The U.S. is all set to double its shale gas exports. Following the first round of exports in February, Cheniere Energy Inc. – the nation’s first and only exporter of shale gas – has received the nod from authorities to supply liquefied natural gas (LNG) from a second plant (Train 2) at Louisiana’s Sabine Pass terminal.

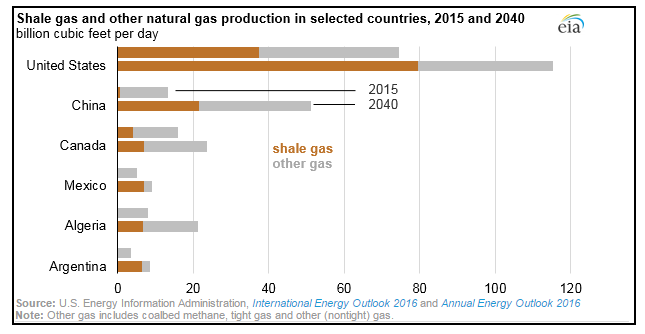

In 2015, shale gas accounted for around half of America’s natural gas output. Shale gas production could double to reach 79 billion cubic feet per day – about 70% of the nation’s natural gas production – by 2040, according to reference case estimates from EIA.

Source: EIA

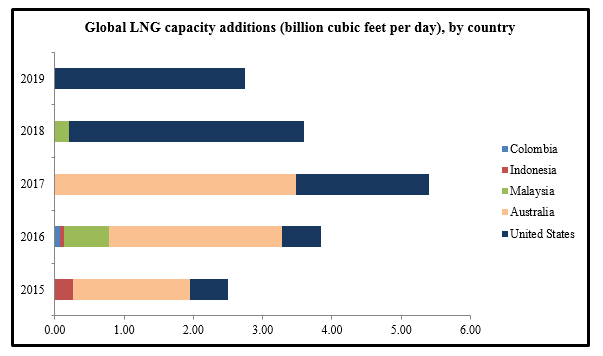

Moreover, the U.S. will edge past many other producers in LNG capacity additions in the coming years, as EIA estimates suggest.

