For the last few weeks, my columns have focused on key concerns circulating in today’s markets: rising interest rates, inflationary pressures, the unfortunate and saddening events unfolding in Ukraine, and stock market volatility.

Taken together, these are all issues that are weighing heavily on investor sentiment.

It is understandably challenging to stay optimistic in this type of environment, especially since there is very little coverage giving investors reasons to be positive. In short, a war and rising prices can easily cast a long shadow on positive economic fundamentals, as we’re seeing now.

But a closer look at the U.S. economy reveals several indicators signaling more growth ahead, and I think there are many under-appreciated reasons to be positive right now. Here are three big ones.

1. Corporate America is in Investment Mode

When U.S. corporations are optimistic about the future, they tend to invest more in labor, equipment, software, and other areas designed to facilitate growth and scaling. The opposite holds true when corporations are skittish about the economic outlook.1

Data suggest U.S. companies are optimistic.

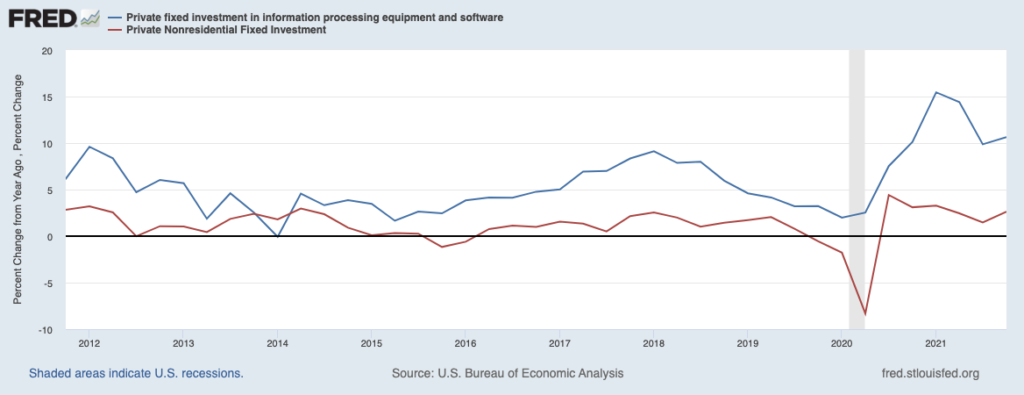

Private nonresidential fixed investment – a proxy for business investment – jumped 7.4% in 2021, even when adjusting for inflation. This uptick in business spending marked the fastest rate of increase since 2012.

Perhaps not surprisingly, U.S. businesses spent the most on software and information-processing (blue line in the chart below), as the need to ‘digitize’ business operations was catalyzed during the pandemic and is bound to grow as remote work becomes the norm. Spending in this area of IT rose a stout 14% in 2021. The trend of ramping up business investment looks poised to continue: manufacturing firms surveyed by the Institute for Supply Management said they plan to increase investment by 7.7% in 2022, and services firms – which comprise a majority of the U.S. economy – expect a 10.3% increase.

Business Investment on the Rise, Particularly in Software and IT

2. Leading Economic Indicators are High and Rising

The Conference Board’s Leading Economic Index (LEI) is a useful indicator that can help investors gauge whether U.S. economic activity is in growth mode, plateauing, or decline. The LEI aggregates a handful of key leading indicators, like average weekly hours worked, jobless claims, manufacturer’s new orders, building permits, credit, consumer expectations, and more. In the LEI’s 50+ year history, only one recession has occurred when the index was high and rising – the 2020 pandemic-induced recession, which I would call an exception that proves the rule.3

At present, the LEI is hovering at all-time highs and is still notching increases, signaling growth mode here in the U.S. In February, the LEI increased by 0.3%, which followed a 0.5% decrease in January but a 0.8% increase in December. Importantly, the 6-month look at the LEI shows a 2.1% increase from August to February, again underscoring positive economic momentum in the U.S.

Altogether, the Conference Board sees 3% year-over-year U.S. GDP growth in 2022, which is a far cry from recession territory for the U.S. economy.

3. The Jobs Market is Historically Strong

The U.S. jobs market is strong and keeps getting stronger.

In the latest jobs numbers release, U.S. employers were seen adding 431,000 jobs in March, with particularly strong hiring in services industries like restaurants and retail. The Labor Department also said that hiring in January and February was stronger than initially reported, signaling that the jobs market is arguably better than most appreciate.4

The latest release marked the 11th straight month where job gains totaled more than 400,000, which marks the longest stretch of consecutive gains dating back to 1939. The unemployment rate fell to 3.6%, which now puts it very close to its pre-pandemic level of 3.5% (which is also a 50-year low). Put simply, labor markets like this one are not the stuff of recessions.

Bottom Line for Investors

I write often that the stock market can thrive in scenarios where widely-known negative stories receive all the attention, while under-appreciated but important economic fundamentals are overlooked. This dynamic is the definition of stocks climbing the ‘wall of worry,’ and I think it accurately describes the setup for the U.S. economy and markets heading into Q2.

Disclosure

2 Fred Economic Data. March 30, 2022. https://fred.stlouisfed.org/series/PNFI#0

3 The Conference Board. March 18, 2022. https://www.conference-board.org/pdf_free/press/US%20LEI%20PRESS%20RELEASE%20-%20March%202022.pdf

4 Wall Street Journal. April 1, 2022. https://www.wsj.com/articles/march-jobs-report-unemployment-rate-2022-11648766857

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.