In today’s Steady Investor, we are taking a deeper dive into key factors that we believe are impacting the future state of this market, such as:

- U.S. consumer spending

- Fed scales down size of rate hikes

- China’s economic recovery

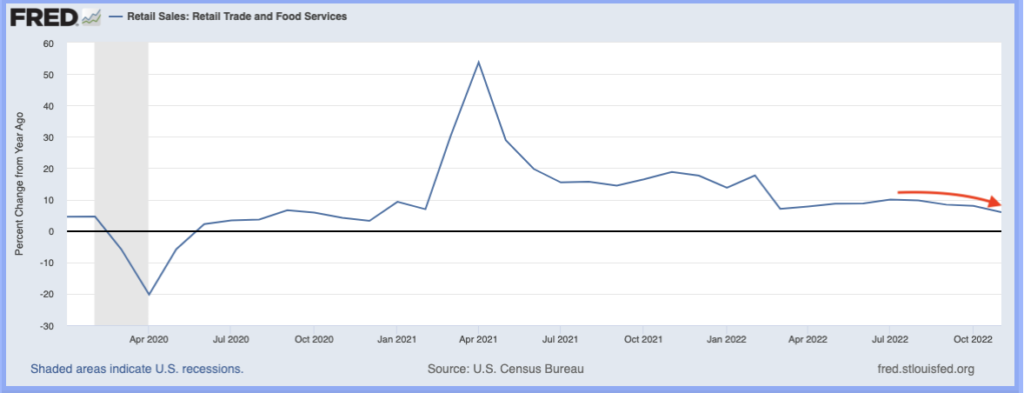

Is the U.S. Consumer Finally Losing Steam? The U.S. consumer pulled back from spending in December, which generally tends to be a strong month with holiday shopping. For the month, spending on services like rent, utilities, and dining out was flat, but when adjusted for inflation marked the weakest reading in 11 months. Throughout most of 2022, spending outpaced inflation by about 2% on average. As seen in the chart below, goods spending as measured by retail sales also appears to be turning over, as consumers are confronting shorter runways with pandemic-era savings1:

Is Your Advisor Adding Value to Your Investment Portfolio?

In a recent survey, about 60% of respondents said they think their financial advisors serve their companies’ interests more than their clients’ interests. Is your investment advisor looking out for your interests?

To help you answer this question, we are offering our exclusive guide, Does Your Investment Advisor Stack Up?3 You’ll learn more about advisor “red flags” including:

- If you receive a “one-size-fits-all” investment strategy

- If your advisor earns commissions on your investments

- If you can’t easily understand your portfolio’s performance

- If your advisor does not clearly disclose all fees

If you have $500,000 or more to invest, our exclusive guide today for our opinions about factors that determine whether investors are getting what they pay for from their advisors.

Download Our Free Guide, Does Your Investment Advisor Stack Up?3

November also marked a relatively weak month, though October was strong as consumers shifted holiday shopping to earlier in the season to take advantage of steep discounts at retailers. As consumer spending accounts for some 70% of the economy, where spending goes in the months ahead will be worth watching closely.

The Fed Scales Down Size of Rate Hikes with a 25 Basis Point Increase – As largely expected, the Federal Reserve raised its benchmark fed funds rate by 25 basis points, to a range of 4.5% – 4.75%. The Fed had telegraphed plans to potentially ratchet down the size of rate hikes, as inflation has been trending in the right direction and as wage growth decelerates (though remains elevated). Earlier this week, the Fed’s preferred inflation gauge – the personal-consumption expenditures (PCE) price index – was reported to have increased by 5% year-over-year in December, a solid improvement from November’s 5.5% print and also the lightest inflation reading since September 2021. The Core PCE-price index, which measures inflation minus food and energy, rose 4.4%. While these inflation readings are still roughly double the Fed’s 2% target, they are steps in the right direction and it is worth noting that the Fed wants 2% average inflation, which may mean settling for inflation slightly higher than the target. On a month-to-month basis, the PCE price index was up 0.1% from November, also encouraging.4

Looking for a Boom – The Early Days of China’s Economic Recovery – China is expected to have a strong rebound year in 2023, with the country finally ending its “zero Covid” policies. January was a great start. According to official metrics measuring services, manufacturing, and construction activity, China swung back into expansion mode following a very weak end of last year. China’s nonmanufacturing PMI, which measures key services and manufacturing activity, crossed above 50 (signaling expansion) for the first time since last September – a drastic improvement from December’s 39.4 reading. Manufacturing activity was also above 50 for the first time since August, and a marked improvement from December’s 47.0 reading. Consumers also showed strong signs of getting back out and spending, despite a surge of infections. Box-office revenues were the highest on record for a Lunar New Year holiday, and train travel surged back to 83% of 2019 levels. China is still in early days of testing a light restriction approach to Covid-19, so it is too early to determine whether this rebound in activity will be sustainable in the coming months. But so far, the growth trends are promising.5

While we may not know how all these stories will pan out, or how they could affect the market in the long-term, having an investment advisor that helps you reach your long-term goals can be critical to your financial well-being.

But is your advisor delivering? Unfortunately, many clients don’t think so. That’s why we developed our FREE guide, Does Your Investment Advisor Stack Up?

Get our opinions about these critical advisor warning signs:

- If you receive a “one-size-fits-all” investment strategy

- If your advisor earns commissions on your investments

- If you can’t easily understand your portfolio’s performance

- If your advisor does not clearly disclose all fees

If you have $500,000 or more to invest, our exclusive guide today for our opinions about factors that determine whether investors are getting what they pay for from their advisors.

Disclosure

2 Fred Economic Data. January 18, 2023. https://fred.stlouisfed.org/series/MRTSSM44X72USS#

3 ZIM may amend or rescind the “Does Your Investment Advisor Stack Up?” guide for any reason and at ZIM’s discretion.

4 Bea. January 27, 2023. https://www.bea.gov/data/personal-consumption-expenditures-price-index

5 Wall Street Journal. January 31, 2023. https://www.wsj.com/articles/chinas-consumers-drive-rebound-in-economic-activity-11675165479?mod=economy_lead_pos3

6 ZIM may amend or rescind the “Does Your Investment Advisor Stack Up?” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.