Katelyn M. from Sandy, UT asks: Hello Mitch, I saw that spending in the U.S. went down in December, which is supposed to be great with the holiday shopping season. Do you think this is yet another sign that the U.S. is headed for a recession?

Mitch’s Response:

U.S. consumer spending is a good metric for consumers to monitor since it accounts for more than two-thirds of total economic output.

To clarify your question a bit, it is the case that consumer spending fell in November and December of last year. Consumer spending was originally reported to have risen by 0.1% in November, but that figure was revised to show a 0.1% decline in the latest Commerce Department report.1

Digging into the December numbers reveals some interesting insights, which I do not think strengthen or weaken the case for recession. Americans cut back spending at restaurants and bars, but at least some of this retrenchment could be attributed to harsh winter weather in many parts of the country. Spending on cars, furniture, and equipment also fell by -1.9% while outlays for clothes and other nondurables fell by -1.4%. At the same time, however, spending on services in December rose by 0.5%, which was buoyed by higher activity in utilities, air travel, and healthcare.

Handling Volatility – What Should You Do?

Volatility often results in emotional decision-making—like when investors believe that selling out of stocks is the best route to avoid further losses. The real challenge is not finding a way to eliminate volatility—it is developing a mental approach to dealing with it.

Our guide, “Helping You Manage Market Volatility,” will provide you with insights and tips to do just that. Get answers to questions like:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Download Zacks Volatility Guide, “Helping You Manage Market Volatility.”2

Importantly, a softening in overall consumer activity in November and December did not prevent the U.S. economy from expanding in the fourth quarter. Advanced GDP estimates – which include the November (-0.1%) and December (-0.2%) consumer spending figures – showed the U.S. economy expanding at a 2.9% annualized rate in Q4. This marks a relatively strong rate of growth despite consumers pulling back at the end of the year.

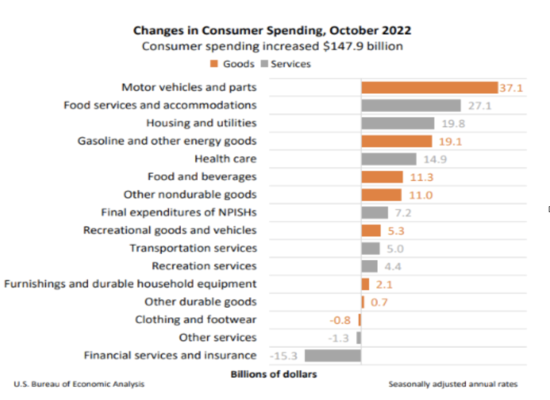

One of the key reasons the overall economy held up – even as spending slowed in the final two months – was because of strong spending in October, which is important to consider in the context of weaker November and December figures. Many retailers notably offered discounts very early in the holiday shopping season to lure consumers into stores, and in an effort to expand the length of the holiday shopping season and to work through bloated inventories. As readers can see in the October consumer spending chart below, it was a very strong month indicative of consumers shifting purchases up – not of them eschewing purchases altogether.

In my view, consumer spending will continue to hold its ground as long as the labor market remains strong and wages continue to push higher, both of which I continue to see in the data today. Though layoffs at major companies (particularly in tech) have made headlines lately, small business hiring remains robust – accounting for 80% of available job openings today.

One final detail to point out is that in my column last year, I suggested that strong U.S. consumers – supported by a strong labor market and good household financials – may help the U.S. avoid recession, but they may also simply have the effect of preventing it from becoming severe if it does indeed happen. I still believe that to be the case, even with weak November and December 2022 spending.

No matter the outcome of the U.S. economy, I still encourage all investors to be one step ahead. One challenge an investor will face is market volatility. Even though it’s a normal part of the market flow, there are ways to eliminate it.

In our guide, “Helping You Manage Market Volatility,”4 we provide you with insights and tips to do just that. Get answers to questions like:

- Market downturns can and will occur, but what should you do?

- How can diversification help you manage volatility without compromising your returns?

- When volatility is too much for you to handle, how can a money manager help?

- Can volatility actually be an opportunity?

If you have $500,000 or more to invest and want to get answers to the questions above, click on the link below to download this guide today!

Disclosure

2 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

3 Bea. December 1, 2022. https://www.bea.gov/news/blog/2022-12-01/personal-income-and-outlays-october-2022#:~:text=Personal%20income%20increased%20%24155.3%20billion,or%200.8%20percent%2C%20in%20October

4 ZIM may amend or rescind the guide “Helping You Manage Market Volatility” for any reason and at ZIM’s discretion.

DISCLOSURE Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals. This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation. Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein. It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.