Just about everyone thinks the U.S. economy will enter a recession this year.

According to a Wall Street Journal survey of 23 of the U.S.’s largest financial institutions, nearly 80% of their top economists think the economy will contract for two consecutive quarters in 2023.1 They may be right.

Corporate earnings estimates for 2023 have been coming down considerably – companies now expect aggregate 2023 earnings to fall -9.2% from their 2022 peaks, or -11.9% if you exclude the Energy sector’s positive contribution.2 Falling earnings estimates and peaking profit margins generally imply an economic slowdown is underway, or very close. In previous columns, I have pointed readers to other key recession indicators, like the negative 6-month growth rate for the Conference Board’s Leading Economic Index and the inverted 3-month/10-year U.S. Treasury yield curve, both of which continue to send relatively strong recession signals.

There are also other signs demand is waning – indexes that track business activity in U.S. services and manufacturing sectors have fallen to levels last seen around the 2020 pandemic-fueled recession, household savings have been trimmed considerably as consumers have largely spent through fiscal stimulus, and banks are tightening lending standards (even though overall loan activity remains strong).3

The upshot to these recession forecasts is that most believe the contraction will be mild and shallow, to the point where many Americans may not even notice it at all. I see this outcome as a distinct possibility as well. But I also think it’s worth presenting a case for the U.S. avoiding a recession altogether, which I strongly believe is possible. Below I’ll give you three reasons why.

- Real Disposable Incomes are Poised to Go Up in 2023, Not Down

A historically strong labor market pushed wages higher in 2022. Nevertheless, real disposable income fell sharply in the first half of 2022 because of fiscal tightening and high inflation. In other words, Americans were making more in 2022 but had less purchasing power, which isn’t a good setup for sustainable growth.

Looking ahead to 2023, ongoing strength in the labor market is likely to continue supporting higher wages, while inflationary pressures should subside significantly. We’re already seeing the latter – price pressures related to supply chain disruptions have almost entirely faded, giving way to falling costs for semiconductors, used cars, gas, appliances, and a range of other goods that contributed significantly to last summer’s inflation surge.

In my view, falling inflation combined with rising wages could push real disposable income up by 2% to 3% in the new year, which would buttress consumer confidence and lead to increased spending. As I wrote later last year, since spending accounts for roughly two-thirds of U.S. economic output, strong consumer finances could help the U.S. avoid recession.

- Job Losses and Rising Unemployment May Not Be Needed to Tamp Inflation

As mentioned in the previous section, “goods” inflation is trending solidly in the right direction, with further declines almost assured in the first half of 2023. But it is also true that one of the Fed’s biggest concerns is not ‘goods’ inflation—which it acknowledges is improving—but ‘services’ inflation, which tends to have closer ties to the jobs market and wages.

In comments following the Fed’s December meeting, Chairman Powell said “the labor market continues to be out of balance, with demand substantially exceeding the supply of available workers.”4 This imbalance puts upward pressure on wages, which can entrench inflation if it influences companies to raise prices to make up for higher costs.

So, many forecasters think the Fed will not stop monetary tightening until it sees significant cooling in the labor market. But in my view, this feat can be accomplished not by triggering massive layoffs, but by instead unwinding available job openings – which would be much less painful.

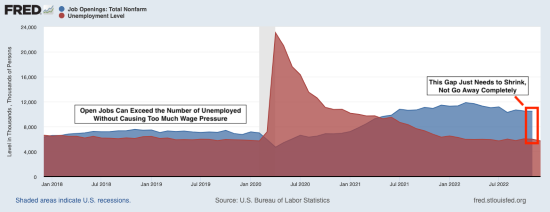

A key feature of this economic fundamental I think many miss: the number of Americans looking for work doesn’t have to exceed the number of available jobs in order for wage pressures to ease. As seen in the chart below, from 2018 up to the pandemic, there were roughly 1.5 to 2 million more open jobs than available workers, and wage pressure was low during that time. In the current environment, I think the ratio of open jobs to available workers only needs to shrink to 2 million (from the current 4 million) to bring wage growth down to a rate compatible with the Fed’s 2% inflation target:

- China’s Economic Reopening Supplying Global Economic Tailwinds

The end of China’s “zero Covid” policy has so far been bumpy. China does not supply reliable data in terms of hospitalizations and how broadly the spreading of infection is disrupting daily life and economic activity. But safe to assume it has so far been hurting more than it’s been helping.

I think that could change later in 2023. While China currently lacks natural immunity and vaccines there are not as effective, over time the impact on day-to-day life is likely to subside much as it has in the U.S. China’s government has also been hinting at the possibility of stimulus to boost the economy, and there are several indicators that regulatory hostility towards hard-hit technology and education sectors could abate in the new year.

China is the second largest economy in the world, so a snap back to stronger growth trends would serve as a tailwind to global GDP and likely boost other emerging market economies.

Bottom Line for Investors

It is important for investors to remember that bull markets typically start during a recession and before corporate earnings reach a low point. That’s because the stock market is a discounter of future economic and business conditions. In other words, if you expect the U.S. economy to struggle in the first half of 2023 and to improve later in the year or even into 2024, it would make now the time to own stocks, in my view. And since corporate earnings estimates have already come down considerably, and some level of economic weakness is anticipated in the new year, then I think that puts us closer to inflection points and opportunities for investors – not further away.

Disclosure

2 Zacks.com. December 15, 2022. https://www.zacks.com/commentary/2029325/have-earnings-estimates-come-down-enough

3 Wall Street Journal. January 2, 2023. https://www.wsj.com/articles/big-banks-predict-recession-fed-pivot-in-2023-11672618563

4 Wall Street Journal. December 15, 2022. https://www.wsj.com/articles/jerome-powells-grim-inflation-outlook-is-at-odds-with-markets-11671072877?mod=djemRTE_h

5 Fred Economic Data. January 4, 2023. https://fred.stlouisfed.org/series/JTSJOL#

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The ICE Exchange-Listed Fixed & Adjustable Rate Preferred Securities Index is a modified market capitalization weighted index composed of preferred stock and securities that are functionally equivalent to preferred stock including, but not limited to, depositary preferred securities, perpetual subordinated debt and certain securities issued by banks and other financial institutions that are eligible for capital treatment with respect to such instruments akin to that received for issuance of straight preferred stock. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.