What the End of Easy Money Means for Investors

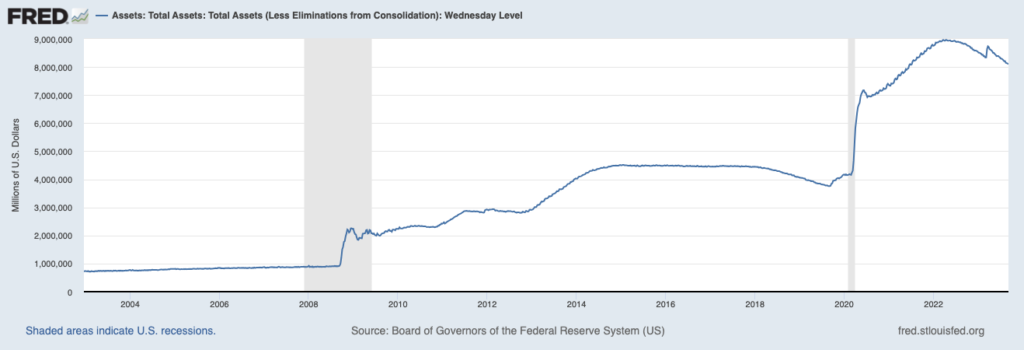

There’s a popular narrative in the stock market that it was the Federal Reserve – and not much else – that powered the strong stock market returns in the decade following the 2008 Global Financial Crisis. The thinking goes that because the Federal Reserve kept interest rates at the zero bound for years following the 2008 financial meltdown (and again following the pandemic), and because the central bank expanded their balance sheet with quantitative easing measures over the same period (see chart below), investors were ‘basically forced’ to flood into risk assets.1

The Fed’s Balance Sheet – Expands in 2008, Soars in 2020

I’m not saying this line of thinking is wrong. Easy money no doubt supercharged capital flows into stocks and other risk assets. Investors in search of yield had limited options in the bond markets, and massive amounts of liquidity meant more money was sloshing around in the capital markets. Much of it made its way into stocks.

What gets left out of this narrative, however, is any role that rising corporate earnings may have played in the stock market’s ascent. That’s where I take issue. Aggregate S&P 500 earnings-per-share grew steadily from 2009 to 2015, contracted slightly, and then trended sharply higher up until the end of 2019. Aggregate EPS for S&P 500 companies more than doubled in this period, with profit margins reaching their highest point in decades by 2022. Zooming out even further, we know that year-over-year operating EPS growth averaged 8.4% from 2001 to 20223, which is almost perfectly in-line with the S&P 500’s 8.71% annualized return over that same period.4 In short, stocks were propelled by much more than just the Fed.

I think a better way to frame the Fed’s easy money impact on the stock market is to view it in terms of market return (beta) versus excess return (alpha).

I’ve made the argument above that the Fed’s easy money policies – combined with many years of steady earnings and economic growth – have been driving the stock market higher since 2008. Valuations were low when the Fed engaged in aggressive monetary easing, which became a ‘rising tide that lifted all boats’ in the stock market. Beta ruled, and the differentiation between individual stocks was lower than average. Investors did not need to do much beyond owning a broad set of stocks in order to do well. In other words, high beta delivered – the average annual return for the S&P 500 was 15% from 2010 to 2021.

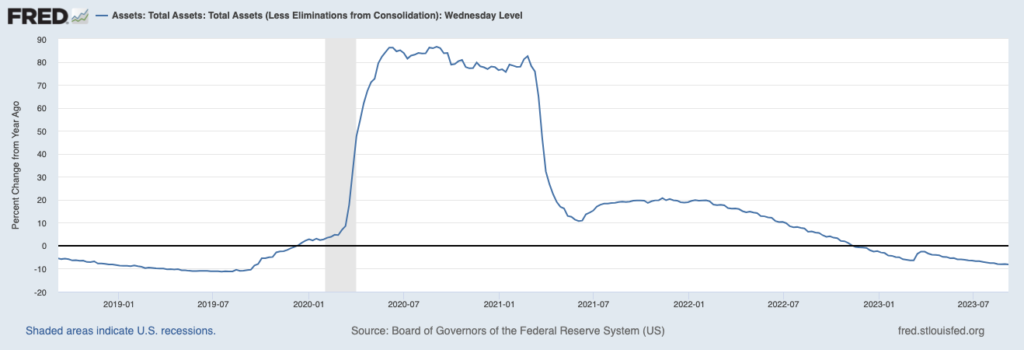

Looking ahead, tighter money (chart below) may mean lower beta, which sets the stage for alpha to play a bigger role in portfolio returns going forward.

Year-over-year % change in Fed’s Balance Sheet

Bottom Line for Investors

In the decade following the Global Financial Crisis, the Fed’s main objective was to support economic growth. Inflation was an afterthought.

The current environment is, of course, just the opposite. With the Fed making decisions almost unilaterally focused on inflation, they are likely to be less supportive of growth – which may factor as a headwind for risk assets. What’s more, valuations are currently at relatively high levels, which means the starting point for tighter monetary conditions is one where stocks aren’t cheap.

Given this setup and looking out over the next decade, investors should not expect the same 15% annualized returns stocks experienced from 2010 to 2021. Lower beta does not necessarily have to mean lower portfolio returns, however. It just means investors and managers will likely need to generate more alpha in portfolios, which plays nicely into a central tenet of our investment approach here at Zacks.

Disclosure

2 Fred Economic Data. September 7, 2023. https://fred.stlouisfed.org/series/WALCL#

3 J.P. Morgan. August 31, 2023. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/?gclid=Cj0KCQjwmICoBhDxARIsABXkXlKEwzu1pOK4ldrG0WzcPVDn1jeam7dSUKFu_7tFO9SbwNAwzFwb9aMaArH1EALw_wcB&gclsrc=aw.ds

4 Moneychimp. 2023. http://www.moneychimp.com/features/market_cagr.htm

5 Fred Economic Data. September 7, 2023. https://fred.stlouisfed.org/series/WALCL#

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.