Financial stocks stumbled hard out of the gates in 2016. Some of the biggest players in the U.S. like JP Morgan (JPM), Wells Fargo (WFC) and Bank of America (BAC) got completely clobbered in the first six weeks. From January 4 to February 11, when broad domestic markets shuddered, JP Morgan declined -19.62%, Wells Fargo came in at -16.92% and Bank of America cratered over -33%. Shares recovered a bit by the end of the quarter, but each name was still down over 10% on March 31 – while the S&P 500 was back in positive territory.

So what happened?

We could point to any number of factors that may have exaggerated the downside for banks: negative interest rate policy in Europe (and the mere thought of it in the U.S.), worries over Energy loan exposure, capital ratio questions in Europe and the list goes on. Negative interest rates and a flattening yield curve spell headwinds for bank margins, yes. But, the extent of selling pressures seemed to outweigh the fundamental impact to banks earnings outlooks, particularly in the U.S. The reality is that we’re not dealing with negative interest rates here, and banks are better capitalized than they’ve been in decades. So, the selling may have gone too far.

Individual names like JP Morgan and Bank of America were dealt a blow and may seem like attractive options for bargain hunters. But, even if you look at the sector in aggregate, there is still a case for attractive valuations relative to the S&P 500:

Q1 2016 Performance

S&P 500 (price only): +0.77%

iShares U.S. Financials (IYF): -5.34%

iShares U.S. Regional Banks (IAT): -9.08%

Is the Outlook for Banks Good Enough to Warrant Increased Exposure?

The fundamentals for U.S. banks are generally doing fine. The ‘bad energy loan’ story is the easiest to dismiss – energy loans only account for about 3% of total U.S. bank loans and most banks have cushioned balance sheets in the event some of them default. Most energy loans are made in the debt markets, think MLPs and high yield bonds.

The negative interest rate concern does not really impact U.S. banks, at least in my view. The Fed still pays 0.5% on reserves (current fed funds rate) and our view is that the fed funds rate will rise over the course of the year, perhaps to 1% or higher. Banks in the U.S. and Europe are both very well-capitalized with Tier 1 ratios (core equity capital relative to total risk-weighted assets) and well over double what they were in 2008. They’re prepared for a crisis that, more than likely, isn’t coming this year.

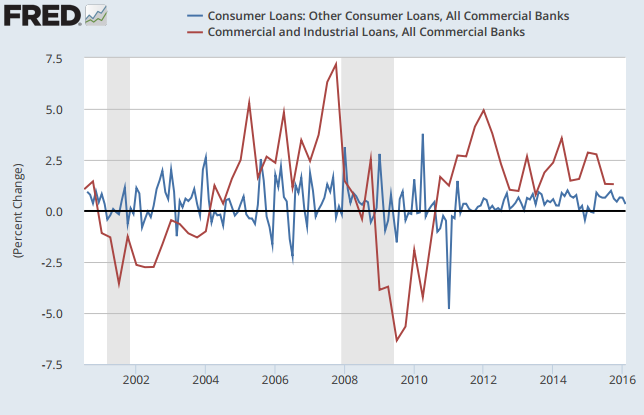

Loan growth is also good. Consumer loans and industrial loans have both been growing at a modestly positive clip over the last few years. We do not expect a material change to that as long as the yield curve remains upward sloping (which we think it will in 2016).

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

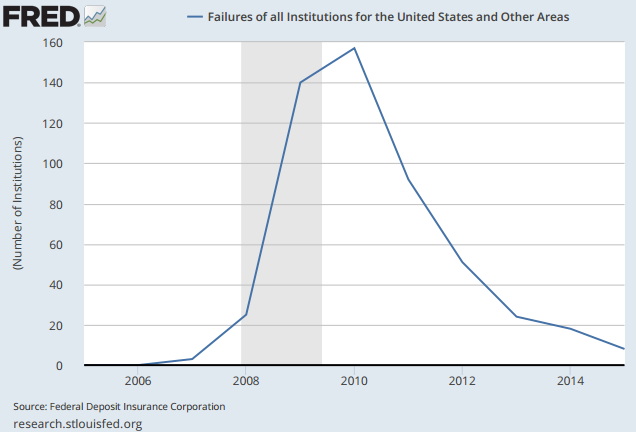

Bank failures are also very few and far between these days which can provide a sentiment boost for the health of the sector. Last year, there were only eight.

Source: Federal Deposit Insurance Corporation

Source: Federal Deposit Insurance Corporation

Earnings paint a bit of a different picture, however. Estimates for the Finance sector have dropped -9.8% since the start of the year, with Q1 earnings growth for the sector now expected to decline -10% from the same period last year. J.P. Morgan (JPM), Bank of America (BAC), and Citigroup (C) all suffered material negative revisions due to a slightly flatter yield curve (the 10-year Treasury yield dropped by 50 basis points in the quarter), weak capital markets and a muted investment banking environment due to heightened volatility and uncertainty. It’s possible that Q1 total earnings could be down -10.9% from the same period last year, on -2.2% lower revenues. This will be the 4th quarter in a row of negative earnings growth for the index.

There are also regulatory uncertainties that have held banks back. Dodd-Frank rules are still not fully understood or established and some campaign trail rhetoric is targeting big banks, which creates uncertainties in how the sector approaches risk-taking. Less risk taking means lower profit potential, which can in turn inhibit compelling multiple growth.

Bottom Line for Investors

The volatility experienced early this year was, perhaps, overly sentiment driven considering that there has not been a meaningful breakdown in fundamentals. At face value, big U.S. banks are trading at more attractive valuations than they were to start the year. Risks to profits remain, however, so the case for financials must have a basis in a very long-term view, in my opinion. If you were considering a longer-term asset allocation shift to increase portfolio weight to financials, you’d have cheaper entry points now. It may be worth a close look for the long-term investor.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.