U.S. stocks continue to bounce around quite a bit, testing many investors’ patience in the process. We continue to believe stocks are the most attractive asset class right now, which we think is especially true given valuations have reset significantly lower over the past few months. As I’ve said before, I think now is a time to buy and/or hold stocks – not to sell them.

Instead of focusing on stock market volatility again this week, I’m writing about another asset class that has created significant value in the economy recently, with basically no downside volatility: the housing market.1

Many buyers, sellers, and middlemen have been baffled by how durable the housing market has been over the past couple of years, even during the pandemic. From March 2021 to March 2022, the average home price as measured by the S&P CoreLogic Case-Shiller National Home Price Index rose by a stout +20.6%. That’s the highest rate of growth ever recorded for the index.

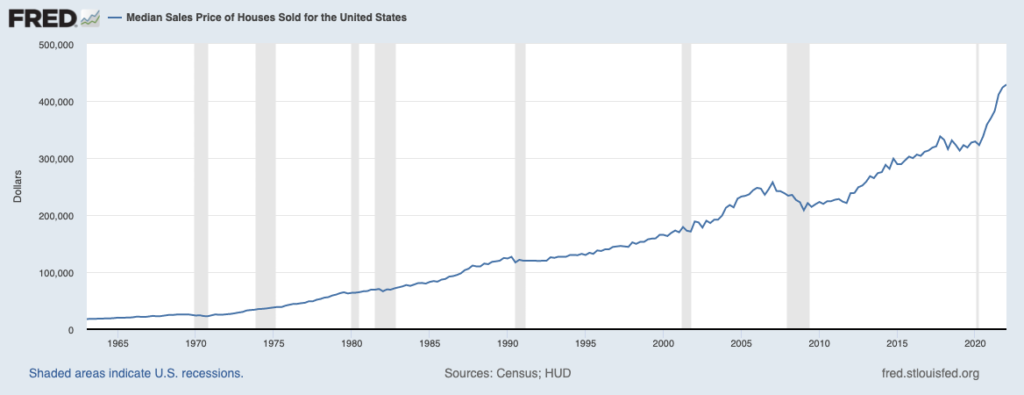

Median Sales Price of Houses Sold in the U.S.

The U.S. housing market matters to the economy and by extension, the stock market. According to the National Association of Homebuilders, housing contributes about 15% to U.S. GDP, a figure that includes money spent building single-family homes, remodeling expenditures, fees for brokers, utilities, rents, and so on. Strength in the housing market often accompanies and supports strength in the economy.

Clients and readers have asked me if this historic run for the housing market is sustainable, or if it could be another shoe to drop if the economy falters in the months/years ahead. To answer that question, I think it’s important to understand what’s driving housing market strength in the first place. I have three factors:

- Low Inventory of Homes –

Like any market, housing prices are determined by supply and demand, and there is currently a very low supply of homes relative to the number of buyers looking.

Following the 2008 Global Financial Crisis – which was spurred in part by a collapse in the housing market – new-home construction in the U.S. plateaued. As a result, the lending giant Freddie Mac estimates that the U.S. is about 3 million homes short of what’s needed. At the end of April 2022, there were only 1.03 million homes for sale in the U.S., which is about a two-months’ supply – about 50% less than historical averages.

Homebuilders trying to ramp up production have faced issues, from labor shortages to wild swings in commodity markets, which make the prices of building materials and other inputs hard to predict. But there is another headwind to the inventory issue: baby boomers are living longer and many don’t want to move. The incentive to relocate is also fading, as interest rates move well above the rates many people secured by refinancing last year.

- Record Low-Interest Rates

Part of the Federal Reserve’s plan to boost the economy during the pandemic involved becoming a large-scale purchaser of bonds backed by agency mortgage loans from Fannie Mae and Freddie Mac. The Federal Reserve created a massive demand for mortgage securities, which pushed yields down and generated the lowest mortgage interest rates in history by the end of 2020.

Interestingly enough, historically low rates also coincided with a massive influx of new buyers, which is the third factor.

- A New and Ongoing Wave of New Buyers

In 2019, millennials surpassed the baby boomers as the largest living adult generation in the U.S. But being the biggest group had not necessarily translated into a massive wave of new homebuyers. Leading up to the pandemic, millennials had seemed to prefer living in urban centers, renting, and delaying family formation.

Covid-19 changed that.

In 2020, millennials accounted for more than 50% of all home-purchase loan applications for the first time ever. By 2021, millennials made up 67% of first-time home purchase mortgage applications and 37% of repeat-purchase applications, a rising trend that appears likely to continue. The largest segment of millennials just turned 30 this year, which is younger than the median first-time buyer age of 33. In other words, this wave of new buyers may only just be beginning.

The pandemic led many companies to allow people to work from home entirely, or on a hybrid schedule with some days in the office and some days at home. This trend has encouraged many would-be homebuyers to invest in a bigger space with a home office, which is also a trend that does not appear to be going away.

