yield on U.S. Treasuries, investors have been increasingly moving further out onto the risk curve to own stocks and capture yield. In many cases, too, the dividend yield on large or mega cap stocks often far exceeds what one can get from low risk bonds. For income-seeking retirees, this often means owning a higher percentage of stocks versus bonds.

Chairman Powell effectively said that no rate increases or slowdown in asset purchases would happen unless certain inflation and employment conditions were met, and today the U.S. economy is far from meeting those conditions. These changes bring the Fed back to the 1940’s, when Fed leaders were overwhelmingly focused on growing the labor market, and it also marks an end to the inflation-focused Fed of the 1970s. We can expect easy monetary policy for years to come, in my view, and that’s generally good news for stocks.

As far as the economy is concerned, interest rates are already at the zero bound, and the Fed is already engaged in asset purchases. So, there’s really no new stimulus here. But in my view, it is meaningful to send the message to consumers, investors, and businesses that policy will remain accommodative for a longer period of time. In a sense, that’s another form of stimulus: money is cheap and will remain so for some time.

Bottom Line for Investors

There’s an old saying that investors should not “fight the Fed,” which is a mantra I think applies today and also over the medium-term. Even without the Fed announcement, I could make a case for owning equities now based on a nascent economic recovery and expected earnings growth over the next 12 months. But if low interest rates are also a known quantity, I think it makes the case for owning stocks even stronger. The Fed just made “lower for longer” a known quantity.

When looking at stocks, you may be wondering what industries and sectors merit your attention. To help you get a deeper look into sectors that are performing well like Tech, I am offering all readers our Just-Released September 2020 Stock Market Outlook Report.

This report not only looks at Tech but highlights several factors that are producing 2020 optimism right now and contains some of our key forecasts to consider such as:

- What’s ‘Fair Value’ on the S&P500?

- Setting U.S. returns expectations for the remainder of 2020

- What should you think about COVID19 era jobs data?

- An update on U.S. fiscal stimulus

- Zacks Rank S&P 500 sector picks

- Status of global energy markets

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!4

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Federal Reserve Bank of New York, Effective Federal Funds Rate [EFFR], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EFFR, September 1, 2020.

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.