Source: EIA

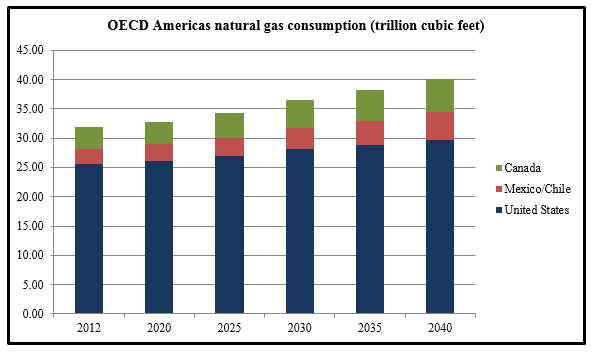

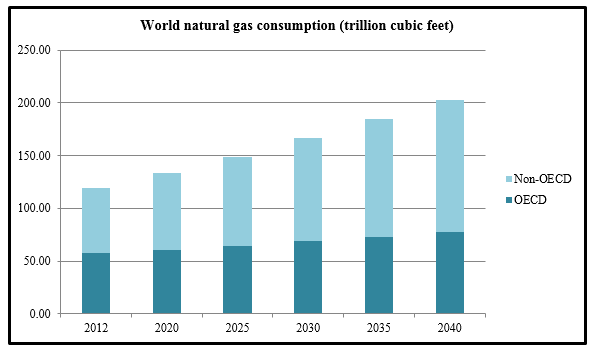

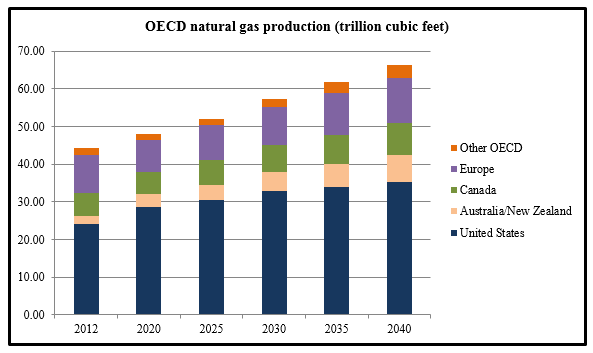

Will that add to the supply glut, or does it spell more opportunities for the nation? Between 2012 and 2024, while the U.S. is expected to have a +16% growth (or, 51% of the OECD Americas’ total increase) in natural gas consumption, the country’s production – the largest in the OECD – is projected to climb at a much faster pace: +47%, largely on the back of shale gas production. That could spell opportunities for U.S. exports’ expansion, especially with demand projected to rise by +26% in the whole of OECD Americas, and by +70% globally.

Source: EIA

Source: OECD

Source: EIA

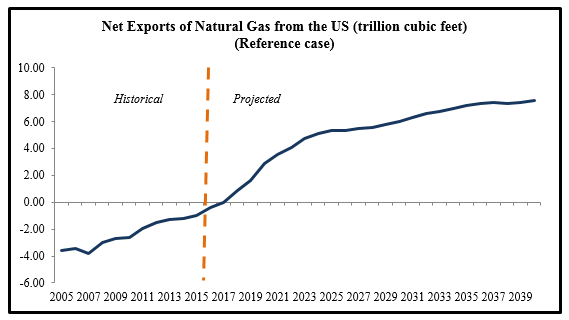

Thanks to the shale revolution, the U.S. could become a net exporter of natural gas in the next couple of years – after having been a net buyer for a long time in the world market.

Source: EIA

By next year, liquefied natural gas (LNG) export capacity from the lower 48 states is projected to more than double to 3.2 billion cubic feet per day.

Already, around 34 LNG carriers have departed the Sabine Pass terminal this year, most of which supplied gas to Argentina, Brazil, Chile and Mexico. Shipments to India and Columbia are also expected to gain momentum soon.

U.S. could also be giving players like Russia some serious competition. Turkey, Russia’s third largest buyer, took its first LNG shipment from the U.S. in September.

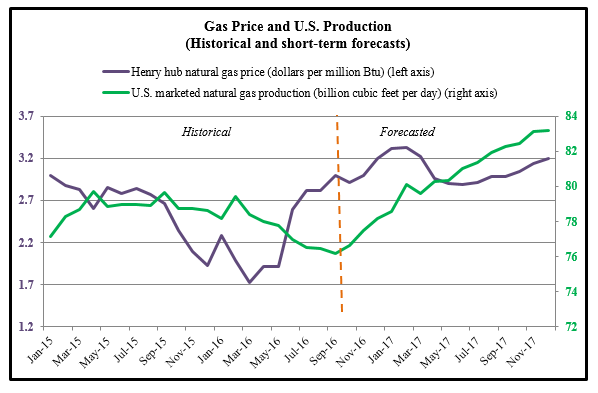

Furthermore, with expected increases in global gas prices over next year, U.S. capacity additions could translate into gains for suppliers – something that should induce more production.

Source: EIA

Bottom Line for Investors

The surge in U.S. gas exports raises anticipations about an already glutted market. Nevertheless, forecasts point to global demand growth, and gas price rebound may already be underway – meaning, U.S. gas exporters’ investments could reap substantial returns over time. Cheniere already has two plants (each with a capacity of producing equivalent of 650 million cubic feet per day) and is planning to set up two more next year. Cheniere will reportedly get paid fixed amounts irrespective of whether its customers eventually take any LNG from the terminal.

The energy sector exemplifies how market dynamics can fluctuate with time, thereby indicating the need to stay updated on market movements while analyzing a sector’s long-term prospects. To get insights on which sectors are gaining and which could be floundering, have a look at the latest Stock Market Outlook from Zacks Investment Management. Click on the link below to download your free version today:

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.