Though CEO Jack Dorsey has made no public mention of a potential sale, the likelihood that Twitter is on the chopping block appears to be rising. Amid the company’s struggle to boost revenues and its user base against fierce competition, Salesforce.com and Walt Disney are rumored to be eyeing the ten-year old online social networking website.

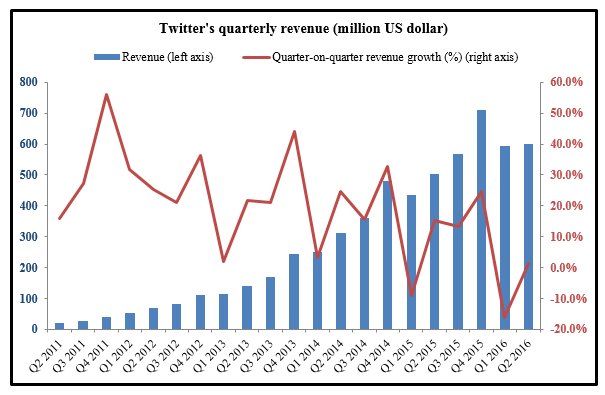

In the first quarter this year, Twitter’s revenue growth declined-16.3% (quarter-over-quarter), a record low. In Q2 2016, its revenues of $602 million fell short of Wall Street’s $607 million estimate.

Source: Statista

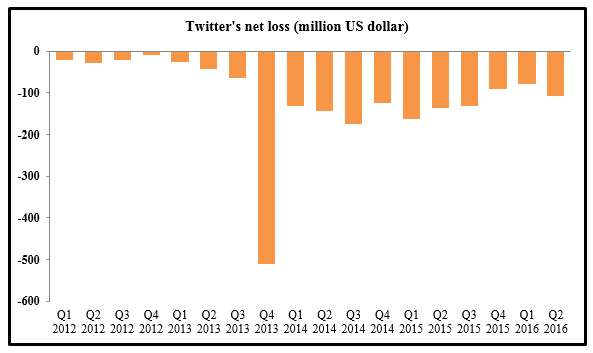

Source: Statista

Source: Statista/Twitter Investor Relations

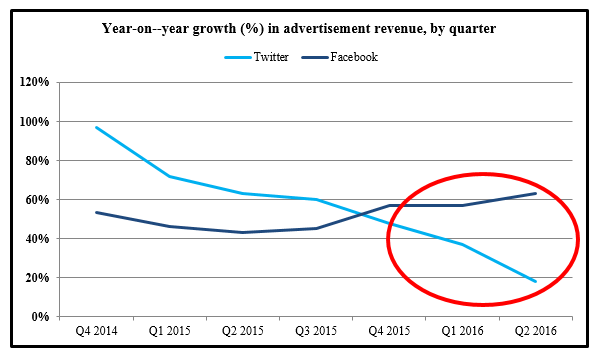

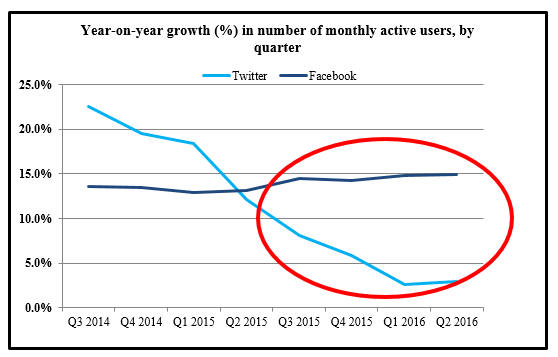

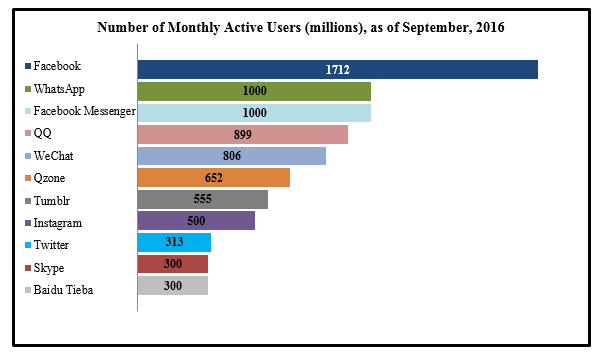

With social networking sites, particularly Facebook, garnering much larger user bases (and therefore, more data), Twitter has lagged considerably in the race for advertising dollars. Advertising customers much prefer sites and apps with greater volume of traffic/users, so they could leverage more consumer data and reach a wider audience.

Source: Computed from individual companies’ earnings reports

Source: Computed from individual companies’ earnings reports

Source: Statista

As of September 2016, the number of monthly active users of Facebook is 1.7 billion – around five times that of Twitter! User numbers of WhatsApp and Facebook Messenger have also raced far ahead of Twitter’s.

Source: Statista

Source: Statista

With an increasing number of social media players and rapidly evolving/innovative platforms, the technology sector has long been fiercely competitive. This was evident recently in Yahoo’s case as well. The internet pioneer was fast losing out on search traffic to its competitors like Google and Microsoft, leading to its dwindling share in the ad-revenue space against Facebook and Google/YouTube. Telecommunications giant Verizon has planned to buy Yahoo and merge it with AOL.

Twitter may not be dying without a fight, however. It is looking to make big bets on live video streaming as its next breakthrough for users. It has struck deals with National Football League and Democratic and Republican National Conventions to stream games and presidential debates, respectively, and also partnered with Bloomberg this year to live stream selected Bloomberg Television shows.

It also signed one of the biggest video advertisement contracts, with CW television network and Ford this year, through which Ford ads will be plugged into recaps/sneak peeks of most tweeted CW television shows.

Twitter also reportedly invested $70 million in SoundCloud this year, in what’s been perceived as a mutually beneficial pact. SoundCloud can avail Twitter’s user base to promote its new subscription service, while Twitter hopes to enhance user growth and engagement by collaborating with the music streaming portal.

The site also added the option for members to see the “best” tweets (based on an individual user’s preferences) first versus what’s strictly chronological. Additionally, it has exempted photos and links from counting towards its 140-character limit on tweets, giving users more liberty to express themselves at length.

Bottom Line for Investors

The new strategies/features that Twitter has embarked upon this year still carry uncertain results, especially as video and picture-sharing rivals Snapchat and Instagram. Both of which have larger daily users and have increasingly warmed up to advertisements, posing a threat to Twitter’s live streaming business.

Twitter’s questionable future has called into question the long-term prospects of other, similarly promising start-ups. On one hand, the technology sector is brimming with opportunities, but on the other, it’s a fiercely competitive industry. A firm’s survival in this space depends a lot on how fast it can incorporate into its product the dynamics of consumer preferences and needs before its competitors do – something that is far from a cakewalk.

Given the cut-throat world of technology, investors need to keep abreast of a company’s evolving trends and its performance relative to others in the business, for effective portfolio rebalancing. At Zacks Investment Management, we strive to keep you updated on every important market development while analyzing its impact on a stock’s long-term return, so you don’t miss out on investment opportunities and portfolio optimization. Additionally, we have helped thousands of people manage their retirement assets with confidence by crafting custom portfolios fit for each individual’s needs, concerns and risk tolerance. To learn more about how you can manage your retirement assets, download our free guide “4 Steps to Managing Your Retirement Assets” by clicking on the link below

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.