At a quick glance, China’s economic growth is decelerating. However, this may just be a temporary “side-effect” of the nation’s re-making itself as a services-oriented economy from that of a manufacturing behemoth.

Looking back at U.S. history, this evolution in China’s economy is not unlike that of the U.S. which started as an agricultural based economy, morphed into a giant of industry and is now an envied service and consumption based economy. As these changes proved successful in the U.S., could this be China’s roadmap to prosperity as well?

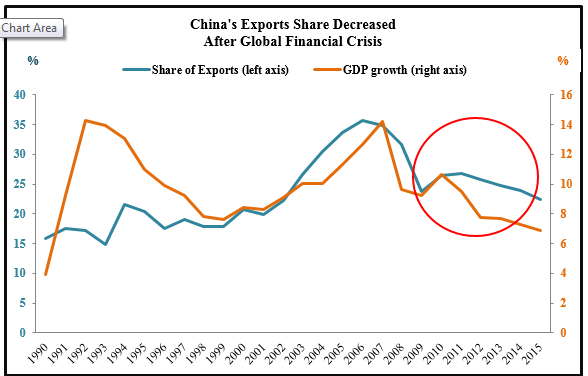

The Chinese manufacturing industry’s epic success—contributing to an average +10% GDP growth in the nation over the last couple of decades—was primarily the result of demand from advanced economies, fueled by China’s low-cost exports. But, that market can’t be expected to continue growing at the same pace forever, especially with overcapacity creeping up in various sectors.

Data source: World Bank

Data source: World Bank

Data source: World Bank

Data source: World Bank

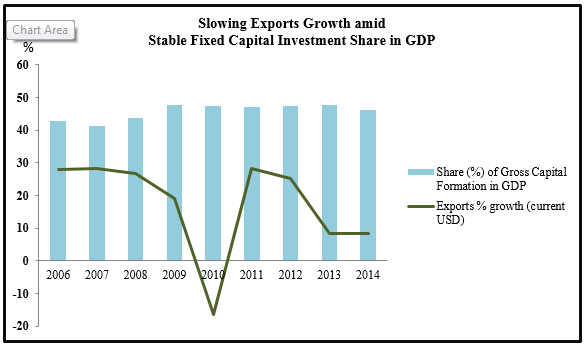

With all the capacity generated by China’s investments in fixed assets, the nation would need a market for an additional output ranging between $5 trillion and $7 trillion (in constant 2009 prices) every year through 2020—as suggested by a 2010 study. That’s something which already saturated foreign demand alone is not likely to accomplish.

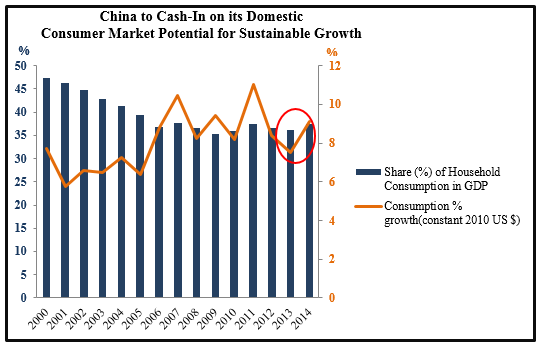

China to Turn ‘Inward’

Notwithstanding China’s citizen headcount exceeding 1 billion, its consumption expenditure share in GDP stood at only 35.9% in 2010 (versus America’s nearly 309 million population’s consumption contributing around 70% of its GDP). That, in addition to a sated foreign market, could have guided Chinese policymakers to turn ‘inward’—as evident from China’s 12th (2011-2015) and 13th (2016-2020) five-year plans—and focus more on capturing their own domestic market to set the wheels in motion for longer-lasting growth.

With a goal to strengthen household purchasing power and improve quality of life, Chinese authorities have planned to improve service industries including health, education, finance, technological innovation, logistics/transport and tourism. Additionally, focus will be put on equitable income and resource distribution as well as creating environmentally-friendly technologies.

It appears the restructuring is already gaining traction. In 2015, slowing industrial growth was accompanied by a strengthening services sector, with the latter growing at +8.3% (up from 2014’s +7.8%). Services sector share rose to 50.5% from the preceding year’s 48.1%, contributing to more than half of China’s GDP for the first time (while Manufacturing share slid more than two percentage points to 40.5%).

Additionally, in 2014, China’s domestic consumption growth accelerated to more than +9%, from the preceding year’s +7.5%. The share of consumer spending increased 1.2 percentage points to reach 37.4% the same year.

Data source: World Bank

Data source: World Bank

Furthermore, the People’s Bank of China’s accommodative policies, such as a record-low lending rate of 4.35% since October and reserve-requirement reductions, have facilitated new loans of 1.38 trillion Yuan this June, beating estimates. Bank deposits and currency in circulation collectively soared +24.6% in June from a year ago, registering the biggest jump in six years.

China’s Restructuring Reminiscent of America’s Transition

China’s restructuring is reminiscent of America’s economic history, although the two are separated by somewhat different sets of driving forces.

The industrial revolution in the U.S., whose first phase spanned the period of 1790 through the 1830s, marked the economy’s transition from agricultural to industry. While China is teetering on overcapacity in manufacturing/heavy industry at present, America was experiencing an abundance of land, far outstripping labor availability, which probably galvanized the nation to switch to machines from manual work for higher productivity. The revolution set the stage for the “factory system” characterized by mass output production from centralized locations, akin to China’s manufacturing success story.

In the post-World War II period, industrial output growth in the U.S. was fast outpacing demand. On the other hand, the higher productivity had already translated into higher wage rates and profits, meaning American consumers had more purchasing power for services. So, to adjust to the situation, employment shifted from the industrial sector to services. Later on, in the late-1970s and ‘80s, Japan and, subsequently, China emerged as strong global competitors to American manufacturing, driving the U.S. further toward a services and consumption-oriented economy. China’s restructuring, however, has less to do with foreign competition than saturated foreign demand for its manufactured products; a largely untapped domestic market only adds to the impetus behind the changeover.

Bottom Line for Investors

China’s reshuffling of economic objectives constitutes a paradigm shift from its decades-old growth engine. And, therefore, it could face some temporary hiccups, such as slackening growth in the initial years of the restructuring process. Nevertheless, these steps are necessary to rein in the Chinese economy’s ‘over-dependence’ on external markets and to become more self-sufficient to mitigate vulnerabilities from external shocks.

Should the nation successfully achieve the restructuring objectives, China could emerge as the next economic superpower, capitalizing on its burgeoning urban populace.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.