We think it’s high time someone put their foot down and called the collapse in oil prices what it really is: a net positive! I find it interesting that, when oil prices are high, the narrative is negative. But, when prices fall precipitously and energy becomes cheaper that’s also a bad thing! You can’t have it both ways but, in my opinion, it’s not inherently good or bad. There are pros and cons to both situations – some industries suffer and others benefit – but, I think in the current environment that lower oil prices will be a net positive for the global economy. It should ultimately help more industries, companies, and consumers than it hurts.

The Broader Context

The collateral damage to lower oil prices falls almost squarely on the sector which, as we all know, has taken an absolute beating in earnings. It spills over to the broader economy in pockets: lower capital spending on oil exploration, about 200,000 industry jobs lost and counting, bank losses (at the margin) which can slow economic activity if banks become risk averse.

A closer look at the numbers provides clearer context for the potential impact of Energy’s decline for the broader economy:

- Capital expenditures from the energy-producing industry are only around 5% of the nation’s total spending on equipment;

- Employment in oil and gas extraction is about one-eighth of 1% of total nonfarm employment;

- U.S. energy companies only account for about 6% of the S&P 500.

The Energy sector is important, but it’s not the be-all and end-all for the economy. The consumer is. And, lower oil and gas prices should inspire more spending and increased saving (which includes reducing debt), and provide a boost to consumer confidence – making bigger purchases of homes and autos more feasible.

There’s a prevailing argument today that there is ‘more to the oil story’ in terms of risk, and it focuses on three lines of thinking as far as I’ve seen. Let’s take a look.

The Three Biggest Worries

1) Bank Exposure – the fear here is that banks have too much energy exposure in their loan portfolios. With a lot of capital intensive oil and production companies being forced to go offline, due to loss of profitability, losses are accumulating and, at worst, some companies are defaulting. If this becomes systemic, banks would arguably be in trouble and the credit issues of 2008 could come right back.

But, the scale of the matter is much smaller than most seem to think it is. The biggest banks typically have less than 5% of their total loan portfolio in Energy, and they are well-capitalized in the aftermath of the credit crisis. Nevertheless, they’ve been adding to reserves just in case: Citibank by $250 million in the latest quarter, J.P.Morgan by $124 million, Bank of America by $2 billion. Smaller regional banks in drilling areas are more of a concern, but they can be avoided and should not drag down the overall financial sector. Another factor to remember is that loans within the oil sector are typically asset-backed loans, meaning that banks can make a claim on property if it comes down to it.

2) Slowdown in China Blamed for Falling Oil Prices – it’s tempting to blame falling oil prices on sinking global demand. And, with China’s slowdown, it’s also a logical argument. But, how do you explain the fact that China imported almost 10% more barrels of oil (335 million) last year than in 2014! Sure, some of that was strategic inventory building while prices were right, but this is rising demand any way you spin it. Falling prices are more heavily weighted in supply pressures with the global glut building as Saudi Arabia and OPEC produce some 30 million barrels per day and the U.S. continues record production. Demand has leveled off as the economic cycle matures, but it hasn’t dropped off.

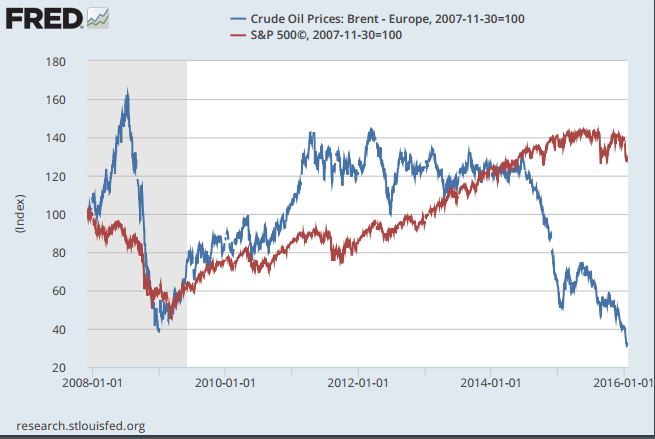

3) Oil Prices Correlated to Stocks – the seemingly lockstep movements of falling oil with falling stock prices has many rushing to call ‘correlation.’ If you buy that story, then the future of stock prices could look in jeopardy – oil prices are still searching for a floor and it’s difficult to know what the price recovery will look like and how long it will take. But, the notion that stock and oil prices are tightly correlated is head-scratching when you look past the last six months. The chart below tells the story – more often than not when one zigs the other zags:

Bottom Line for Investors

Give the adjustment period some time. The immediate impact of steep declines in oil prices is mostly negative: depressed earnings in the Energy sector that drag down aggregate S&P 500 earnings, lost industry jobs, young companies going out of business, loan losses for banks at the margin. The medium to longer-term impact of lower energy prices outweighs the short-term adverse effects, in my opinion: lower input costs for resource-sensitive products and companies, higher discretionary income, better prices for travel and tourism. The net effect, I think, will be to help more industries and companies than it hurts and to give consumers a monetary and confidence boost to go out and spend more.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.