Yields on long-duration U.S. Treasury bonds have gone up briskly over the last few weeks, sounding alarm bells for many investors. The 10-year U.S. Treasury bond yield started 2022 at 1.44%, and as I write, the yield has pushed up to 2.75%. Meanwhile, inflation concerns have not abated – in February 2022, inflation was running at 7.9%, marking the highest year-over-year pace of inflation since January 1982. The producer price index, which measures input costs to businesses, is even higher.1

Inflation and interest rate expectations have no doubt shifted higher. The Federal Reserve’s increasingly hawkish stance is also contributing. Chairman Jerome Powell and other Fed governors have indicated the Fed’s willingness to be more aggressive at future meetings, suggesting half-percentage point increases are on the table.

Many investors are left wondering what happens next. I have three key points for consideration.

The first is that stocks have tended to do quite well, historically, during Fed tightening cycles (when the central bank was actively raising rates, as they are now). Going back 50 years, there have been nine periods when the Fed entered a cycle of raising the benchmark fed funds rate, and stocks did well in all but one of them. In fact, the S&P 500’s average annualized returns during the tightening cycles was a stout +11.8%. This data point does not tell us stocks will go up during the current tightening cycle, but it does provide a pretty clear indication that stocks have not responded adversely to rising rates in the past. Far from it.

My second point is that rising rates are not necessarily a good rationale for avoiding or selling bonds. Bonds may struggle as yields move higher, but ownership of bonds in your investment portfolio should be more about what your long-term goals and objectives are, not necessarily a factor of whether interest rates are poised to go up or down. Remember, too, that over time the performance of bonds and stocks are not tightly correlated, which means investors can derive benefits from owning bonds as a diversification tool. Bonds can help mitigate equity risk and volatility over time, a feature important to many investors, particularly in retirement.

Finally, there are dividend stocks, which have a history of holding up particularly well during rising rates and inflationary environments. When inflation has historically run in the 6% to 7% range—which is basically where it is now—a sector-neutral strategy of owning the top dividend payers outperformed the broad S&P 500 index by approximately +10% over 12-months.

Rising interest rates have also historically impacted dividend stocks less than other categories of stocks. For example, over the past year, the Nasdaq 100’s returns have been more tightly correlated to interest rate returns (10-year U.S. Treasury bond) than usual, which helps explain why growth stocks may continue to struggle as bond prices fall. Conversely, dividend stocks (S&P 500 High Dividend Index) have been negatively correlated to bond prices and interest rate returns over the past few years, arguably making dividend stocks a diversification hedge in a rising rate environment.

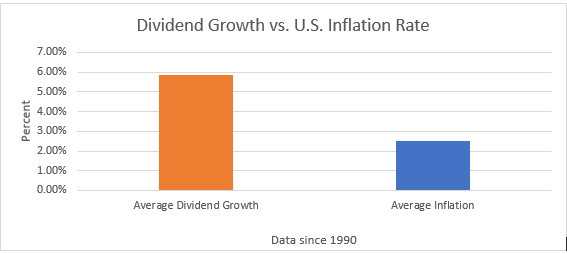

A distinct advantage that dividend-paying companies have is the ability to increase dividends above the inflation rate, which many high-quality companies often do. Indeed, companies have grown dividends at roughly twice the pace of inflation since 1990, as the data in the chart below illustrates:

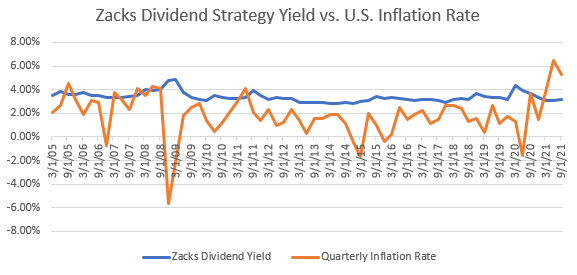

For investors seeking to ensure that income from a portfolio does more than just ‘keep pace’ with inflation, dividend-paying stocks provide a viable solution. The Zacks Dividend Strategy is one such solution. As readers can see in the chart below, the Zacks Dividend Strategy has consistently delivered a dividend yield above—and sometimes well above—the inflation rate.

The most recent spike in inflation is an anomaly that I think could course-correct later in 2022. However, if history is any indication, dividend yields are likely to respond to higher inflation by also pushing higher over the course of the year and beyond. The Zacks Dividend Strategy is well-positioned for this possibility. Our process focuses on identifying companies with already strong and sustainable dividend payments, but the upshot is that these high-quality companies also tend to be the ones actively growing their dividends—a win-win.

Bottom Line for Investors

Narratives in the financial media seem to be focused on spiraling, long-term inflation with interest rates that are poised to move significantly higher. I take a more measured view – I think inflationary pressures will ease by the second half of 2022, and I see rising long-duration Treasury yields as the market pricing-in future Fed hikes and somewhat higher-than-expected inflation. There seems to be a sense of panic that the 10-year U.S. Treasury bond yield is approaching 3%, but I’ve been around long enough to know that 3% is still very low relative to history.

In my view, higher inflation and higher rates warrant a diversified equity portfolio of quality, earnings-generating companies with strong cash flows and perhaps strong dividend programs. And on the fixed income side, I think investors do not necessarily need to exit bonds so much as actively manage duration and interest rate risk, which we do here at Zacks Investment Management.

Disclosure

2 Zacks Dividend Guide. 2022.

3 Zacks Dividend Guide. 2022.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.