Bottom Line for Investors

The Federal Reserve is raising rates and has announced plans to trim its balance sheet and drastically reduce – and eventually end – the purchasing of mortgage securities and other bonds. Mortgage interest rates have already shifted higher as a result, with rates moving up over 2% from November 2021 through today – the sharpest six-month increase in decades.

Higher rates do have the effect of cooling demand, but the other supply and demand variables in play suggest the housing market could remain strong for years. Very limited inventory of homes, long lag times for bringing up new supply, and a massive cohort of first-time homebuyers yet to enter the market underscore strong fundamentals in the space, in my view. The housing market alone cannot deliver strong economic growth for the entire economy, but it can provide key support. I think it will in 2022.

Disclosure

Instead of focusing on stock market volatility again this week, I’m writing about another asset class that has created significant value in the economy recently, with basically no downside volatility: the housing market.1

Many buyers, sellers, and middlemen have been baffled by how durable the housing market has been over the past couple of years, even during the pandemic. From March 2021 to March 2022, the average home price as measured by the S&P CoreLogic Case-Shiller National Home Price Index rose by a stout +20.6%. That’s the highest rate of growth ever recorded for the index.

Median Sales Price of Houses Sold in the U.S.

Source: Federal Reserve Bank of St. Louis2

The U.S. housing market matters to the economy and by extension, the stock market. According to the National Association of Homebuilders, housing contributes about 15% to U.S. GDP, a figure that includes money spent building single-family homes, remodeling expenditures, fees for brokers, utilities, rents, and so on. Strength in the housing market often accompanies and supports strength in the economy.

Clients and readers have asked me if this historic run for the housing market is sustainable, or if it could be another shoe to drop if the economy falters in the months/years ahead. To answer that question, I think it’s important to understand what’s driving housing market strength in the first place. I have three factors:

1. Low Inventory of Homes –

Like any market, housing prices are determined by supply and demand, and there is currently a very low supply of homes relative to the number of buyers looking.

Following the 2008 Global Financial Crisis – which was spurred in part by a collapse in the housing market – new-home construction in the U.S. plateaued. As a result, the lending giant Freddie Mac estimates that the U.S. is about 3 million homes short of what’s needed. At the end of April 2022, there were only 1.03 million homes for sale in the U.S., which is about a two-months’ supply – about 50% less than historical averages.

Homebuilders trying to ramp up production have faced issues, from labor shortages to wild swings in commodity markets, which make the prices of building materials and other inputs hard to predict. But there is another headwind to the inventory issue: baby boomers are living longer and many don’t want to move. The incentive to relocate is also fading, as interest rates move well above the rates many people secured by refinancing last year.

2. Record Low-Interest Rates

Part of the Federal Reserve’s plan to boost the economy during the pandemic involved becoming a large-scale purchaser of bonds backed by agency mortgage loans from Fannie Mae and Freddie Mac. The Federal Reserve created a massive demand for mortgage securities, which pushed yields down and generated the lowest mortgage interest rates in history by the end of 2020.

Interestingly enough, historically low rates also coincided with a massive influx of new buyers, which is the third factor.

3. A New and Ongoing Wave of New Buyers

In 2019, millennials surpassed the baby boomers as the largest living adult generation in the U.S. But being the biggest group had not necessarily translated into a massive wave of new homebuyers. Leading up to the pandemic, millennials had seemed to prefer living in urban centers, renting, and delaying family formation.

Covid-19 changed that.

In 2020, millennials accounted for more than 50% of all home-purchase loan applications for the first time ever. By 2021, millennials made up 67% of first-time home purchase mortgage applications and 37% of repeat-purchase applications, a rising trend that appears likely to continue. The largest segment of millennials just turned 30 this year, which is younger than the median first-time buyer age of 33. In other words, this wave of new buyers may only just be beginning.

The pandemic led many companies to allow people to work from home entirely, or on a hybrid schedule with some days in the office and some days at home. This trend has encouraged many would-be homebuyers to invest in a bigger space with a home office, which is also a trend that does not appear to be going away.

Bottom Line for Investors

The Federal Reserve is raising rates and has announced plans to trim its balance sheet and drastically reduce – and eventually end – the purchasing of mortgage securities and other bonds. Mortgage interest rates have already shifted higher as a result, with rates moving up over 2% from November 2021 through today – the sharpest six-month increase in decades.

Higher rates do have the effect of cooling demand, but the other supply and demand variables in play suggest the housing market could remain strong for years. Very limited inventory of homes, long lag times for bringing up new supply, and a massive cohort of first-time homebuyers yet to enter the market underscore strong fundamentals in the space, in my view. The housing market alone cannot deliver strong economic growth for the entire economy, but it can provide key support. I think it will in 2022.