Perhaps not surprisingly, the Federal Reserve left the fed funds rate unchanged in their June meeting, almost certainly on the back of a weak May jobs report (+11,000 m/m). It is yet another example of the Fed’s hypersensitivity to single data points or events, much like their choice to delay a hike in the beginning of the year because of global market volatility (which ended up short-lived).

The Fed’s newfound tendency to backpedal on rate hikes and seemingly “wimp out” on normalizing interest rates is nothing new. If you take a look at the Fed’s record of guidance on interest rates, you’ll find a healthy history of flip-flopping. In December 2015, policymakers expected the benchmark fed funds rate to be around 1.375% by the end of 2016, with a median forecast of 2.375% by the end of 2017. That “dot plot” was actually a reduced version of what they said in June 2015, when they gave guidance of a 1.625% rate by the end of 2016 and 2.875% by 2017. Neither of these outcomes seem even remotely likely now as we’re midway through 2016 and the fed funds rate is still sitting at 0.25%–0.50%.

If it sounds like I’m telling you not to trust Fed guidance, then I’ve made my point. Interest rates are low enough (and should remain so) that investors need not get wound up in “Fed watching” and/or base an investment strategy around the FOMC minutes. To me, it’s a feckless exercise. What we should be looking out for is the relationship between short-term interest rates and long-term interest rates, known of course as the yield curve. More on that in a moment.

What ‘Lower for Longer’ Interest Rates Mean for Investors

The expectation of ‘lower for longer’ interest rates should have several favorable outcomes for the economy and the equities markets. At a glance, this is what I see:

- The yield on risk assets, like stocks, is better than what an investor can currently get out of the 10 year U.S. Treasury (~1.6%). Yield chasers will increasingly favor stocks (particularly the dividend payers) and bid-up prices

- Corporations will continue using cheap capital for M&A and share buybacks, and I would expect corporate debt levels to rise in the medium term (not a bad thing since debt is so cheap)

- The housing market should continue to feel the tailwind of favorable mortgage terms.

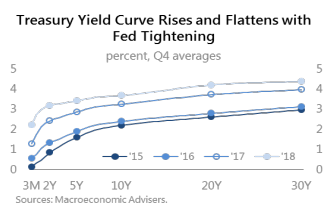

The factor to watch right now is the yield curve. In the wake of pronounced volatility in the beginning of the year (driven by China fears) and the ‘Brexit,’ U.S. Treasuries have been bid as a safe haven in a “risk-off” environment, which has kept downward pressure on the long end of the curve. Even with the Fed’s inaction, the yield curve is flattening. It follows that, when the Fed raises interest rates eventually, the yield curve is likely to flatten even further. A flat or inverted yield curve creates a higher probability of recession.

Bottom Line for Investors

Zacks continues to expect that an acceleration of corporate earnings in the back half of 2016, and a stable jobs market, should support two rate hikes this year. The 10-year note yield is also expected to gradually trend higher, as ‘Brexit’ hype recedes and demand pressures ease. Much will be made of the Fed raising rates the next time they decide to do so, but just remember that it’s really nothing more than the fed funds rate going from “extremely low” to “very low” (not much economic difference there). What investors will need to watch closely in the next 12 months is the yield curve, and whether it flattens more than expected due to continued pressure on the long end of the curve. This could mean bad news for the economy and it would probably go unnoticed by most— so keep your eye on it.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.