Humans are about to take a back seat to robots – literally. Self-driving cars are armed with radars, camera, LIDAR, computer vision and various software designed to detect surroundings and identify navigation routes. Data sharing will allow autonomous vehicles to learn from other accidents on the road, even the accidents they aren’t involved in. It’s hard to fathom, but it seems only a matter of time, in the not too distant future, where robots are far superior drivers to humans.

From an investment standpoint, the expectation is that we are on the verge of witnessing the emergence – and boom – of a new industry. And, we wouldn’t bet against it.

Investment Opportunities in Self-Driving Cars

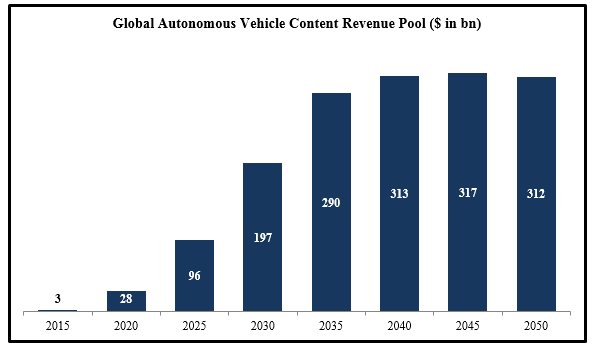

Along with carmakers, component/software suppliers could profit from technology’s latest offering. From $3 billion in 2015, revenues in this space could leap to over $28 billion – a 56% compound annual growth rate (CAGR) in five years, as suggested by a 2015 Goldman Sachs study. By 2045, the industry could eclipse $300 billion.

Source: Goldman Sachs Global Investment Research; September 2015

Big players are already positioning themselves to capture growth and secure market share. Early this year, Ford Motor Co. announced tripling the size of its fully autonomous test vehicles fleet. The auto major also unveiled its $182 million investment – a 6.6% stake – in cloud computing venture Pivotal Software Inc., indicating a step forward in enhancing its driverless technology.

GM will reportedly launch its fleet of fully autonomous electric cars on Lyft – the ride-sharing platform in which it is investing $500 million. The automaker also announced a $1 billion acquisition of autonomous features-producer Cruise Automation.

Fiat Chrysler has teamed up with Google to form 100 autonomous Chrysler minivans. Google has already tested its own self-driving prototypes for more than 1.4 million miles.

This month, Uber unveiled its autonomous fleet trials in Pittsburg, allowing its loyal customers a taste of the driverless phenomenon. Additionally, Apple is rumored to be working on a self-driving car technology, though recent layoffs indicate they may be pulling back for now.

Auto content and software suppliers are also exploring opportunities in the space. Delphi Automotive Plc. and Mobileye have teamed up to develop a sophisticated navigation system – expected to be ready for installation in vehicles by 2019. The navigation system is designed to help cars mange highway traffic, multiple traffic lanes, and other road complexities. Earlier this year, Mobileye entered into yet another partnership, with auto manufacturer BMW and chip maker Intel (according to Bloomberg).

As all of these innovative partnerships and product developments catch hold, the U.S. government has surprisingly been open and supportive. Where regulation usually gets in the way initially of rapid-onset innovation, in the case of driverless cars it has been virtually the opposite with a few exceptions. Federal regulators have recently indicated that self-driving cars could make highways safer, conditional upon a 15-point “safetys. What’s more, the U.S. government had already declared earlier this year that it would spend around $4 billion over a decade to facilitate safe adoption of driverless cars.

Bottom Line for Investors

The autonomous vehicle market seems to be brimming with opportunities for automakers and their content suppliers. Although there may still be questions regarding how much we can rely on software (with reduced or no human intervention) to feel safe on roads, the recent proclamation of regulatory surveillance should assuage some of the fear. Also, NHTSA research showing that human error is the critical reason behind 94% of car crashes could strengthen the case for going driverless.

Self-driving cars are further evidence of just how fast the technology landscape is evolving. For investors, this means staying aware of what investment opportunities will evolve with it. But, the real challenge for equity investors is to make sure they pick the “right” companies with strong fundamentals, without getting too caught up in the hype (potential bubble) that usually comes with exciting, rapid-onset innovation. If you decide to invest in some aspect of driverless car technology, be sure that it is only a piece of a broader, more diversified strategy. Zacks Investment Management can help you strike that balance.

To learn more, contact us today at 1-800-245-2934 at no charge to you. And in the meantime, to get additional insights into the current state of the market, download our Stock Market Outlook report. This report is filled with important facts and eye-opening forecasts. It also projects overall returns from small-caps vs. large-caps, where the S&P 500 is headed by year’s end, what propels U.S. optimism on 2017, and much more. These insights can help you determine your long-term investing objectives. Click on the link below to download the report now…

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.