Earnings season is on the menu now and bears everywhere are drooling. Why? Because looking at Q1 as a whole, total earnings are expected to be down -10.3% on -0.6% lower revenues versus the same period last year. This will be the 4th quarter in a row of negative earnings growth for the S&P 500, and only very rarely do you see that without a recession.

I’ve belabored the point concerning the disproportionate impact of the Energy Sector on aggregate S&P 500 earnings many times in this space – and you are probably tired of hearing it. So, I won’t rehash that whole argument here. It’s true that earnings outside of Energy have seen better days, but the drag caused by resource-sensitive companies has been profound. Excluding energy, earnings have been weak for the last few periods but not negative in every quarter.

Regardless, earnings “optics” have been bad and I have a feeling that the media is really going to focus on it this quarter. The media loves a good bearish narrative and, given that Q1 could deliver close to double-digit earnings declines while marking the fourth quarter of negative earnings growth, they could have their golden child of storylines.

That’s where the “making money” part comes in. I’ve always been a believer in the wall of worry. If negative sentiment rises so substantially that it makes most investors lose sight of positive fundamentals, stocks generally tend to thrive. I could point to dozens of times in history when this was the case. It even dates back to the time of Sir John Templeton, who famously said, “bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” Earnings weakness could help “skepticism” build.

Earnings revisions are one way to measure sentiment. Generally, as optimism about future growth fades, companies will temper their earnings expectations. Setting the bar too high and not reaching it can crush shares, so companies would rather see the opposite occur and set the bar low.

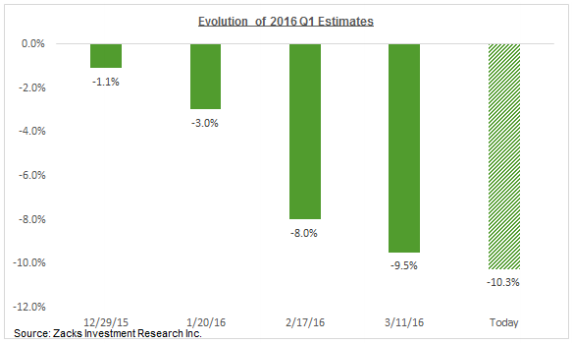

Q1 estimates followed this pattern as the quarter unfolded. As noted earlier, total S&P 500 earnings for the quarter are expected to be down -10.3% on -0.6% lower revenues versus the same period last year, a sharp drop from what was expected at the start of the period. The chart below shows how growth expectations have evolved since the start of the quarter:

Source: Zacks Investment Research, Inc.

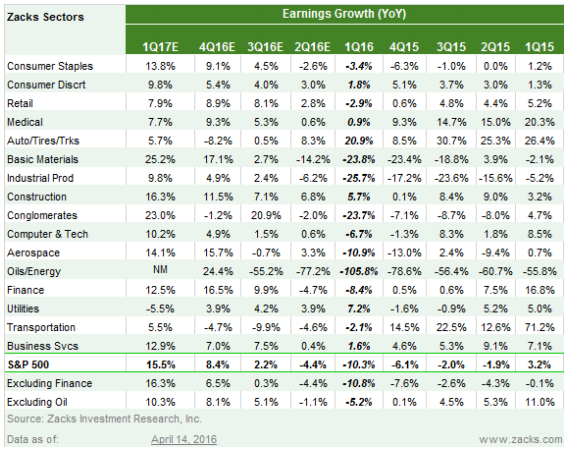

Not only is the magnitude of negative revisions suffered in Q1 the largest compared to other recent quarters, but they are also broad-based and not just a function of Energy Sector issues. The Energy Sector’s estimates have unsurprisingly suffered the most, but the reality is that estimates for 14 of the 16 Zacks sectors have come down since the start of the period.

All of this combined could be bullish. With negative earnings on the quarter coupled with negative revisions looking ahead, it feels like a recipe for sentiment to take a turn for the worst. But, at the same time, it gives companies a better shot at beating earnings expectations later, and markets love positive surprises.

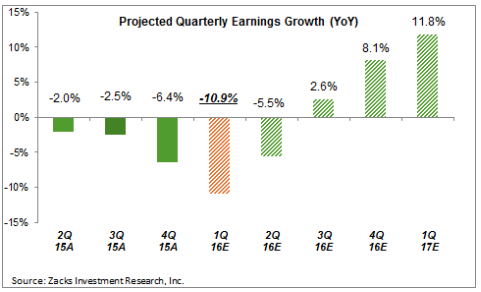

We’re optimistic about that possibility, because we continue to forecast a strong Q3 and Q4 in 2016 for earnings.

Source: Zacks Investment Research, Inc.

This positive expectation reflects an anticipated end to the Energy Sector’s drag based on consensus expectations for stabilized oil prices. But, it’s not unusual for Wall Street analysts to be optimistic about the outer periods; they start out with a positive tone and start pacing back as the period gets closer. If history is any guide, then we should see estimates in the second half of the year start to come down in the upcoming months – which again, can give companies an even better shot at surprising to the upside.

The chart below gives a breakdown of how we see earnings shaking out by sector, which gives investors some ideas as to where to look for value.

Source: Zacks Investment Research, Inc.

Bottom Line for Investors

There are numerous variables that factor into making investment decisions. But, sometimes it’s best to simply take a step back and think like Sir John Templeton. In this case, what I’m suggesting is that if you see and believe that positive fundamentals remain intact, but that other factors (negative earnings and earnings revisions) are causing investors to lose optimism, what you may discover is a wall of worry that the stock market is eager to climb.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.