Though this week’s column will delve slightly into the negative, I do want to make it clear that Zacks Investment Management maintains our base case for positive, single-digit gains in the U.S. stock market this year. That forecast has not changed, and ultimately, we see the positives like earnings growth and global GDP growth as outweighing the negatives. The point of this week’s column is simply to remind investors that the negatives are still out there – and showing signs of blooming.

The list I make below outlines four of the biggest threats to this bull market and economic expansion that I see today.

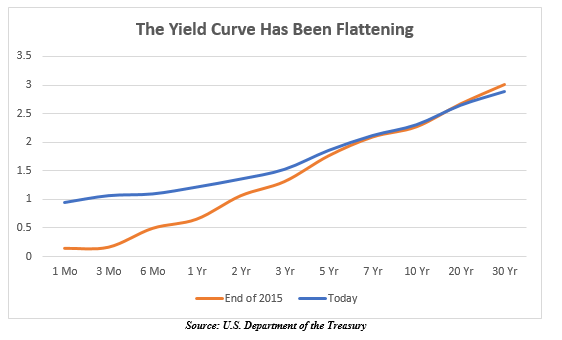

Risk #1: The Yield Curve

The yield curve has been notably flattening over the last few years, which is a warning sign that a slowdown may be ahead. On average, the yield curve inverts 16 months prior to an economic recession and 13 months before major stock-market corrections. We’re not there yet, but as you can see in the chart below, the blue line (today’s yield curve) is notably flatter than the orange line (yield curve at the end of 2015). In the last two cycles, stocks advanced while the yield-curve flattened, but they eventually turned south once it inverted.

Source: U.S. Department of the Treasury

Economic conditions in the U.S., which include modest but consistent growth, close to full employment, near double digit earnings growth, and steady inflation should allow the Fed’s tightening cycle to continue, meaning we can reasonably expect another rate increase this year. That puts upward pressure on the short end of the curve, while global demand for U.S. Treasuries is likely to remain strong – putting downward pressure on the long end of the curve. If the short end rises faster than the long end, the yield curve will flatten further and could eventually invert. That would be a significant warning sign and is something investors should monitor closely.

Risk #2: Monetary Policy Tightening

Related to Risk #1, another risk factor to watch is the pace of monetary policy tightening. Every recession in the last 50 years has been preceded by a decline in money supply growth (to zero or below), so as the Fed tightens investors should be eyeing how economic conditions, and in particular, corporate earnings, are affected as a result. The Fed has indicated that balance sheet reductions should begin in September. While the rate of balance sheet reductions could be very slow, taking 5+ years to reduce the Fed’s balance sheet to $2.5 trillion, it is still tightening across the board.

Risk #3: Credit Markets

On the credit side, delinquency rates are on the rise, and it’s been fairly broad-based. Auto loans were the delinquency du jour this week, making headlines as analysts took note that subprime auto bonds were exponentially rising. Subprime auto bonds are nothing new, but the sheer increase in circulation is enough to liken it to the subprime mortgage crisis of 2008. A look inside the numbers makes this point clear: in 2009, $2.5 billion of new subprime auto bonds were sold. In 2016, that number rose to $26 billion.

But, it’s not only auto loans that are turning sour. Delinquencies are rising across a variety of sectors, including consumer loans, commercial and industrial loans (many being energy-related), and agriculture. We’re not at ‘flashing red’ warning levels just yet, but it’s important to note that rising delinquencies in these areas have historically preceded recessions.

Risk #4: Complacency

In the second quarter, U.S. and global stocks continued their steady upward march in a low volatility environment. For most investors, the combination of low volatility and relatively strong positive returns is a blessing, and reason to cheer. But to investment managers like us, the combination of low volatility and strong returns – amidst a flattening yield curve and rising steep(ish) valuations – tends to raise eyebrows. When markets are calm for too long, complacency has a tendency to settle in, and risks can start to build in pockets of the economy that few people notice. Ignored or unnoticed risks are the very kind that can bubble up and lead to major dislocations, and it can happen fast. The past few bear markets provide evidence of how this can take shape.

If the market continues to trade in a very low volatility setting, and optimism continues to build on future economic growth and potential stock market gains, it would concern us even more.

Bottom Line for Investors

As I stated at the beginning of this column, Zacks Investment Management continues to believe that the positives currently outweigh the negatives. But, now is a time to be extra vigilant, and to make sure your portfolio has adequate diversification and risk-controls should the market take a turn.

Disclosure

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this artice is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Returns for each strategy and the corresponding Morningstar Universe reflect the annualized returns for the periods indicated. The Morningstar Universes used for comparative analysis are constructed by Morningstar (median performance) and data is provided to Zacks by Zephyr Style Advisor. The percentile ranking for each Zacks Strategy is based on the gross comparison for Zacks Strategies vs. the indicated universe rounded up to the nearest whole percentile. Other managers included in universe by Morningstar may exhibit style drift when compared to Zacks Investment Management portfolio. Neither Zacks Investment Management nor Zacks Investment Research has any affiliation with Morningstar. Neither Zacks Investment Management nor Zacks Investment Research had any influence of the process Morningstar used to determine this ranking.