At the time of this writing, the S&P 500 and global markets (as measured by the MSCI World) are negative for the year. Some investors are losing patience and I’ve noticed the media increasingly spinning negativity – last week, a soft jobs report spurred a flurry of nervous headlines (never mind that the unemployment rate held steady at 5.1%).

For investors to be running short on patience is understandable though. Before the correction unofficially began on August 17, the markets were essentially flat on the year. What happened to the positive outlook for stocks? Frequent readers may recall that back in January, I wrote that our research team here at Zacks was looking for a modest +4% return for the S&P 500. I added that I could see the market notching even a bit higher, assuming earnings on the year would post 8% year-over-year growth.

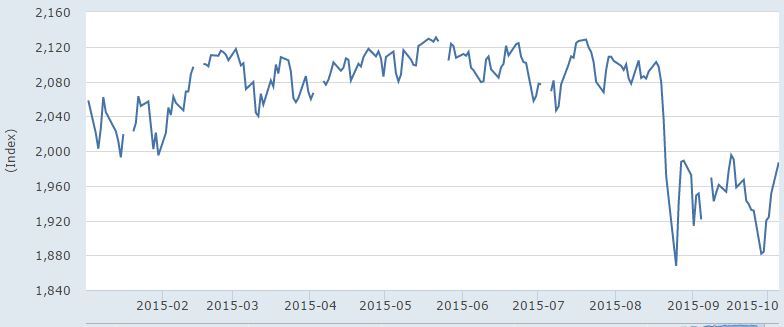

Yet, here we are in October with the market down 2.14% year to date (S&P 500) in a world still anxious about China growth, commodities prices, Emerging Markets currencies, and European economic (and socioeconomic) stability. Can stocks really recover some 10+% between now and the end of the year?

4 Reasons I Think We Could See a Solid 4th Quarter Rally

Remember that stocks do not keep a calendar like we do – if the S&P 500 does not perfectly rally to post a 4+% gain for the year, investors needn’t get discouraged about whether or not the bull market may be over.

Take 2011 as an example. You can see below that, through October, the year 2011 looks quite similar to 2015 so far: the market trended mostly sideways through the end of summer (see the red line in both charts), then in late July underwent a steep, quick correction, then rallied late in the year but not quite enough to notch positive gains on the year. The market was down -0.04% for the calendar year.

The S&P 500 in 2011

The S&P 500 in 2015 Looks Like 2011: Sideways Through Summer then a Steep Drop

But, if you focus on just the calendar year for 2011, you’d miss the fact that the S&P 500 was up +13% in 2012, +30% in 2013, and +11% in 2014. The rally that started in late 2011, after the steep summer decline, essentially just ended two months ago! This correction, in my view, was due.

I think a similar pattern of recovery could form in 2015 like we saw in 2011, to the extent that the market could experience a good rally sometime between now and the end of the year. Here are four reasons why:

1. Seasonality Trends – February and September have historically been the weakest months for the S&P 500, with December as the strongest. Though I do not advocate for seasonality trades, it has also been generally true that May – September is seasonally weaker for returns as compared to upticks seen in October – May.

2. Earnings Bounce – earnings have been a big story of late, given that the S&P 500 has seen falling and negative earnings – in aggregate. But strip away the caving Energy sector, and earnings take on a much different light. Without Energy, total earnings for the S&P 500 would have been up +5.2% in Q2 on +1.3% revenues. And, on a forward looking basis, Zacks sees Q3 earnings ex-Energy at +1.7% on +0.7% higher revenues. For Q4, I think we will see nicely higher earnings surprises, especially on a backdrop of soured expectations.

3. Retail Surprise – a stronger dollar, firmer employment picture, and lower gas prices all give the U.S. consumer a tailwind for spending, and it’s showing in the data – real consumption is up 3% over last year, and consumer spending still accounts for over two-thirds of GDP growth. With the holiday shopping season around the corner, I believe we could see impressive numbers in retail that underscore this strength.

4. Correction Snapback – I’ve said before that I could see this correction still having room to run – and I still believe that to be the case. But, another symptom of corrections is that they tend to end just as quickly as they begin. As you can see from the chart of the S&P 500 in 2011, when the correction is over the market tends to whipsaw into recovery.

Bottom Line for Investors

If you are thinking about making reactionary moves in your portfolio due to the downside volatility, or loss of patience with equities, you may want to reconsider – the 4th quarter has tended to be a solid one for stocks, and I don’t think this year will buck the trend. Stay steady, and long.

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This communication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any securities or product, and does not constitute legal or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.